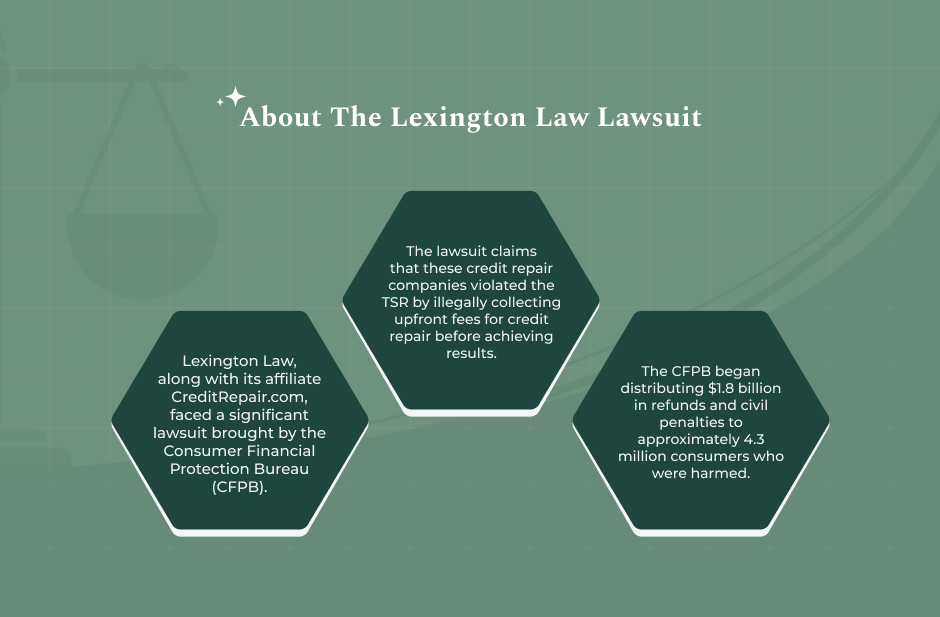

- As part of the Lexington Law Lawsuit, the CFPB has put forward a settlement offer that includes a hefty fine of $2.7 billion for major credit repair companies, along with a prohibition for these companies to carry out telemarketing activities related to credit repair services for ten years.

- In a direct violation of federal law, the companies were taking illegal advance fees through their telemarketing operations.

- The CFPB claims that over 4 million consumers have been deprived of close to 3.1 billion dollars intentionally.

As most of us are already aware, Lexington Law is one of the most popular credit repair and rebuilding companies in the United States. A lot of people relied on this company to make their credit history nice again. But in return, they were accused of doing the opposite of what they should have done.

The authorities said that the company violated the rules and that they charged people before actually fixing their accounts. This is absolutely forbidden.

This credit repair industry has taught a lot through this learning experience. Credit restoration is a lot like improving your school report card—it’s a process, needs genuine work, and honesty.

So, if your intention is to know the truth about the case and what lessons we can learn from it, then you are exactly where you need to be.

In this article, we will be talking about the following things:

- Is there a Lexington Law lawsuit going on?

- What is the lawsuit against Lexington Law about?

- Major allegations in the lawsuit.

- How did Lexington Law and Credit Repair respond to the lawsuit and allegations?

Therefore, if these are a few things that you want to know, keep on reading this blog till the end…

Is There A Lexington Law Lawsuit Going On?

Yes—and it’s a big one. The Lexington Law Lawsuit wasn’t the first time a credit repair company got into trouble, but it was one of the biggest cases we’ve seen in recent years.

Many companies claim they can fix your credit score fast, but not all of them play fair. Over the years, credit repair companies have been accused of:

- Charging people money before doing any work.

- Lying about what they can do.

- Tricking customers into signing up for services they don’t need.

- Not telling the truth about how credit rebuilding actually works.

This lawsuit reminded everyone to be more careful. It showed us that not all companies who say “we’ll fix your credit” are honest. Some just want your money. So yes, there is a Lexington Law Lawsuit—and it matters.

Important Note: Credit repair is not magic. It’s a process that takes time, real changes, and the right help.

What Is The Lexington Law Lawsuit About?

In short, the Lexington Law Lawsuit says the company broke federal rules. The government says they:

- Took money from people before doing any work.

- Tricked people with fancy ads that weren’t true.

- Broke a law called the Telemarketing Sales Rule (TSR), which says you can’t charge people for credit repair unless you actually help them first.

“The court concluded that [Lexington Law] broke the law by illegally charging upfront fees and engaging in deceptive, bait-and-switch advertising for credit repair services in violation of the Consumer Financial Protection Act of 2010 and the Telemarketing Sales Rule,” according to the official website of CFPB.

“Americans across the country looking to improve their credit scores have turned to companies like CreditRepair.com and Lexington Law. These credit repair giants used fake real estate and rent-to-own opportunities to illegally bait people and pad their pockets with billions in fees,” Rohit Chopra, the Director of CFPB mentioned in their official announcement.

Investopedia stated that more than 4 million people/consumers were impacted as a result of this issue.

Let’s take a deeper look at what exactly they were accused of.

Major Allegations In The Lexington Law Lawsuit

After these companies did not adhere to the federal regulations, consumers were charged hundreds of dollars in illegal upfront fees by these companies, according to Investopedia.

Over four million consumers have paid these companies a total of $3.1 billion. The consumers were charged a $15 sign-up fee, and then recurring monthly fees were charged within two weeks.

Here are the main things the government said Lexington Law and its sister company, CreditRepair.com, did wrong:

- Charged illegal upfront fees: They asked people to pay before they actually fixed anything on their credit reports. That’s against the law when using telemarketing.

- Bait-and-switch ads: They advertised free or cheap services but later charged more than what was promised. That made customers feel tricked.

- Didn’t wait to prove results: They didn’t show that people’s credit was really fixed for at least 6 months before charging them.

- Confused customers with unclear terms: People didn’t always know what they were signing up for or how to cancel.

According to ClassAction.Org, in the court-stipulated final judgment and order filed in August 2023, the court determined that Lexington Law, CreditRepair.com, their parent companies, along with numerous affiliates—basically the biggest credit repair brands spread across the US—were engaged in the violation of certain federal consumer protection laws.

How Did Lexington Law and CreditRepair Respond?

After the court mostly agreed with the government, Lexington Law and CreditRepair.com did something serious—they filed for Chapter 11 bankruptcy. That’s when a company runs out of money and needs to shut down or start over.

Here’s what they did:

- Shut down many operations: They closed parts of their business.

- Agreed to a settlement: Instead of fighting more, they agreed to pay money to help the people who were harmed.

- Promised to change: As part of the deal, they are now banned from telemarketing credit repair services for 10 years.

Here’s what happened:

| Event | What Happened |

| Lawsuit filed | CFPB sued in a Utah court |

| Court ruling | Judge agreed with CFPB |

| Bankruptcy | Lexington Law filed for Chapter 11 |

| Settlement | $2.7 billion in penalties and refunds |

| Ban | No telemarketing for 10 years |

Additionally, on August 28, 2023, the Consumer Finance reported that “the companies filed for Chapter 11 bankruptcy protection” after the ruling of the district court. “The companies represented that they had shut down about 80 percent of their business, including their call centers, and laid off about 900 employees in response to the court’s ruling,” they continued.

Did Customers Get Refunds?

Yes, and that’s good news! The CFPB (Consumer Financial Protection Bureau) made sure people got some of their money back.

- Total Refunds: $1.8 billion

- Refunds sent to: About 4.3 million people

Here’s how it worked:

- The government looked at company records to find customers who paid illegal fees.

- People didn’t have to do anything to get their money back—it was automatic.

- Refunds were sent out between December 2024 and January 2025.

If you used Lexington Law or CreditRepair.com, check your mailbox or bank account—you might already have your refund.

How Do Credit Repair Companies Work?

Credit repair companies say they can fix your credit by removing errors from your credit report. But here’s the truth:

- They can’t magically erase bad credit.

- They can only dispute errors—like mistakes or wrong information.

- You can often do the same work yourself for free!

For instance, as we have mentioned in my earlier blogs, Jefferson Capital says it offers legal credit advice. However, if I were in your place, I would still want to be careful and read the fine print.

Here’s how honest credit repair companies are supposed to work:

- Look at your credit report.

- Spot mistakes, like wrong addresses or false missed payments.

- Ask the credit bureau to fix them (called a dispute).

- Wait for results—this can take time.

- Only then can they charge you for services (if legal).

But what about the warning signs of a scam? How would you know if they are genuine or not? Let me tell you! You need to stay safe from certain services if they:

- Ask for money right away.

- Promise to erase all bad credit, even the true stuff.

- Say you’ll get a new credit identity.

Your Legal Guide: What Should You Keep In Mind About Rebuilding Your Credit?

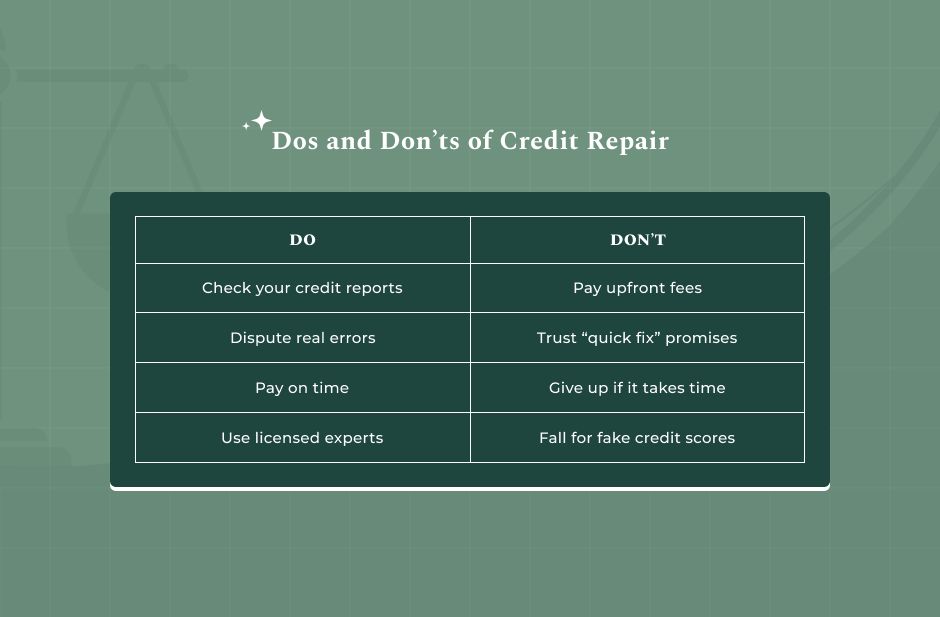

In conclusion, rebuilding your credit can feel hard—but it’s totally doable if you take the right steps. Here’s what the Lexington Law Lawsuit teaches us:

1. You have rights: The law protects you from unfair credit repair companies. Learn about the Telemarketing Sales Rule and your rights under the Fair Credit Reporting Act.

2. You don’t need to pay someone else: You can dispute errors on your credit report for free. Sites like annualcreditreport.com let you see your report once a year.

3. Build good credit slowly: Here are real steps that work:

- Pay your bills on time.

- Keep your credit card balances low.

- Don’t apply for too many loans at once.

- Check your credit reports for errors regularly.

Ultimately, you must know when to ask for help. Sometimes, a credit counselor or lawyer can guide you—but make sure they’re licensed and have good reviews.

Read Also: