If you have been getting calls from Johnson Mark LLC and have been wondering why they are calling when you did not borrow, I am here to answer those questions!

You see, there are several funding companies that collect debts through other services. And there are companies who ask their legal team or consultant firms to take care of the debt if they cannot reach the borrower.

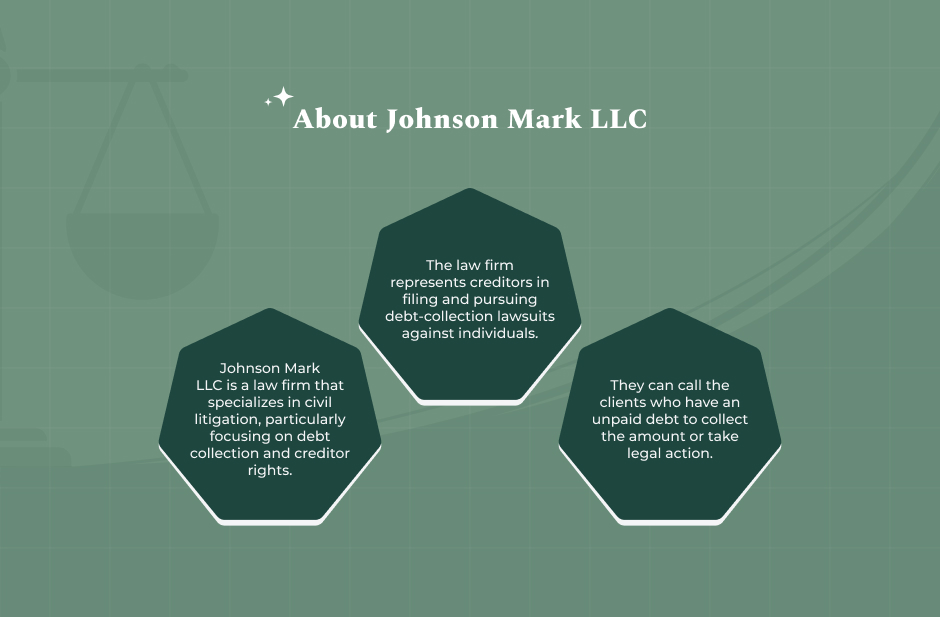

Johnson Mark LLC is the law firm that represents these creditors and funding organizations when they cannot reach the person concerned.

But what happens when they call you? And what will happen if you do not respond to them? Additionally, can Johnson Mark LLC get you jailed?

If these are some of the things that you want to know, then you have come to the right place! So, keep on reading this blog till the end, and thank me later…

Johnson Mark LLC: A Brief Overview

Before talking about how you can deal with Johnson Mark LLC, let me tell you something about the company.

So, Johnson Mark is a law firm that is located in Utah. They specialize in the field of debt collection. They basically function by representing several financial institutions like banks and lending companies that aim to deal with unpaid debts.

In simple words, this firm does not just collect money on behalf of the creditors. Rather, they also have the legal power to represent them and take you to court if necessary.

Just like Jefferson Capital Systems, there are several different companies that they work for. Some of them include:

- Credit card companies

- Medical providers

- Loan companies

- Retail stores with financing options

In case you have been getting calls from this firm, it is most likely that you have an unpaid debt record in one of these companies and they have asked the firm to get in touch with you.

How Does Johnson Mark LLC Work?

First things first, if you have fallen into a situation where Johnson Mark LLC sues you, there are a few things that you will need to do. Like how do they work? And what is the process behind their debt collection?

Well, it all starts when your original creditor either sells your debt to the firm or hires them to collect it from you. This is where the debt collection law firm gets your information.

After that, they will start contacting you. In some cases, they might send you a letter (read: notice). At other times, they might even call you to let you know about the debt. This is when they will request you to make the payment.

There are times when Johnson Mark might offer you several payment options. In such a case, you will be able to either pay the debt in instalments or even negotiate a lesser amount than what you really owe.

However, if you decide to ignore their calls, you will be in big trouble. And that’s primary because they can even take legal action against you and take you to court.

In the worst case scenario, you find yourself in a lawsuit where the court will ask you to pay your debt.

Johnson Mark LLC: Why Are They Calling Me?

If you have read my previous blog on Rauch Sturm, you already know that creditors hire their services to get back unpaid debts. Johnson Mark kind of works in the same way.

If you are thinking about why you are receiving calls from the firm. Here are some of the reasons:

- You might have an unpaid debt from a financial institution or a credit card company.

- The creditor whom you originally owed the debt has hired their services to collect the money from you.

- Your original creditor has decided to sell your debt to the firm, which gives them the legal right to collect it from you.

- The firm wants to negotiate the debt amount with you before they decide to take legal action against you.

How to Respond to Johnson Mark LLC?

By now, you are already aware that if the firm is calling you or trying to contact you in any way, it is mainly because they want you to repay a debt. Therefore, ignoring their calls is a mistake that you MUST avoid at all costs!

Not responding to Johnson Mark LLC will potentially harm you and make the matter even worse. You might even end uo in a debt collection lawsuit, which (I am pretty sure) you do not want to happen!

Also, it is best that you keep in mind one really important thing. That’s because Johnson Mark LLC is a firm that collects debt on behalf of other organisations and agencies.

This means they will have to stick to certain guidelines when it comes to settling or even negotiating the debts.

Johnson Mark LLC: What Can You Do If They Sue You?

Now that you know why this firm might be calling you, you might want to know what are some of the things that you can do if they plan to sue you.

You see, if they have decided to sue you, it means that they are filing a lawsuit against you to ensure that the court can force you to pay the money you owe.

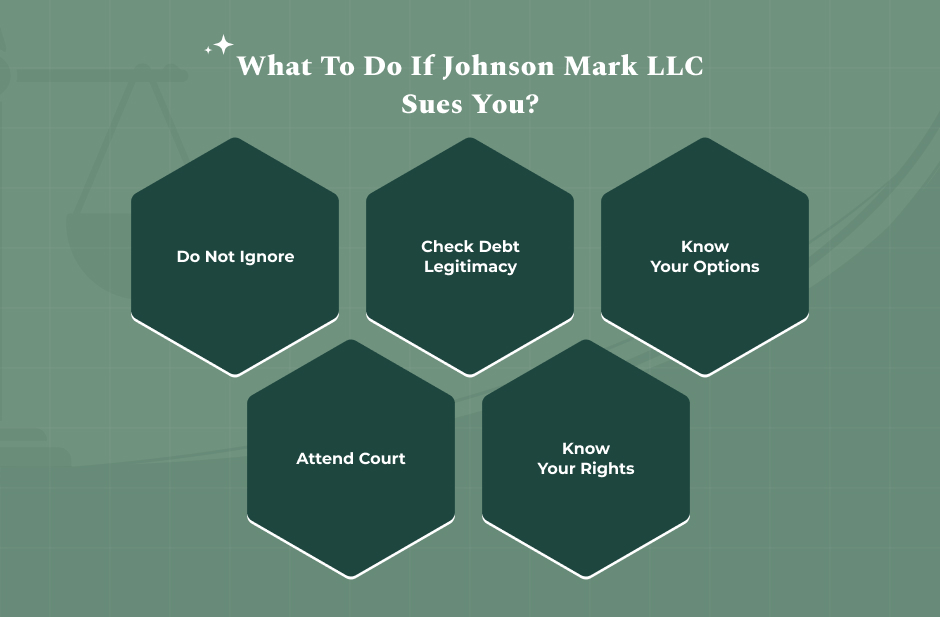

Here are some of the things that you should do in such a case:

1. Do Not Ignore

Firstly, while you might think they are trying to scam you, do NOT ignore their calls or messages. You should also be very prompt in any case you receive a court summons.

Just in case you did not know, if you ignore their calls and do not respond to them, the court will automatically rule in favor of the firm, and you will lose the case.

2. Check Debt Legitimacy

After responding to them, you must check the legitimacy of the debt. Try to figure out if that debt is really yours or not by requesting them.

Additionally, you can also try to check your past records and try to verify whether you really owe the amount that they are claiming.

3. Know Your Options

Third, after you have verified your debt, it is best that you consider all the options that you might have at hand. Some of them include the following:

- Negotiate a settlement: It is best that you talk to them as you might be able to negotiate an amount that is lesser than the original debt.

- Dispute the lawsuit: In case you have figured out that the dent they are claiming is not ours, you can dispute the lawsuit and fight the claim.

- Get legal help: If you realize that the debt is actually yours, you can try to find the best debt settlement lawyer who can help you in such a situation and deal with the firm.

4. Attend Court

Next, if, by chance, the court hearing has already been scheduled, it is best that you attend it. This is mainly because if you do not do that, the judge might rule against you.

5. Know Your Rights

Finally, and most importantly, it is important that you are aware of your legal rights/ Keep in mind that the debt collection firm cannot harass you by calling you repeatedly.

Additionally, they cannot threaten you about a legal action that they “might” take if you do not repay our debt. Moreover, they cannot call you at work or very late at night.

Your Legal Guide to Debt Collection and Debt Relief

In conclusion, when you are dealing with a debt collection law firm like Johnson Mark LLC, it is very important that you keep your calm.

The main thing you need to do is to understand the rights that you have and respond to their calls when they try to contract you.

Additionally, it is also important that you review and explore your settlement agreement and other options. You never know what might work for you!

Read Also: