Ordinary people like us who are constantly scared of anything happening to their credit score might know about Jefferson Capital Systems. It is one of the most famous (or infamous) debt collection companies. But who does Jefferson Capital Systems collect for?

If you are trying to understand how Jefferson Capital Systems works, you have come to the right place. In this blog, I will explain this financial service and how it might impact its users. So, keep reading this blog until the end, and thank me later!

What is Jefferson Capital Systems?

So, you might have a debt but you are sure about the fact that it is not from Jefferson Capital. Then why are you receiving calls and messages from this company stating that you owe them an amount? It is probably because they bought the debt from the other company.

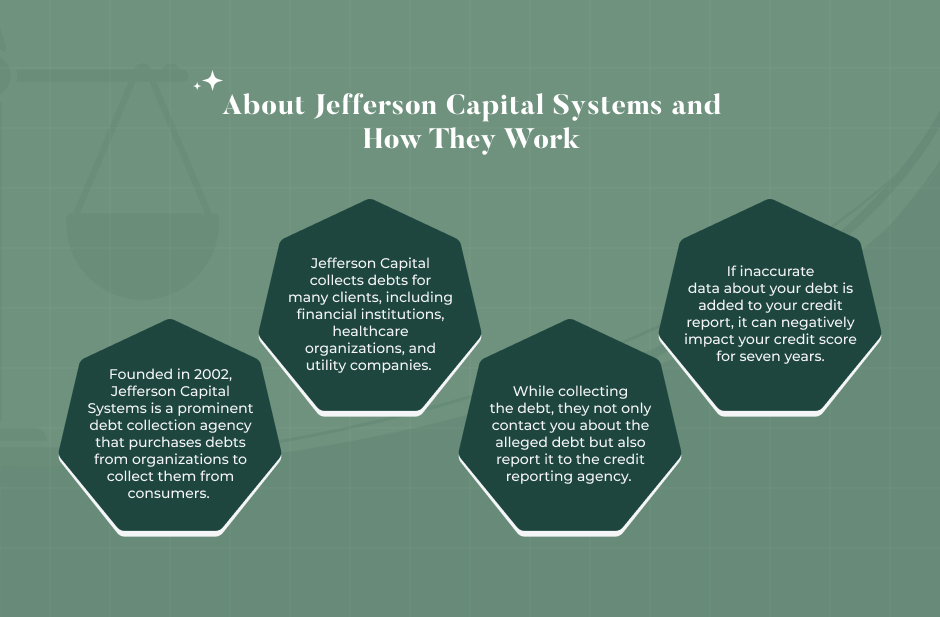

Jefferson Capital Systems, founded in 2002 and based in Saint Cloud, Minnesota, is a prominent debt collection agency. They specialize in purchasing charged-off debts from creditors, including banks, healthcare providers, and telecom companies.

If you have unpaid debts, your original creditor may have sold them to Jefferson Capital for collection. Their operations are designed to help consumers regain financial stability by resolving outstanding accounts.

But how much does it actually help?

Who Does Jefferson Capital Systems Collect For?

Considering you did not owe anything to JCap, it is only obvious for you to think who Jefferson Capital Systems collects for.

This financial service company buys “junk debts” from other companies. These generally include financers, banks, telecommunication companies, and other credit card companies.

Jefferson Capital collects debts for many clients, including financial institutions, healthcare organizations, and utility companies. They often acquire debts that the original creditors have written off due to non-payment.

Jefferson Capital on your credit report usually indicates that they are attempting to collect a debt you owe to one of these entities.

How Does Jefferson Capital Systems Work?

Jefferson Capital Systems can appear under various names regarding your credit report. Some of the most common are Jefferson Capital Systems, Jefferson Capital LLC, and Jefferson Collection.

Once they acquire a debt, Jefferson Capital typically reaches out through calls, letters, or messages to encourage repayment.

They must follow regulations set by the Fair Debt Collection Practices Act (FDCPA), which protects consumers from abusive practices.

If you owe money and fail to pay, the debt can remain on your credit report for up to seven years, negatively impacting your credit score.

How Can This Impact the Users?

If I have further simply the entire process, Jefferson Capital Systems is a financial services company that purchases debts from other companies to which you might owe. Upon buying and consolidating debts, they collect the debts from the consumers.

While collecting the debt, they not only contact you about the alleged dent. Additionally, they also report it to the credit reporting agency. These agencies, like Experian and TransUnion, collect and store financial data about businesses and individuals.

Eventually, with the help of these data, they generate your credit reports, which they then share with the lenders and borrowers. So, if you have a bad credit score in the report, it might be difficult to take a loan when you need one.

If you get a message for an unpaid debt from this company and do not heed it, it will likely negatively impact you. How? Let me tell you!

If the company reports a debt you have not paid to the credit bureaus making your credit report, it will lower your credit score.

Will Jefferson Capital Systems Harm Your Credit Score?

YES. Jefferson Capital Systems has the potential to harm your credit score. For instance, if you have a debt collection account that the company reports for credit to the bureaus, it can affect your score.

This is not the only thing. Sometimes, the debt collection company enters inaccurate data alleging a certain debt amount. It can also be related to failure to report a payment plan.

When entered into your credit report, all this data stays in the seven-year history. This can potentially harm your chances of getting a loan.

How to Remove Jefferson Capital Systems from Your Credit Report?

Now that you are aware of what Jefferson Capital Systems is bout and how it can harm your credit score, it is time for you to take the right approach to remove it from your history. But can you do that?

Here are some of the things that will help you:

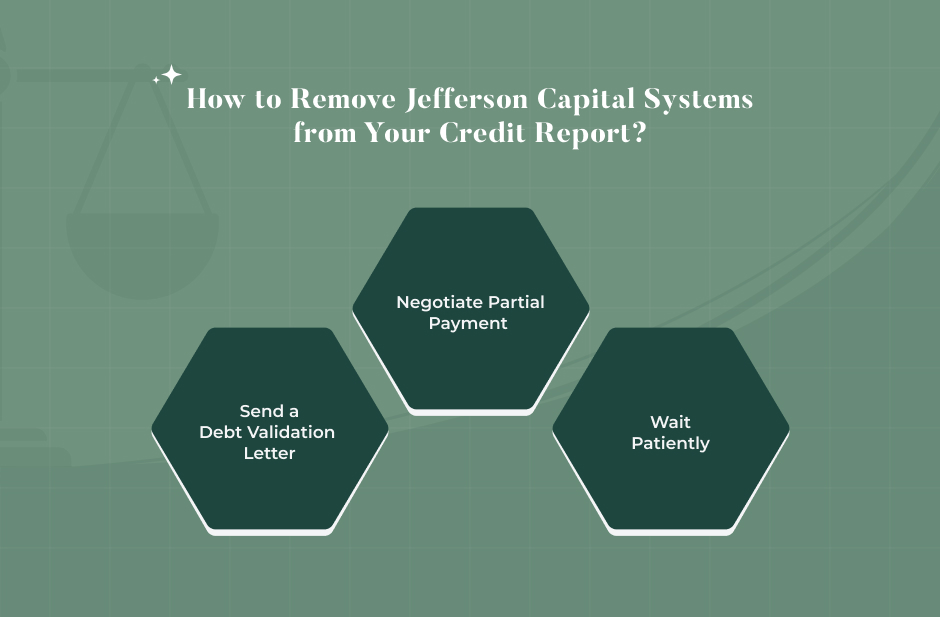

1. Send a Debt Validation Letter

When you start getting letters or calls from Jefferson Capital Systems, you should first check your credit report. This will help you find out what debt they are contacting you about.

You can easily access your credit report for free once a week from the three major credit bureaus: Equifax, TransUnion, and Experian. Just visit AnnualCreditReport.com to get started.

Once you see a debt collection account on your report, remember that you have 30 days to dispute it. Thanks to the Fair Debt Collection Practices Act (FDCPA), you can send Jefferson Capital a debt validation letter.

In this letter, ask for important details like who the original creditor is, how much you owe, how old the debt is, and any documents that prove the debt is valid. If you think there’s an error or the debt isn’t yours, you can dispute it with one of the credit bureaus.

2. Negotiate Partial Payment

If you discover that the debt is valid, it’s time to consider paying it off. Jefferson Capital often buys debts for less than their original value, so they might agree to accept a lower payment.

For example, if you owe $150, they might settle for $75. The negotiation process can take some back-and-forth communication until both parties agree on an amount. You can pay in one lump sum or set up monthly payments.

As you consider how much to offer, take a good look at your finances. Make sure you leave room for any unexpected expenses that might come up later.

If you’re feeling overwhelmed, consider contacting a non-profit credit counseling service for help creating a manageable payment plan.

Once you’ve agreed with Jefferson Capital, get everything in writing. This step is crucial as it documents your payment plan and protects your rights.

3. Wait Patiently

Remember that even after settling your debt, it may still appear on your credit report for about seven years.

Unfortunately, the debt cannot be removed early if it is valid. However, understanding these steps can help you manage your debts more effectively and improve your financial situation.

Understanding the Legalities of Debt Collection

When dealing with debt collection, it’s essential to understand your rights and the legal framework surrounding it. Understanding these legalities not only empowers you but also helps in managing your financial health effectively.

Jefferson Capital Systems operates as a legitimate debt collection agency, purchasing debts from various creditors, including banks and telecom companies.

This means they may contact you regarding debts you owe, often called “junk debt,” because it’s usually sold for less than its face value.

Under the Fair Debt Collection Practices Act (FDCPA), consumers are protected from unfair practices. For instance, debt collectors cannot harass or threaten you.

If you receive a notice from Jefferson Capital, you have the right to request validation of the debt. This includes asking for details about the original creditor and the amount owed.

You can send a debt validation letter within 30 days of their initial contact to dispute any inaccuracies.

If the debt is valid and you owe money, it’s important to know that Jefferson Capital may be open to negotiation. Since they buy debts at a discount, you might settle for less than you owe.

For example, if you owe $200, they might accept $80 as full payment. Moreover, if you pay off the debt in full or settle it, they may agree to remove the collection account from your credit report after a specified period.

If you’re facing issues with Jefferson Capital or any other debt collector, consider seeking advice from a consumer rights attorney or a financial counselor to explore your options.

Read Also: