“What is LVNV Funding LLC, and why am I getting so many calls?” You are not alone in this search, trust me when I say this!

Times are tough for people who borrow money or are in any form of debt. This is something that people who are getting calls from the debt collection company have been saying.

If you have read my previous articles on the Jefferson Capital System, you might like this blog. So, keep on reading till the end and thank me later…

What is LVNV Funding LLC?

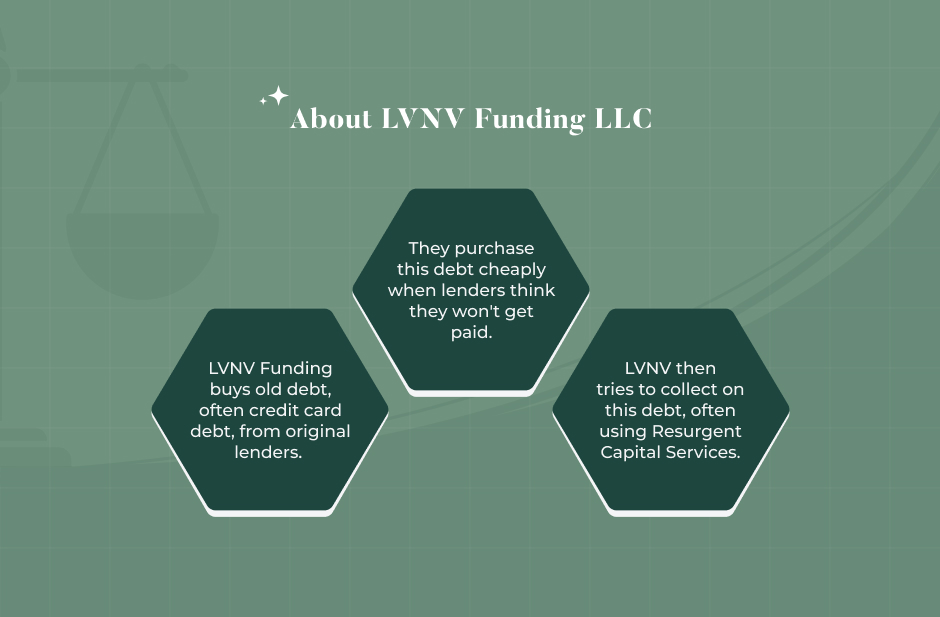

Third-party debt collector LVNV Funding LLC purchases debt that has been paid off by the original creditors. These are typically from consumer credit cards and other personal loans.

Sometimes, creditors sell the debt for cents on the dollar. This happens when customers fall too far behind on their payments, and creditors don’t believe they will be reimbursed.

LVNV Funding frequently acquires large portfolios with a large number of past-due accounts. After that, they hire Resurgent Capital Services to handle account management. Additionally, they are in charge of pursuing the account owner to collect payment.

Why is LVNV Funding LLC Calling You?

In order to collect payment on an unpaid credit card or loan amount, LVNV Funding is contacting you. They bought the debt from a business, such as a credit card company, with which you had an account at first.

They are now attempting to collect the debt from you. Most likely, the individual contacting you is from Resurgent.

What to Do When LVNV Funding LLC is On Your Credit Report?

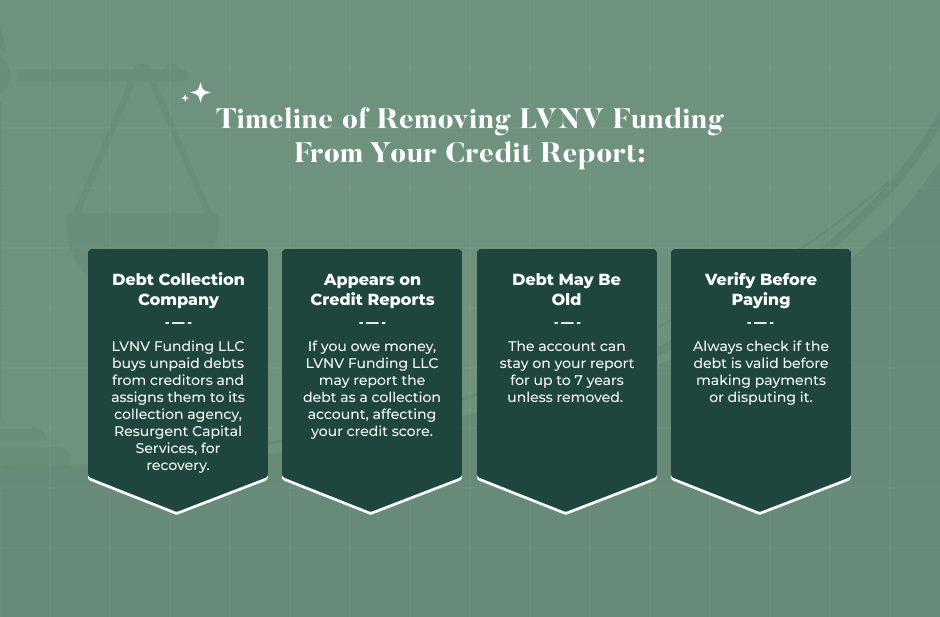

In addition to the charged-off account with your original lender, the account may appear on your credit reports as a collections account when LVNV Funding purchases your debt.

Resurgent Capital Services, a different business, enters into a contract with LVNV Funding to handle debt collection. And what does that mean?

This implies that even though LVNV Funding might appear on your credit reports, Resurgent will most likely be the one contacting you if you receive a call from a debt collector.

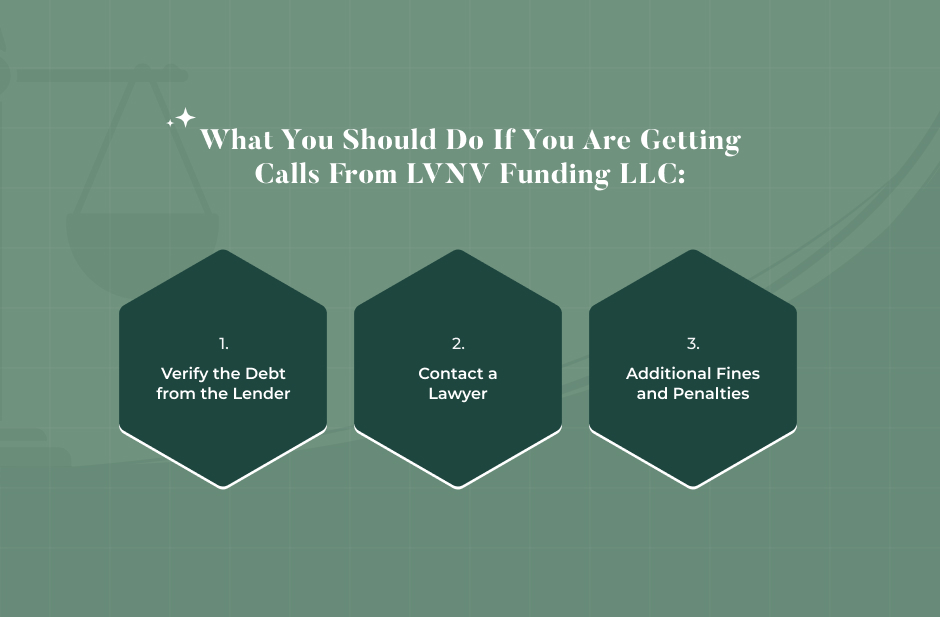

Verifying the debt and making sure the debt collector has the authority to collect on it should be your first course of action. This is regardless of whether you receive a call from a debt collector or notice a collection account on your credit reports.

Make sure you are aware of your rights under the Fair Debt Collection Practices Act and obtain written information regarding the debt from the debt collector.

Do You Have to Pay LVNV Funding LLC?

You will most likely have to pay them at least some of the debt if LVNV financing confirms it. Furthermore, you have to acknowledge that you owe it and that the amount is accurate.

Collection efforts will probably go beyond phone calls and collection letters if you choose to disregard the issue. A lawsuit could result in the garnishment of your wages or bank account.

The good news is that you can work with LVNC to settle the account permanently. How? Well, by agreeing to pay less than the initial debt amount.

Is LVNV Funding LLC Legit?

Absolutely, LVNV Funding is a reputable debt collection business with several locations. It has been accredited by the Better Business Bureau (BBB) since 2017 and has its headquarters in Greenville, South Carolina.

In the last three years, more than 1,000 complaints have been made against it, and many more have been made to the Consumer Financial Protection Bureau (CFPB), despite its A+ rating with the BBB.

How to Remove LVNV Funding LLC From the Credit Report?

The account that is in collections will probably remain on your records for around seven years, or until it is removed, if you have confirmed that the debt was accurately reported.

You might be familiar with the “pay-for-delete” strategy when the debt collector consents to expunge the collections account from your records in exchange for a one-time payment.

Although the Federal Trade Commission claims that debt collection businesses are legally obligated to provide correct information to the credit bureaus, there is no assurance that this would be successful.

Therefore, it is typically against the law for debt collectors to intentionally report false information. Any company that says you may pay to have a collections account removed from your credit reports should be avoided at all costs.

Furthermore, the negative mark from the first charged-off account would still be present even if the debt collector were successful in deleting the collections account by fraudulently declaring it as erroneous.

On the other hand, if the debt is not authentic, it can indicate identity theft. After investigating an account, if you still don’t recognize it, dispute the debt with the three main consumer credit bureaus.

Credit bureaus need to look into disputes and notify the debt collector of the inaccuracy. In order to get your records updated, the debt collector is required to look into that information and submit any errors to all three credit bureaus.

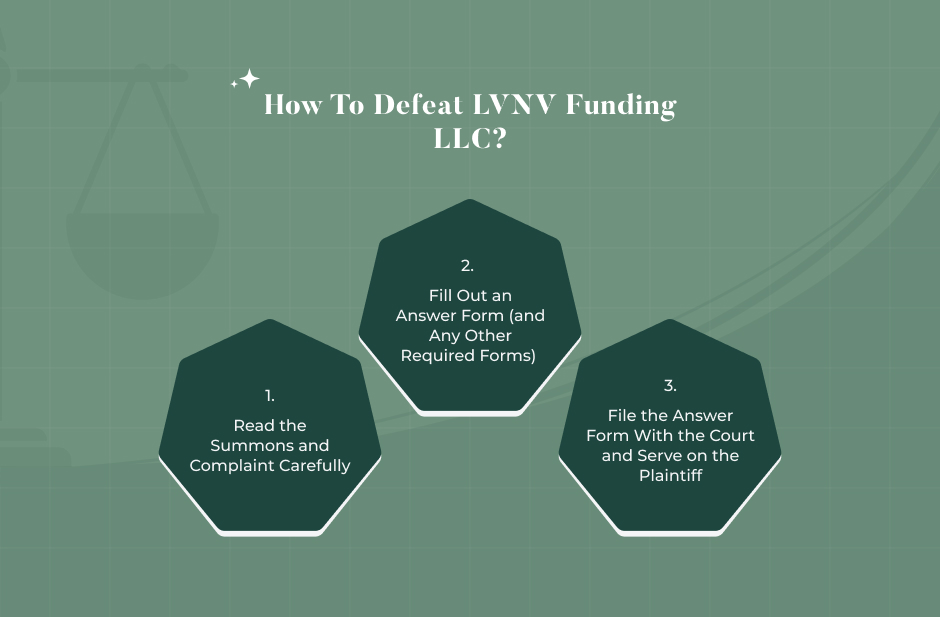

How to Defeat LVNV Funding LLC in a Debt Lawsuit?

LVNV Funding may ultimately choose to file a lawsuit against you if they are unable to collect money from you for an unpaid debt.

If you receive a formal notice from the court, you will be aware that you are being sued. A summons and a complaint are the two documents that typically accompany this.

Answering the summons is the most crucial action. The judge will probably grant the debt collector a victory and issue a default judgment if you choose to disregard the complaint.

Wage garnishment becomes possible as a result. Their chances of success are diminished if they take part in the litigation. And it’s not as hard as you may imagine!

Step 1: Read the Summons and Complaint Carefully

A summons is a court document that informs you of a lawsuit. Furthermore, it contains further details like:

- Name and address of the court

- Names and addresses of the individuals concerned

- Case number

- What the lawsuit is about

There might also be a caution regarding the legal repercussions of failing to reply to the case, as well as advice for the defendant—that would be you if you are the one being sued.

Finally, the time frame for responding to the lawsuit will be specified in the summons. This could refer to a particular day or a set amount of days.

Alongside a summons, a complaint lists allegations against the defendant, typically in numbered paragraphs.

Without retaining legal counsel, many people are able to successfully reply to debt collection litigation. However, if you require or desire legal assistance, you can use the search engine provided by the Legal Services Corporation to find free legal assistance or get in touch with a local debt settlement lawyer.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

The court will send you a summons and complaint and you have to respond to the lawsuit. In certain courts, you can fill out blank answer forms to use as your response.

Do a Google search for the court name that appears on the summons with “answer form” or “court forms” to discover if your court provides these.

You should carefully study the directions on the answer forms that the court has provided to ensure you are following them. Inquire with the court clerk about the availability of answer forms.

Although they cannot offer legal advice, court clerks are a valuable resource for questions and for assisting you in understanding the documentation and procedures involved in the judicial system.

You have the chance to assert an affirmative defense in your response to the lawsuit. A claim that the debt collector should lose the action against you due to material they omitted from their complaint is known as an affirmative defense.

To learn more about debt defenses, read 3 Steps to Take if a Debt Collector Sues You. Remember that several procedures differ depending on the court.

For instance, in addition to the answer form, some courts demand other forms. Although it’s frequently included in the response form, a certificate of service is a typical one.

Check the court website for local guidelines if you have any questions about any additional steps or forms, and don’t be afraid to ask the court clerk for clarity.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

You can submit the papers to the court once you have completed the answer form and any other forms that you need for your response to the case.

You can nearly always mail your response or file in person at the courthouse. Although less often, some courts let you email the clerk your paperwork or submit it online.

To find out what your alternatives are, consult the court clerk, the webpage for your particular court, or the summons.

Additionally, you have to give the plaintiff—the debt collection agency suing you—a copy of your response. Ask the court clerk about your other delivery options, or send it to the address on the summons.

To ensure you have documentation of the date and time of delivery, you should mail court documents by certified mail.

Read Also: