“How many exemptions should I claim?”

You are not the only one thinking about this! Deciding it is a critical financial decision that impacts your monthly take-home pay and your final tax bill.

Taxpayers had been relying on a ‘simple allowance’ system for a considerable number of years. However, the IRS has totally redesigned the Form W-4 because of the need for much greater accuracy.

As of 2026, there is an enormous focus on ‘withholding’ because the IRS is catching up on tax rates due to inflation at that time.

Under-withholders: You’ll get a surprise bill or perhaps even an underpayment penalty when it’s time to file next April. Over-with holders: You are effectively giving the government a no-interest loan instead of letting that money sit back in your savings account.

In this article, we will elaborate on the following:

- The difference between old allowances and the current W-4 system.

- How your filing status changes your withholding strategy.

- Calculating the right amount for households with multiple jobs.

- How many exemptions should you claim?

- Avoiding IRS penalties through accurate reporting.

The Mechanics Of Modern Payroll Withholding

Before you come to a decision as to “how many exemptions should I claim”, let us try to understand this whole thing of taxes being deducted from your income.

Your employer needs the information on the form filled out in W-4 to start deducting money from your income, which is then remitted to the IRS for your account. This will enable you to settle the taxes in bits.

Withholding vs. Refund vs. Owing

What every taxpayer looks forward to accomplishing is coming out even. If your taxes are withheld too much, this leads to a big refund.

However, it may also be a sign that money flow might feel tight throughout the month. If you set this number too low, in April, an account balance is due.

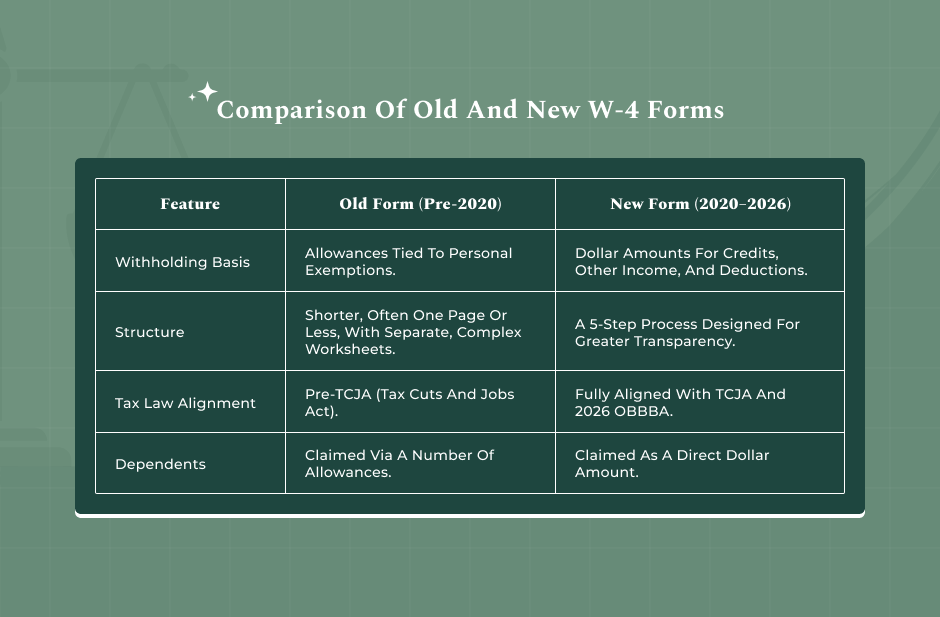

Historical Context: Old W-4 vs. New W-4

“How many personal exemptions should I claim?”

The Tax Cuts and Jobs Act (TCJA) eliminated personal exemptions for federal purposes through 2025. The federal W-4 no longer uses “allowances”. Instead, they use dollar amounts for credits and deductions.

Why Allowances Disappeared

The IRS simplified or removed allowances to make withholding more precise and less confusing. Although the language is different, the underlying question of how many exemptions to claim is still applicable, since many states continue to use the old allowance system on their tax returns.

Knowledge of how the old and new systems work is essential to remain tax compliant at both levels.

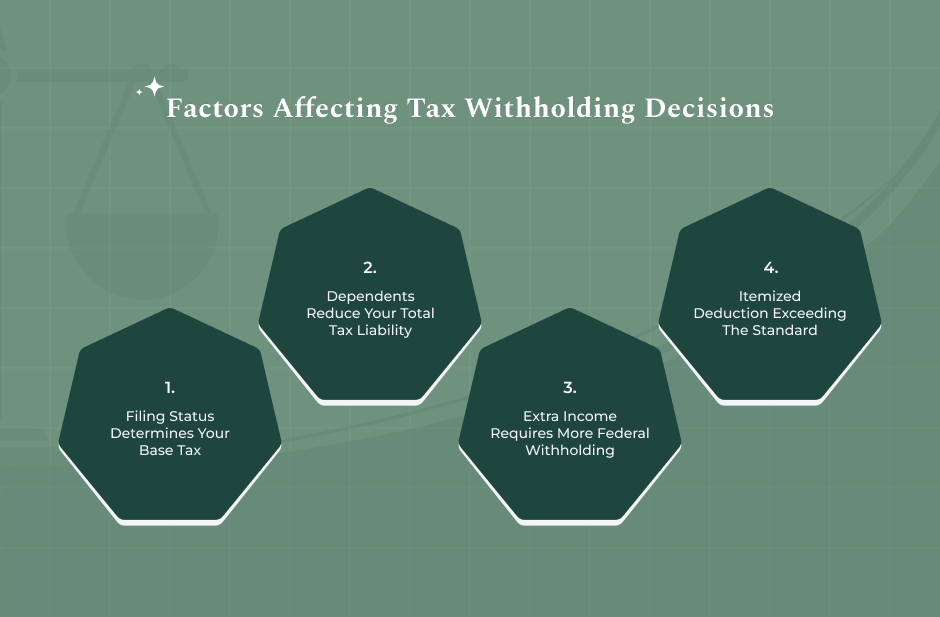

Factors That Determine Your Withholding Strategy

Several life factors dictate how many tax exemptions should i claim or how much extra withholding I need. Your filing status is the most significant starting point. A single person with one job has a much simpler calculation than a married couple where both partners earn a high income.

Here are the different factors that govern the parameters for the Withholding Evaluation.

- Total household income from all sources.

- Number of dependents under age seventeen.

- Eligibility for the Child Tax Credit.

- Income from side gigs or investments.

Effects Of Filing Status When Making Claims

The filing status determines which standard deduction value to use from the IRS table. Additionally, a “Head of Household” standard deduction value is greater than that of “Single.”

This variation impacts the calculation of exemptions that should be claimed in order not to result in an overpayment or underpayment by your employer.

Multiple Jobs And Working Spouses

This, of course, means that you can’t take the same deductions on both W-4s without ending up underpaying. You will need to coordinate your W-4s to match their total withholding to your total household income. Most often, it is best to reflect the largest adjustments on the W-4 for the highest-paying job.

How To Figure The Right Amount For Your Situation

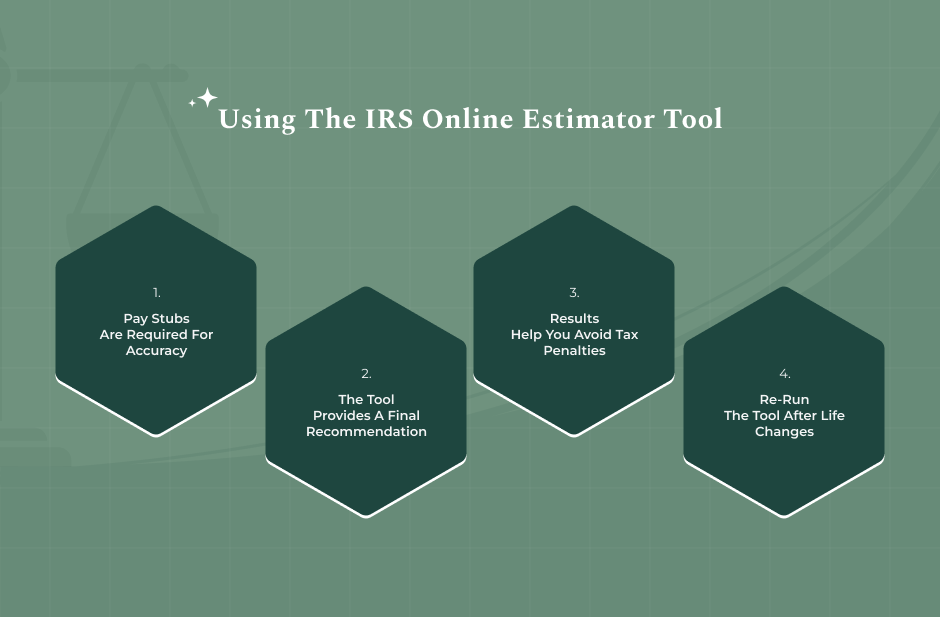

To accurately determine how many exemptions should i claim, you should use the official tools provided by the government. The IRS Withholding Estimator is the most reliable way to get a custom answer based on your most recent pay stubs. This tool is especially helpful if you have complex finances or multiple income streams.

Here’s what the Step-by-Step Withholding Calculation looks like.

- Gather your most recent pay stubs.

- Estimate your total annual gross income.

- Input your expected tax credits and deductions.

- Follow the specific instructions for Form W-4.

Using The IRS Withholding Estimator

This virtual tool assists in answering questions such as “how many exemptions should I claim?” through a scenario of conducting a simulation of your taxes.

Besides asking for information regarding your earnings and bonuses, the tool also seeks information regarding other sources of money not related to your job, such as dividends and interest (TurboTax, Intuit).

Suggested Ranges For Different Scenarios

However, in your personal capacity, if you are single, have one job, and do not have children, “the default W-4 would be enough.”

Having a spouse and children may qualify you for credits that count as an exemption for a W-4. In your scenario, your objective at this point is to withhold as little as possible so that you can have that money to spend where you want to.

Errors And Precautions – Missteps And Associated Risks

Too many exemptions or deductions may trigger an “underpayment penalty.” TheIRS requires you to pay at least 90% of your current year’s tax or 100% of last year’s tax through withholding.

If your situation does not meet these requirements, you may owe an additional penalty as well as your tax due (Community Tax).

The Danger Of Over-Claiming

If you ask yourself, “how many exemptions should I claim?” and choose a high number, such as 10, when you cannot substantiate it with the income, you are inviting trouble.

Your employer can be obligated to send your W-4 to the IRS for review if the claims appear suspicious. Always ensure that your claims are supported by actual dependents or legitimate tax credits.

Under-Withholding In A High-Interest Era

How many exemptions should I claim? With interest rates factoring into the IRS’s penalty calculations in 2026, owing the government money is indeed more expensive nowadays than it was just a couple of years ago. In this way, being conservative with your claims tends to be a safer financial move rather than trying to maximize every penny of your paycheck.

Special Cases And State Variations

Although the federal government dropped the old system, the states did not. When filling out a form for a state, the following form will be required to be filled out: “How many personal exemptions should I claim?”

For California or Hawaii, there will be their own forms; these will be separate from the federal W-4 form (Hawaii Department of Taxation).

Let us check out the Differences Between State vs. Federal Rules at a glance.

- State allowances often differ from federal.

- Some states have no income tax.

- Reciprocal agreements may affect your withholding.

- Local taxes might require separate adjustments.

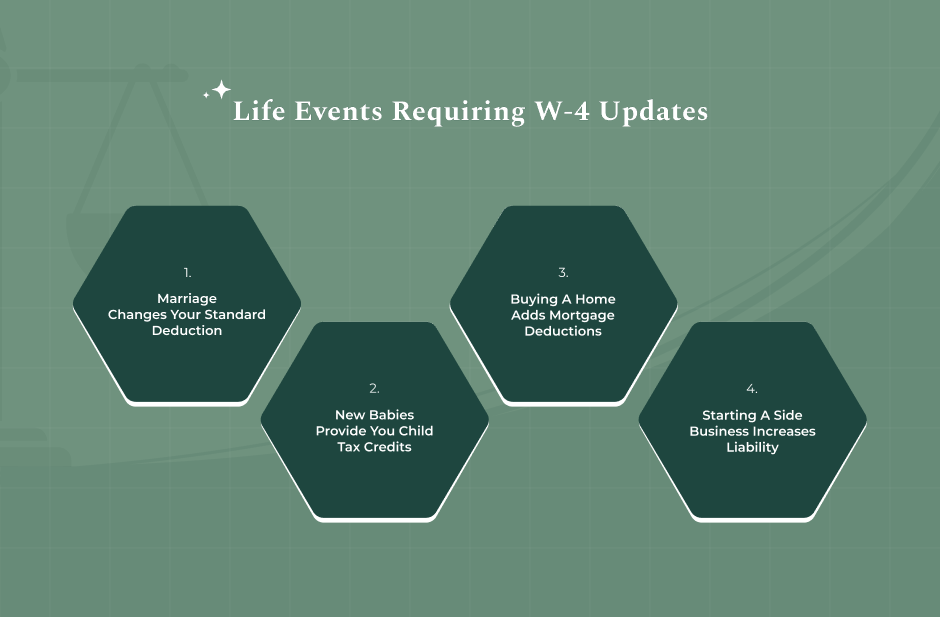

When To Update Your W-4

You cannot simply fill out your W-4 and never think about it again. Changes in your life affect the answer to “how many exemptions should I claim?”

Getting married or divorced, having a child, or buying a new home will all affect your taxes. It is a good idea to update your form within ten days of these occurrences to stay on top of your finances.

Freelancers And Side Hustles

You can have a “Side Hustle” in 2026. This means that the taxes that are withheld by your employer may not be sufficient for the self-employment tax that you need to pay.

You can ask for “Extra Withholding” by showing it on Line 4c of the W-4 form. This way, you can ensure that the W-2 income that you have covers the 1099 income.

Read Also: How Much Do You Have To Be In Debt To File Chapter 7 Protection?

Best Practices For Tax Success In 2026

How many exemptions should I claim? The best way to keep ahead of the game with the IRS is to keep your financial situation open and check it regularly.

Rather than speculating what number of exemptions I should claim, you can take thirty minutes every six months to check your income statements and compare your year-to-date amounts against what you estimate your taxes will be for the year.

Here are some Expert Tips for your Paycheck Management at a glance.

- Aim for a small refund to stay safe.

- Coordinate with your spouse on all forms.

- Keep copies of all W-4s you submit.

- Use a tax professional for complex income.

Passing Up The Tax Refund Anticipation

Many people overwithhold just for the benefit of this forced savings program, Ruthley said, referring to the big refund check. Nevertheless, finance specialists recommended that you could be making money from that amount. By adjusting your deductions to bring home an additional $200 a month, you could deposit it into a high-yield savings account or an IRA.

How Many Exemptions Should I Claim? Final Review Checklist

So, before signing another W-4 yourself, ask yourself these questions: Does this reflect my current family situation? Does this include my spouse’s income? Does this include my investments? So if your answers to those questions are yes, you have successfully figured out how many exemptions to claim so that your tax season is stress-free.

Frequently Asked Questions On How Many Exemptions Should I Claim?

It can be confusing for you to understand your paperwork for paying employees, in light of changes to the tax code that seem to occur annually. These questions refer to areas of confusion for American citizens trying to identify how many exemption claims they can make for the year 2026.

The IRS regulations can sometimes be a moving target. However, concentrating on your total tax liability, not just an individual amount on a tax return, will give you the greatest degree of comfort.

To protect yourself from owing any taxes, 0 is the best choice. This maximizes the amount of taxes withheld. But if this is your situation, a small refund with a slightly larger monthly paycheck will result if you enter 1 or the equivalent single default choice.

You probably want to claim fewer exemptions and/or file for “Extra Withholding” on the W-4 form. Since your side business doesn’t have taxes withheld on it, you’ll want your full-time job’s taxes withheld to cover both incomes so that you don’t have an underpayment penalty.

You are eligible to file for “Exempt” ONLY if you didn’t owe taxes last year and currently owe none for this year as well. If you are exempt but are actually liable to pay taxes, then you may end up with hefty penalties in addition to interest charges from the IRS.

Know The Exemptions That You Can Claim!

So, the question of “how many exemptions should I claim” comes down to finding the right harmony for your life. As the old system of exemptions is becoming less applicable, the question of correct withholdings is more pressing than ever for the year 2026.

With the help of the IRS Estimator tool and staying current on any life events, you will be able to avoid any penalties while also achieving maximum financial health for your life. There is always time now, while the money you have is simply lingering with the government until spring.