In case you did not know, according to a 2024 survey, 79% of respondents think bankruptcy will do more damage to their credit than debt settlement. Well, if you are one of them, it is best to get a debt settlement attorney in your life!

Times are difficult and most of us struggle with finance and debt. In most cases, we have seen our friends having a hard time settling their unsecured debts. These include the ones from credit cards, a student loan, or even medical bills.

If you do not want to be in that situation, it is best you get a debt settlement lawyer. They are the ones who negotiate with the bank and represent you in court. But is that all?

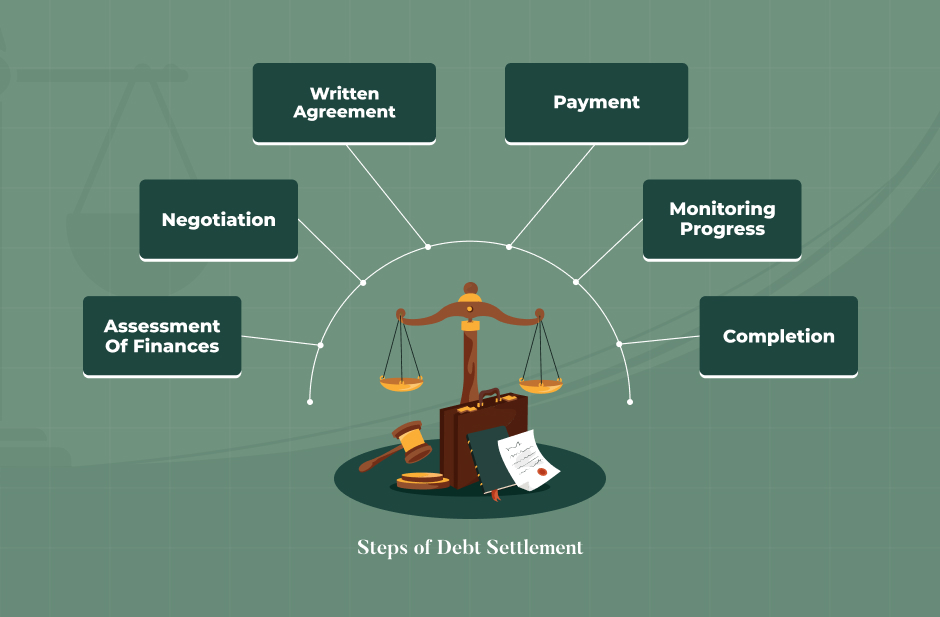

Understanding the Legal Process of Debt Settlement

The legal debt settlement process is a complicated journey that stages to significantly reduce the total amount of money you owe to creditors. However, what is it exactly? And how does it work?

The initial phase of the procedure involves evaluating your financial condition. It is imperative that you are aware of the load of your debts and of your financial ability.

After that, you or your representative will carry out a negotiation with creditors for a lesser amount to be paid.

For this, the first step would generally be to offer a single payment lower than the arrears. Apart from that, lower interest rates or extended payment schedules are negotiable. When a deal is made, it is very important to have it in writing promptly.

This agreement should cover not only the amount agreed, but also the time and form of the payment, as well as the way the creditor will inform the settlement to the credit bureaus.

When this is done, it will be your responsibility to do your part by making the payments that have been agreed upon. Keep all your transaction records safe.

On the journey, be tracking your payments and talking with the creditors, which should lead to them keeping their part of the agreement if they are honest.

After all payments have been made, check that your debt is completely cleared and that the creditors have informed the credit agencies truthfully about this matter.

Who is a Debt Settlement Attorney?

A debt settlement attorney is basically someone who steps in to help you deal with overwhelming unsecured debts—like credit card bills or medical expenses.

Their job? They talk to your creditors and try to get them to agree to settle your debt for less than what you actually owe. They’re like your financial negotiator, working to get you better payment terms or even cut down the interest.

They also make sure everything follows the law and that you’re protected from shady stuff or legal trouble while going through the whole process.

If you’re stressed about bankruptcy, a good debt settlement attorney might even help you avoid it by finding other ways to handle your debt.

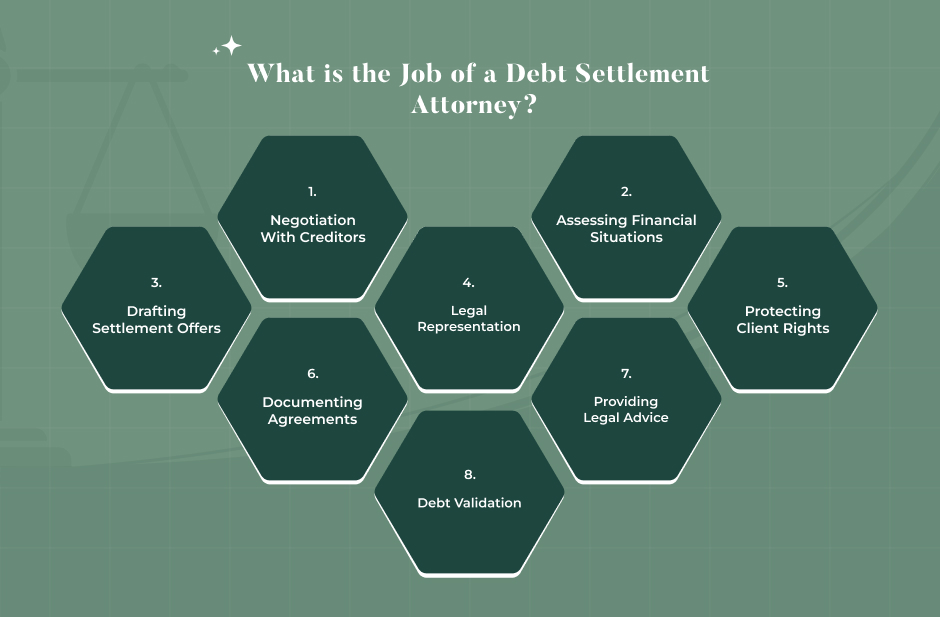

Debt Settlement Attorney: Role and Responsibility

A debt settlement attorney plays a huge role in helping people or small businesses tackle their debt problems. Their main goal? To make a bad financial situation more manageable.

Let’s break down exactly what they do:

1. Negotiation with Creditors

It is the main part of the work of the debt settlement attorney. They enter into negotiations with the creditors and act as your representatives seeking better conditions. These include:

- Lowering the interest rate.

- The amount of money agreed upon.

- Extending the repayment period.

They also get much better deals than you would get by yourself because of their legal knowledge and negotiation skills.

2. Assessing Financial Situations

They will not take any steps before thoroughly checking your financial situation. They will attempt to gather information about the following things:

- Total amount you owe.

- Recipients.

- Interest rates.

- Your payment history.

In this way, they can make a customized plan for your financial recovery.

3. Drafting Settlement Offers

Once they’ve got a strategy, they’ll draft settlement proposals. These might offer to pay a lump sum that’s less than the total you owe—if the creditor agrees.

They also make sure these proposals are legally tight and designed to benefit you, not the other side.

4. Legal Representation

If a creditor threatens to take you to court—or already has—a debt settlement lawyer can step in and represent you. They’ll either fight the claim or work out a settlement before it turns into a full-blown lawsuit.

5. Protecting Client Rights

They’re also your shield. If collectors start calling non-stop or crossing legal lines, your attorney will make sure your rights are respected. That means no more harassment or illegal tactics.

6. Documenting Agreements

Once a deal is made, your lawyer ensures it’s all put into writing. The paperwork includes every detail—how much you’ll pay, when, and what protections you have if things go sideways.

7. Providing Legal Advice

They’ll also talk you through your other options, like bankruptcy, and help you figure out the best route. Legal processes can be confusing, and they’ll be there to simplify it all.

8. Debt Validation

Before settling any debt, they’ll double-check that the debt is real and legally valid. Some debts may be too old to collect—or even belong to someone else—and your lawyer will spot that.

Are There Risks of Hiring a Debt Settlement Attorney?

Hiring a debt settlement attorney might sound like a smart move—and it often is—but there are a few risks you should know about:

- Credit Score Damage: Settling debts can tank your credit score. Why? Because of all the late payments and charge-offs that get reported.

- No Guarantees: Creditors don’t have to say yes. If they refuse your offer, you’re still stuck with the debt—and interest keeps piling on.

- High Costs: Legal help isn’t cheap. The fees might eat into any money you save through settlement.

- Scams: Some “debt help” companies aren’t legit. They charge big fees and then disappear without doing much.

- Legal Risk: If you don’t have good legal backup, a creditor might sue you, and you’ll be stuck handling it on your own.

How to Choose the Right Debt Settlement Attorney?

Picking the right lawyer makes all the difference. Here are a few things to keep in mind when looking:

- Experience: Go for someone who’s been doing this for years—ideally, someone who’s helped resolve millions in debt and handled lots of cases.

- Reputation: Check online reviews, BBB ratings, and what past clients say. If people rave about their results, it’s a good sign.

- Access to the Attorney: Make sure you can actually talk to the attorney—not just their office staff. Direct contact is a must.

- Specialization: You want someone who focuses mostly (or only) on debt settlement. It shouldn’t be just a side hustle for them.

- Clear Fees: Understand exactly what they charge, and don’t fall for unrealistic promises. No one can guarantee results.

Debt Settlement Attorney: When Should You Hire Them?

There are definitely times when it makes sense to get a debt settlement attorney involved.

Say you’re drowning in unsecured debt—like medical bills or credit cards—and can’t keep up with payments. That’s a good time to talk to a lawyer. They can work with creditors to slash what you owe or come up with a payment plan that actually fits your budget.

Also, if a creditor threatens to sue you (or already has), getting a lawyer ASAP can protect you. They might even stop the lawsuit entirely through a deal.

Are debt collectors bugging you nonstop? A lawyer can step in and make it stop. They’ll make sure everything’s legal and fair.

Maybe you’ve tried to negotiate on your own, but it’s gone nowhere. That’s when a pro can help. Lawyers know how to push back—and they know the laws that can work in your favor.

One more thing—if you owe more than $10,000, it’s usually worth talking to a lawyer. They can help you make a solid plan, save money in the long run, and finally take back control of your finances.

How Much Does a Debt Settlement Attorney Cost?

There’s no one-size-fits-all price tag, but here’s what usually affects the cost:

- How complicated your situation is

- How much experience the attorney has

- Where you live

Fee Structures:

- Hourly Rates: Expect anywhere from $150 to $350 an hour, depending on the lawyer. The total depends on how much work your case needs.

- Flat Fees: Some attorneys offer one flat rate—typically $1,500 to $3,000—which gives you a clear idea of what you’ll pay.

- Contingency Fees: This is when they take a cut (usually 15% to 25%) of the amount they save you. So, the more they help you, the more they earn—which aligns their goal with yours.

Extra Costs:

There might be added expenses, like court fees or document charges, which can run a few hundred bucks more.

Case Complexity:

The simpler the case, the cheaper it tends to be. If you only have one or two creditors, fees might fall between $500 and $1,500. But if you’re juggling lots of debts or a big amount, expect $5,000 or more.

Bottom line? Always compare lawyers. Ask them exactly what’s included in their fees and make sure you’re not surprised later on.

Your Legal Guide: Debt Settlement Attorney is the Need of the Hour

Do you lack the funds to pay off a significant portion of your debt? A non-profit consumer credit counseling agency that may assist you with budgeting and offer financial guidance may be a good place to start.

A debt settlement lawyer may be able to lessen your debt, combine it, or place you on a payment plan if you’re still having trouble making your payments.

The best way to reduce your legal risk and other dangers, such as those to your credit score, should be known to your lawyer.

Although debt settlement lawyers and bankruptcy attorneys are similar, you might wish to seek their assistance first to prevent filing for bankruptcy.

Additionally, when you seek help from an agency that promises to lower your debts, there is one thing most people don’t think through.

You see, their services often cost you more than you initially owed in the long run. However, a debt settlement attorney can provide you with better options, making them a better choice!

Read Also: