If you have ever received a letter or call from CKS Prime Investments, it is best that you do not avoid them. And while you might feel like it is a scam, that is not really the case!

In case you were wondering, this one is a debt collection agency. They primarily buy unpaid junk debts from several financial institutions and creditors. After that, they call up the borrower and collect these debts.

“I can just ignore them, right?” NO. You cannot. And that’s the saddest part. If you try to ignore their calls, they will be in a powerful position to sue you and take you to court!

Yes, you read that right! This means, eventually, you will be trapped in a lawsuit over debt collection. And trust me, no one wants that.

So, what can you do about it?

Well, for starters, it is important that you understand your legal rights when you are dealing with debt collectors like these. For instance, they cannot harass or threaten you to get the money.

Additionally, there are certain guidelines and rules that they must follow in this entire process of collecting the debt.

So, if you have been getting calls from CKS Prime Investments and you want to know how you can protect yourself from this potential legal trouble, you have come to the right place!

Therefore, keep on reading this blog till the end, and thank me later!

CKS Prime Investments, LLC: A Brief Overview of the Company

CKS Prime Investments, LLC is a third-party debt collection company based in Texas, USA. It specializes in buying old debts from banks, credit card companies, and other lenders. Its goal is to collect money from people who have not paid these debts.

Once they buy a debt, they become the new owner. This means that even if you originally owed money to a different company, CKS Prime Investments now has the right to collect it. They might call you, send letters, or even take legal action if you don’t pay.

“But I have never heard this name. I don’t think I have ever taken a loan from them!” You are not the only one in this case.

You see, most of the people don’t recognize the name CKS Prime Investments. And that’s because they have actually never taken a loan from them. So, how did they contact you and why?

Generally, it is because the original creditor or financial institution from whom you have borrowed might have sold these debts to the firm.

In other words, if you have old credit card debt, medical bills, personal loans, or other unpaid balances, your debt might have been sold to them without even realizing it.

How Does CKS Prime Investments Work?

Now that’s a really good question! And let me explain how they work.

CKS Prime Investments buys debts at a very low price from many creditors. These creditors usually sell these as “junk debts” when they cannot get it back from individuals.

For example, if you owed $1,000 to a credit card company but didn’t pay, the company might sell that debt to CKS for as little as $100. After that, CKS will then try to collect the full amount from you so they can make a profit.

Makes sense?

For their usual operation and flow of work, they would:

- Contact you: You might get phone calls, emails, or letters asking you to pay the debt.

- Negotiate payment plans: If you cannot pay the full amount, they may offer a settlement or payment plan.

- Report the debt: If it is valid, it might be reported to credit bureaus, affecting your credit score.

- Might sue: If you don’t respond, they could file a lawsuit against you to collect the money.

Understanding how they work is important to protect yourself and make the best financial decision.

CKS Prime Investments: Why Are They Calling?

If CKS Prime Investments calls you, they believe you owe them money. They may have bought an old debt from a credit card company, loan provider, or another creditor.

Here are a few common reasons why they might be contacting you:

- You have an unpaid debt: They believe you owe money from an old loan or credit card.

- They are trying to verify your identity: They may want to confirm that you are the right person before discussing the debt.

- To offer a settlement: Sometimes, they might let you pay less than the full amount to close the debt.

- They are preparing for legal action: If they don’t get a response, they might sue you in court.

Important: Even if you don’t recognize the debt, do not ignore their calls or letters. Instead, follow the steps below to protect yourself legally.

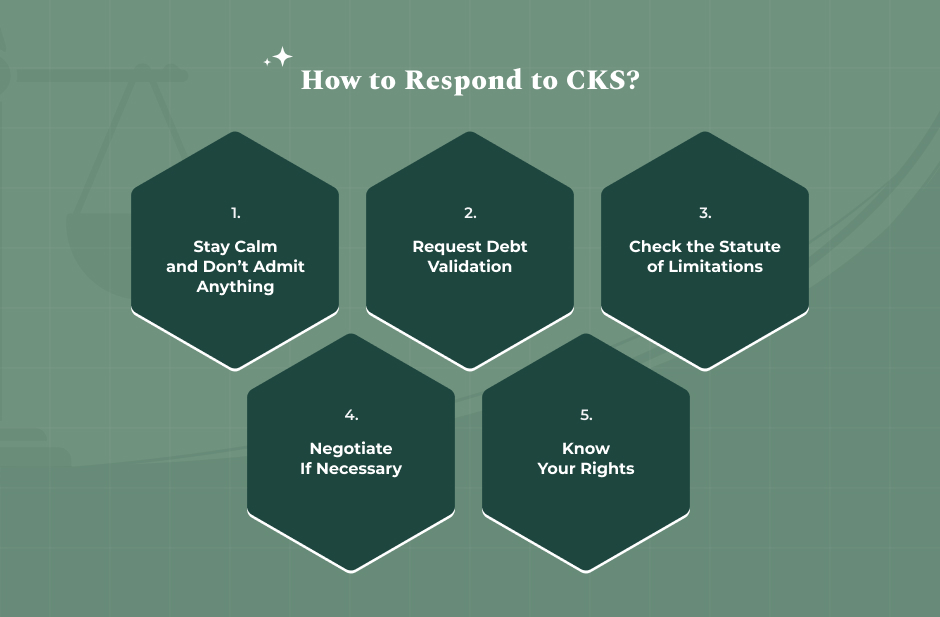

How to Respond to CKS Prime Investments?

