You must have seen people trying to seek legal help as they cannot handle their debt anymore. Well, in most cases, they will take the help of a debt relief lawyer.

This is the legal profession where lawyers help people struggling with overburdening debt. Yes, that is something that’s possible as well.

You see, when people struggle with a lot of debt and want to find ways in order to reduce the amount that they owe, they find the help of a legal professional.

For example, you might have seen people getting calls constantly from creditors for not paying their debts. There are times when, after being unable to pay the debt, people lose their car or their house to the sharks.

This is where a debt relief lawyer comes into play. These professionals have the knowledge and ability to negotiate with the creditors and help you out legally.

But how does that work? And what are some of the things that you should know related to debt relief? If this is what you want to know, you have come to the right place. So, keep on reading this blog till the end…

What is Debt Relief?

Before talking about what a debt relief lawyer does and how can they help, let me tell you what this entire process is about.

Debt relief is a method that helps you make the repayment of your debt much easier. In this, you will be able to use several ways to reduce or minimize, and sometimes eliminate, the amount you owe as debt.

Now, you might have one question: Why is this important? Well, the primary goal is to help people who are struggling financially get back on their feet.

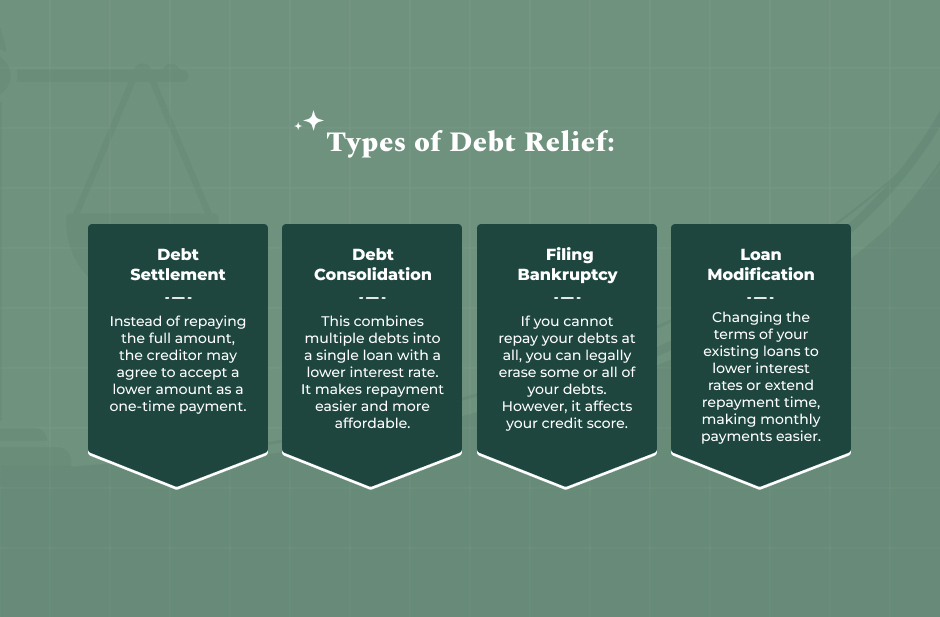

There are several types of debt relief methods. Some of them are as follows:

- Debt Settlement

- Debt Consolidation

- Bankruptcy

- Loan Modification

With the help of these, people who are literally drowning under debt can feel at ease. However, without having a detailed understanding about how they work, it is impossible fro you to make a good decision!

Understanding Debt Relief Programs

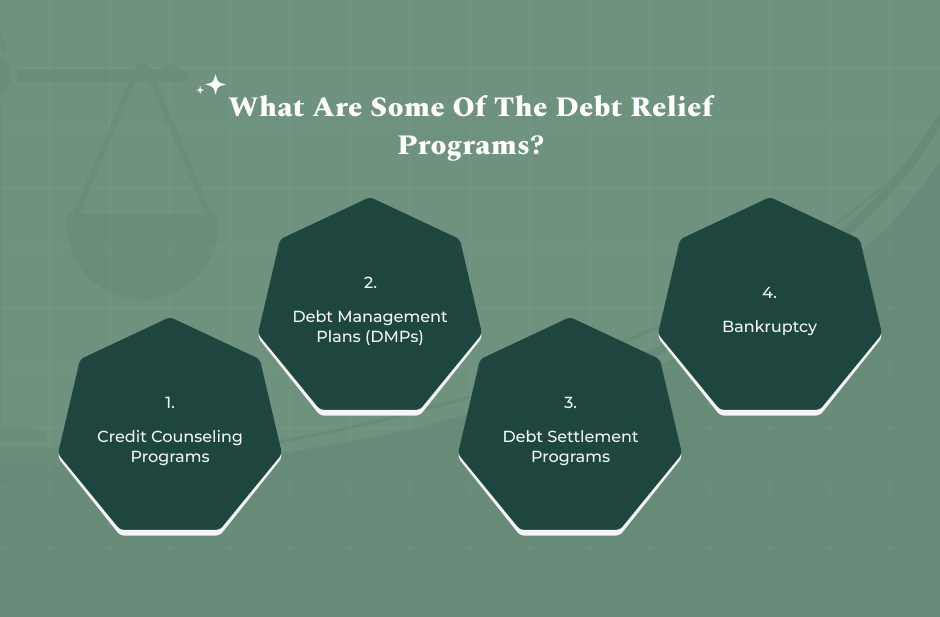

Now that you know what debt relief is all about, let me tell you about debt relief programs.

These are some programs that are designed specifically for people who are struggling to repay their debt. With the help of these programs, people get structured plans that allows them to eliminate or reduce the debt amount.

However, this debt amount does not go away like magic. Experts do this through negotiations and other legal processes. Here are some of the different types of debt relief programs that you need to keep in mind:

1. Credit Counseling Programs

Firstly, there are Credit Counseling Programs. These are agencies that lets you create a budget for your repayment. Additionally, it also helps you strategize a repayment plan.

Furthermore, these agencies negotiate with the creditors on your behalf and reduce the amount of debt interest significantly.

This means that while you will still have to pay the entire amount, you will still be in a better place.

2. Debt Management Plans (DMPs)

Secondly, there is a DMP or Debt Management Plan. similar to the first one, these are also credit agencies that work by counseling individuals and coming up with a plan for them.

These agencies work with the creditors to bring down the interest rates and combine several debts into a single one-time payment.

While it is a popular plan and a fantastic solution for most people, you need to keep in mind that it can take years (3 to 5) to complete.

3. Debt Settlement Programs

Thirdly, you can take help from debt settlement programs and companies. These help people by negotiating with creditors to lower the original debt amount.

This is something that a debt settlement lawyer will be able to help you with! But you can either pay the amount at a single time. Or you can also make small payments over time.

Now, there is something that you need to keep in mind. While it lets you del with the dent much faster, this program can impact your credit score negatively.

4. Bankruptcy

Finally, one of the ways in which you can get a reduction in debt repayment amount is by filing for bankruptcy.

This is a legal process through which people and businesses can get rid of debts completely when they cannot repay them anymore.

For instance, the Chapter 7 bankruptcy lets you erase most of the debts. On the other hand, Chapter 13 lets you create a plan for repayment.

Just like having a bad record as a debtor, this can also impact your credit score. However, it also lets you have a fresh start financially.

Debt Relief Lawyer: Who Are They & How They Work?

As I have already told you before, one of the best people who can help you with debt is a debt relief lawyer. These are the legal professionals who can help you deal with debt-related issues.

Basically, they provide pieces of advice and legal assistance to people who need solutions to their problems. Additionally, they are the omes who can better negotiate with the debt collectors and come up with repayment terms.

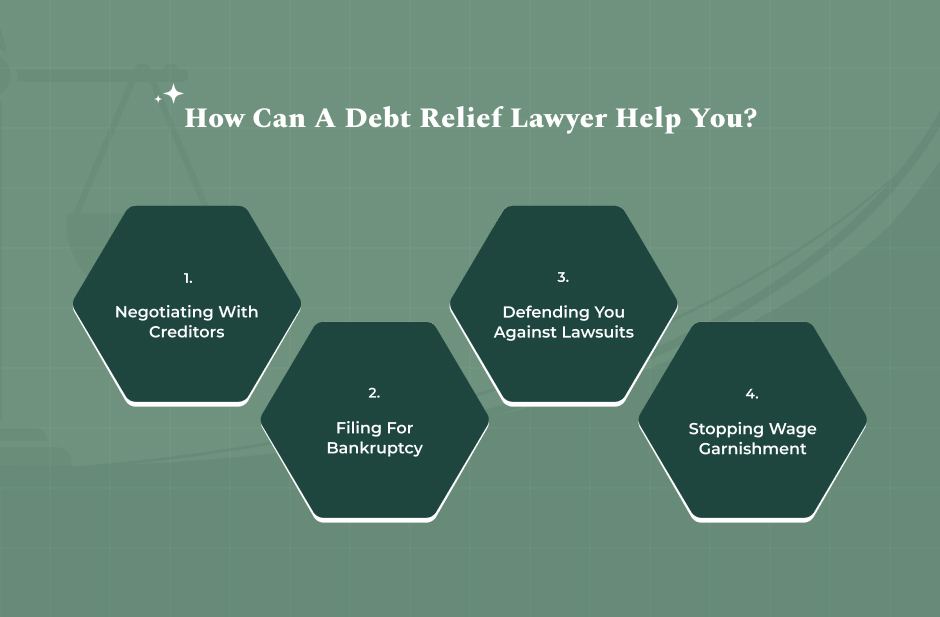

How Can Debt Relief Lawyer Help?

Apart from the fact that debt relief lawyers can help you with financial guidance, there are several ways in which these lawyers can help you. Some of them are as follows:

- Negotiating With Creditors: These lawyers help you by negotiating with your creditors for better (read: lower) interest rates. Additionally, they also help you deal with the harassment.

- Filing for Bankruptcy: In such a case, the debt relief lawyer guides you through the entire legal process for filing. They will also help you make the decision between Chapter 7 (debt elimination) or Chapter 13 (repayment plan).

- Defending You Against Lawsuits: In case you face debt lawsuits from collectors, your lawyer will help you fight them legally by representing you in court.

- Stopping Wage Garnishment: In case your employer deducts money from you to repay a certain debt amount, you can take the help of a debt relief lawyer. They can either reduce the amount or completely stop this from happening.

When Do You Need A Debt Relief Lawyer?

“I cannot pay my debt right now. Do I need to contact a lawyer?”

Well. No. That is not how it works. Let me tell you when you would really need to hire a debt relief lawyer:

- You are facing a lawsuit.

- Your wages are being garnished by the employer.

- Debt collectors are harassing you for repayment.

- You are considering bankruptcy.

- You are planning to settle your debt for a lesser amount.

How Much Does Debt Relief Lawyer Cost?

This is a very normal question to have if you are planning to look for debt settlement or debt relief.

Normally, the cost of hiring a debt relief lawyer generally depends completely on the complexity of your case. Additionally, the services that your lawyer is going to provide you will also have an impact on the cost.

However, here are a few pricing methods when it comes to debt relief lawyer costs:

1. Flat Fee: Some lawyers charge a one-time fee for handling your debt settlement or bankruptcy case. This can range from $500 to $5,000, depending on the situation.

2. Hourly Rate: If you need legal advice or representation in court, a lawyer may charge an hourly rate, typically between $100 and $500 per hour.

3. Contingency Fee: Some lawyers take a percentage of the money they save you through debt settlement, usually around 20-25%.

Your Legal Guide: Things To Keep in Mind While Opting for Debt Relief

In conclusion, if you are planning to hire a debt relief lawyer, it is important that you take note of your options. You must have a clear understanding of the debt relief program that you are going for.

Furthermore, the debt relief agencies that you choose also matter a lot. You need to ensure that the company you are choosing is not scamming you.

Additionally, you also need to understand the risk you are taking. Not all options are great options. Some might affect your credit score significantly.

Read Also: