“How much do you have to be in debt to file Chapter 7?”

This has become a question that has occupied the minds of many American citizens who find themselves in times of economic hardship.

Interestingly enough, there is no minimum amount required under the United States Bankruptcy Code in order to be able to file. Rather, it becomes how affordable it is to repay what it is that you owe.

You will learn the following in this guide:

- Why There is No Such Thing as How Much You Have to Be in Debt in Order to File Chapter 7.

- How the “Means Test” decides eligibility based on state medians of income.

- The distinction between dischargeable unsecured debts and non-dischargeable debts.

- Practical advice on when the costs of filing exceed the value of discharge.

- How much do you have to be in debt to file Chapter 7

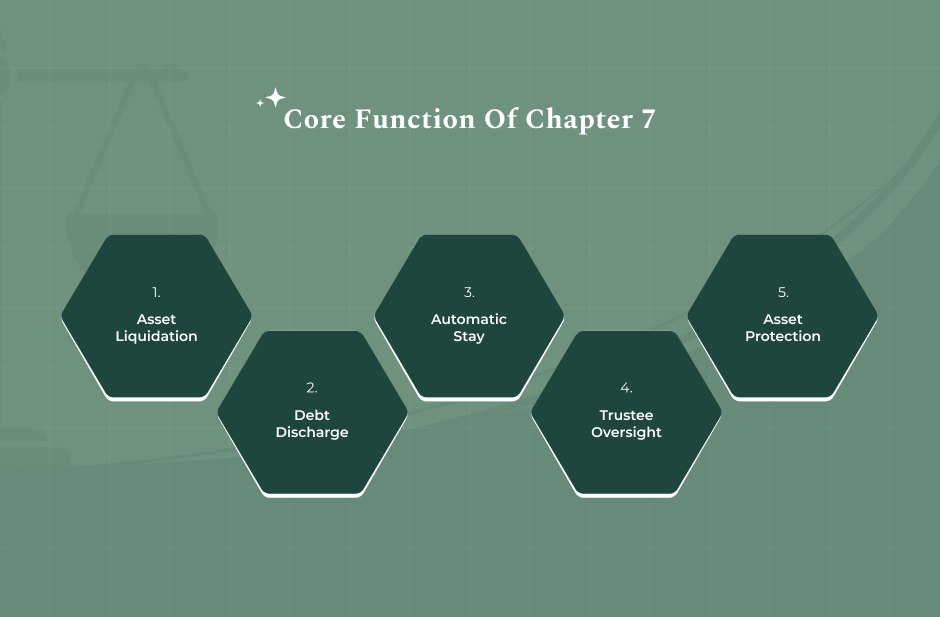

Understanding Chapter 7 Bankruptcy

How much do you have to be in debt to file Chapter 7? Chapter 7 Bankruptcy, also referred to as “liquidation,” is intended to give a person a clean start by canceling most debts. In this unique case, debt relief happens comparatively quickly, usually within a period of four to six months (Investopedia).

Liquidation And Discharge

In Chapter 7, the court-appointed trustee then examines what you have to liquidate to pay off the debtors.

However, most people have “no-asset” cases, which means that all their properties are exempt, so they get to owe nothing while their eligible debts are wiped away. In asking how much one should be in debt to file Chapter 7, one should not forget that the objective is to have the legal duty to pay erased once and for all.

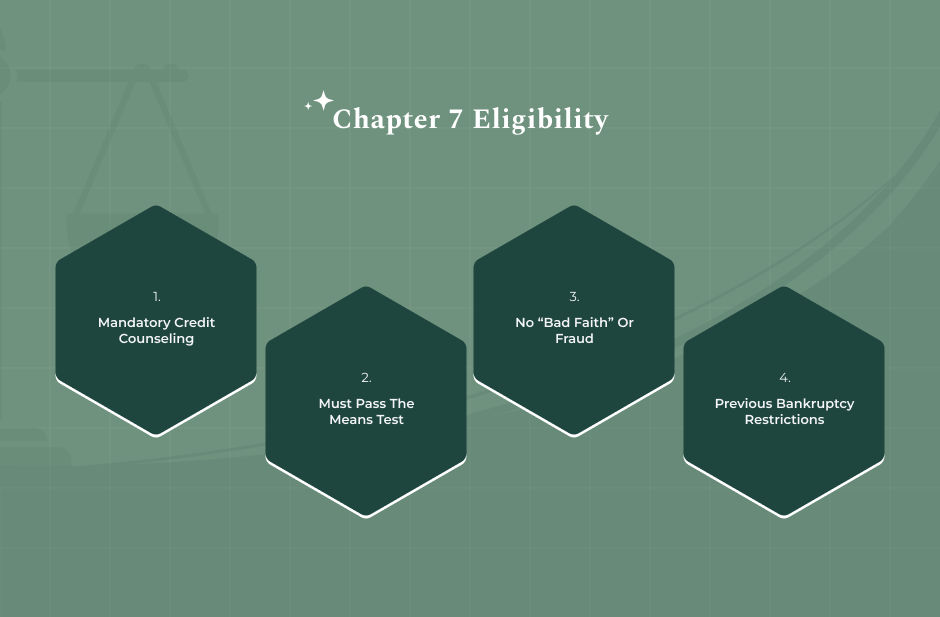

Essential Eligibility Criteria To File Chapter 7

Although there are no regulations regarding how much you have to owe to file for Chapter 7 bankruptcy, there are strict regulations on who gets to file. This is to ensure that only those who owe enough to pay back are granted a discharge of all their debts.

There Should Be “No Minimum Debt Requirement

How much do you have to be in debt to file Chapter 7? It’s also a misconception that you are going to have to at least file for $10,000 or $20,000. Technically speaking, you could file for $500, though this would hardly make financial sense, considering the fees.

Looking to figure out what the final answer to the question “how much debt do you need to file chapter 7?” is, you must also consider the rates that are causing you not to be able to attain a balance of $0.

Income And The Means Test

In place of the debt floor, the courts hold an income ceiling. The “Means Test” compares how much income you get with the average mean income of families of equal size, where you live (U.S. Courts).

How much do you have to be in debt to file Chapter 7? If you are trying to determine how much income there may be to file for Chapter 7, the amounts are extreme.

For example, for a family of one in California in late 2025, the mean income for a Chapter 7 filing would be $77,221, and for Mississippi, it would be $52,594 (Department of Justice).

However, if you have an income above the median, you can still qualify for the second part of the means test. Here, you subtract allowed expenses, such as rent, food, and taxes, from gross income.

Additionally, you have to have “disposable income” that is insufficient to repay any substantial part of your debt within five years.

So, how much do you have to be in debt to file Chapter 7? According to what we just found out, we still qualify, no matter how much we have to be in debt to file Chapter 7.

Typical Amounts Owed By Petitioners

Although the statute does not specify what the number is, the reality is that most families wait until the end is in sight. How much do you have to be in debt to file Chapter 7?

Several lawyers recommend not filing for bankruptcy unless you have at least $10,000 in dischargeable debt because the effect may not be as beneficial in the long run.

Most people filing for Chapter 7 protection have between $15,000 and $50,000 of unsecured debt, including credit card and medical debt.

How much do you have to be in debt to file Chapter 7? When assessing what debt total you have to consider Chapter 7 bankruptcy protection, consider your debt-to-income ratio.

If the total debt exceeds 50% of your yearly earnings and no payment plan appears within sight in terms of repaying within five years, then Chapter 7 protection is likely an available and viable option.

Bankruptcy can cost money, and this goes into considerations of how much money you can be in debt to consider Chapter 7 bankruptcy. The cost of filing bankruptcy is equal to or similar to the amount in debt, and it would be better to just pay it.

Cost Breakdown

As of late 2025, the cost of filing a Chapter 7 bankruptcy is $338 (U.S. Courts). Counsel fees vary depending on your location and may cost anywhere from $1,500 to $3,500.

Taking your total investment of approximately $2,000, I believe that when it comes to how much do you have to be in debt to file chapter 7 bankruptcy, cost vs. benefits is a far more pressing consideration than technicalities.

Chapter 13: Options To Chapter 7 Bankruptcy

If you do not qualify or determine that the criteria do not apply to your situation regarding the answer to the question of how much do you have to be in debt to file Chapter 7, other options are available. Not all debtors must liquidate; some just need a better structure.

Chapter 13 bankruptcy permits you to retain your property while repaying a reduced amount of debt within three to five years (Investopedia).

You can also opt for a Debt Management Plan offered by a non-profit credit counseling organization that reduces your interest rates without leaving a “black mark” on your credit report for ten years. These are usually better options for you in case you are earning a regular income but are burdened by heavy interest rates.

Consolidating Debts For Lower Interest Rate

Steps to follow prior to filing:

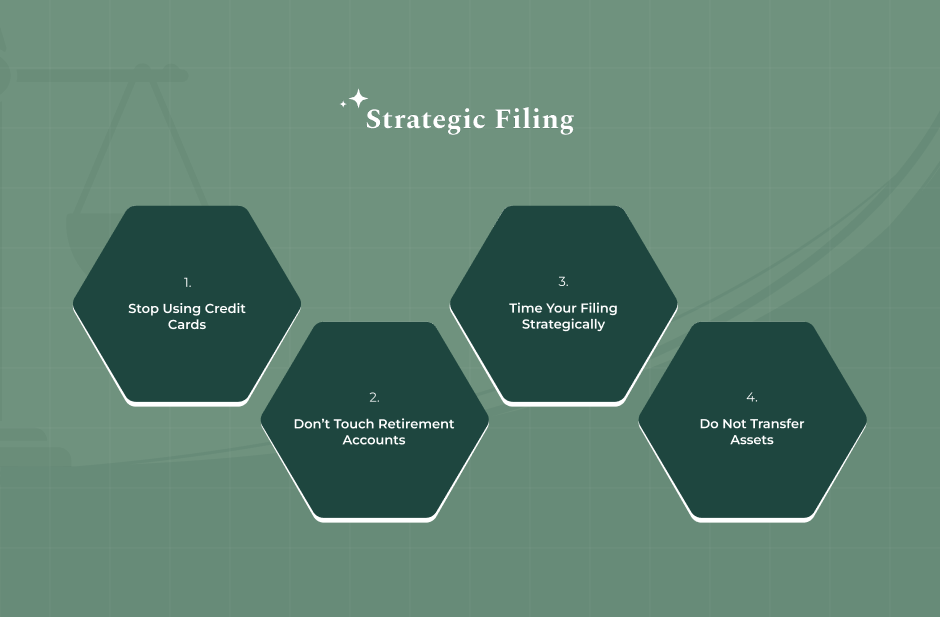

So, before you make your filing, you need to do your research. How much do you have to be in debt to file Chapter 7? Bankruptcy is not an act you enter into lightly, and you must be transparent about your finances.

Bring along your last two years of tax returns, six months of pay stubs, and a complete list of lenders. There is also a requirement by law to undergo a credit counseling course offered by an approved credit counseling organization within 180 days of filing (U.S. Courts). This will give you time to determine how much you have to owe in order to qualify to file Chapter 7.

Expert Tips And Best Practices

Experienced attorneys often refer to delays as the most common mistake that individuals make. They exhaust the money that could be protected during a bankruptcy case by depleting the retirement accounts, expecting that this will wipe out the debt.

When evaluating how much do you have to be in debt to file Chapter 7? Think about your quality of life.

Are you going without food or doctor visits so that you can make minimum payments on your debts?

If your debt is expanding, even while you are making a good-faith effort to repay it, then it is time to consult a professional. You should always have an attorney review your finances to determine how much income is necessary to file a Chapter 7 bankruptcy in your county of residence.

Frequently Asked Questions (FAQs):

What you owe in debts on deciding when it is enough to consider chapter 7 is an ultimate personal decision based on how well you can envision the future without having to worry about debt collections.

Maybe you are having problems affording the basic needs that you require based on the debts you have, and this is where the bankruptcy code can give you the exit you may be looking for.

Yes, you can file for Chapter 7 bankruptcy in this scenario as you only have $5,000 in debt. Nevertheless, experts recommend not choosing this method as the cost associated with filing for Chapter 7 may be close to half the amount of your debt. Another issue is the fact that this type of bankruptcy appears in your records for a total of 10 years.

No, you can file for bankruptcy on your own even if you are married. But your spouse’s income will still be taken into account when determining your eligibility for bankruptcy under the Means Test. If there are joint debts, filing for bankruptcy on your own will protect you, but the creditors can come after your spouse for the whole amount.

You are entitled to retain your car provided that the equity that you hold in the vehicle does not exceed the state’s homestead or motor vehicle exemption. Additionally, you are required to make the latest payments on the car.

You are likely to lose the vehicle provided that the value that you place upon the vehicle far exceeds the state’s exemption, though this typically won’t happen to a necessary vehicle.