If you receive a call or letter from CKS Prime Investments, follow these steps:

1. Stay Calm and Don’t Admit Anything

First, debt collectors sometimes use pressure tactics to make you admit the debt. Instead of answering immediately, say, “I need to verify this debt first.”

2. Request Debt Validation

Secondly, you have the legal right to ask for proof that the debt is real. Send a written request asking for a debt validation letter. This letter should include:

- The original creditor’s name

- The amount owed

- Proof that CKS Prime Investments owns the debt

Additionally, they cannot legally collect your debt if they cannot provide this proof.

3. Check the Statute of Limitations

Debts have an expiration date, usually between 3 to 10 years, depending on your state. If the debt is too old, CKS cannot legally sue you. Check your state’s statute of limitations before making any payments.

4. Negotiate If Necessary

If the debt is valid and within the statute of limitations, you can:

- Offer a settlement (paying a smaller amount to clear the debt).

- Set up a payment plan if you can’t pay in full.

- Ask for debt forgiveness (sometimes, they accept lower payments).

5. Know Your Rights

Under the Fair Debt Collection Practices Act (FDCPA), CKS Prime Investments cannot harass you. They cannot:

- Call you at odd hours

- Threaten or insult you

- Call your family or workplace

- Lie about what you owe

If they break these rules, you can report them to the Federal Trade Commission (FTC) or file a complaint.

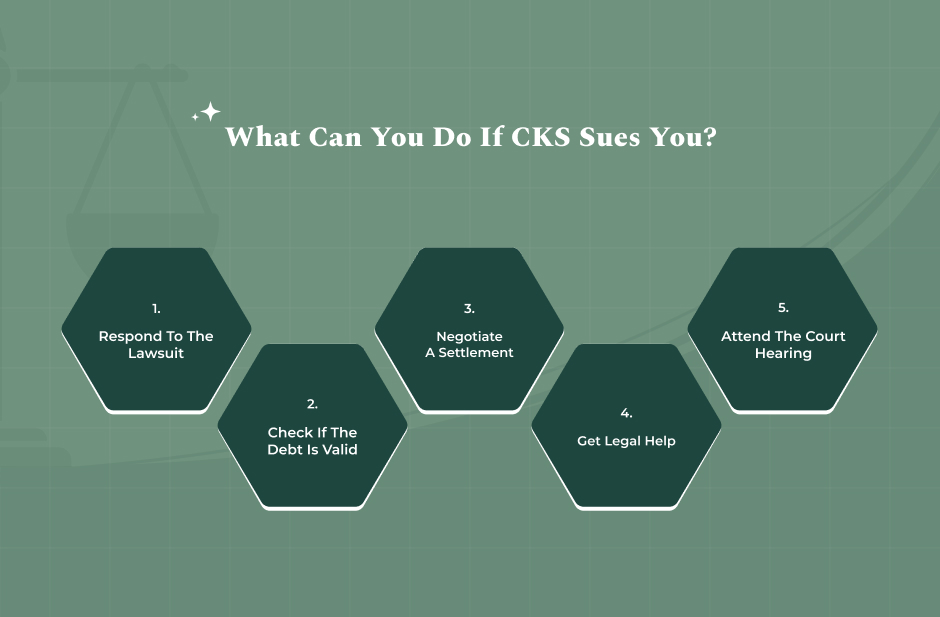

CKS Prime Investments: What Can You Do If They Sue You?

If you receive a lawsuit notice from CKS Prime Investments, do not ignore it. But what can I do? I have the answer to that question.

Here’s what you should do:

1. Respond to the Lawsuit: First, you need to remember that ignoring the lawsuit can result in a default judgment. This means the plaintiff wins automatically. Therefore, it is important to file a response in court before the deadline (usually 20–30 days).

2. Check If the Debt Is Valid: Secondly, if CKS cannot prove you owe the debt, you can request a case dismissal.

3. Negotiate a Settlement: Before the court hearing, you can negotiate with CKS to settle the debt for a lower amount.

4. Get Legal Help: If the lawsuit is serious, consider hiring a lawyer. Some legal aid services offer free advice for debt collection cases.

5. Attend the Court Hearing: Finally, if you go to court, it is important that you present all forms of evidence. For instance, these can include things like an expired debt or missing documentation. These will help you fight the case.

Your Legal Guide to Investment and Debt

In conclusion, dealing with debt collection agencies like CKS Prime Investments can be really scary. However, knowing your rights and options makes all the difference. Remember:

- Never ignore debt collection notices or lawsuits.

- Always request proof of the debt before making payments.

- Check if the debt is too old to be collected legally.

- Negotiate for a lower payment if necessary.

- Seek legal help if they sue you.

Taking the right steps allows you to handle debt collection wisely and protect your finances. If you feel overwhelmed, contact a consumer protection lawyer for guidance.

Read Also: