A legal tool called a Living Trust in Texas lets you to oversee your properties and decide who will inherit them after your passing—without the necessity of going through the probate process.

Court proceedings are the main cause of this as they are quite prolonged and costly. According to the Texas State Law Library, probate in Texas can take from six months to a year and will cost the heirs thousands of dollars.

To avoid all of this, a living trust can help you.

A study by the American Association of Retired Persons (AARP), dated 2023, said that just 33% of the U.S. population have a Will.

Most people are under the impression that living trusts as well as wills are for those who have lots of possessions, but that is not the case.

A living trust is for anyone who wants to make sure that their family members and assets are protected.

If you are a house owner, you have children, or you just want to have your beloved ones inherit your property in a straightforward manner, a living trust is definitely the right option for you.

What is a Living Trust in Texas?

A living trust is similar to a container in which you move your home, investments, and other valued assets during your life.

You will also assign a plan for how your assets will be managed and distributed after your death.

One of the most beneficial elements is that it avoids court involvement (probate), which will greatly help your heirs.

Let’s understand this with an example:

Imagine you have a toy chest filled with your favorite toys. You don’t want your friends to fight over them when you’re not around.

So, before anything happens, you create a list stating which friend gets which toy. You also pick someone (let’s call them your “trustee”) to make sure the toys go to the right friends at the right time.

A living trust works the same way. You (the “grantor”) create a trust and put your house, bank accounts, or other assets in it.

You choose someone (the trustee) to take care of everything. Additionally, you also decide who will receive your assets when you’re no longer around (your beneficiaries).

The best part? Unlike a will, which needs to go through probate (a lengthy court process), a living trust lets your beneficiaries get what you left for them quickly and without extra costs.

How Does a Living Trust Work?

In Texas, a living trust functions similarly to a set of rules pertaining to your assets. The framework is as follows:

- Form the trust: You create a legal document evidencing your intent to form a living trust and transfer whatever assets you want into the trust.

- Choose a trustee: While you’re alive, you are your own trustee, which means you control the assets in the trust. You also select a successor trustee (e.g., a relative or an attorney) to step in and manage your assets when you die.

- Determine dispositions: You indicate one or more beneficiaries (e.g., children or a spouse) who will inherit the assets upon your death.

- Administer the trust: While you’re alive, you can add and remove assets in the trust, decide who will receive what, or even revoke the trust (with a revocable living trust).

- After your death: The trustee follows the instructions you provided and distributes everything to the named beneficiaries without having to go through any court process.

Hence, your family will not have to grade month or years of court paperwork—they will get their share much, much faster!

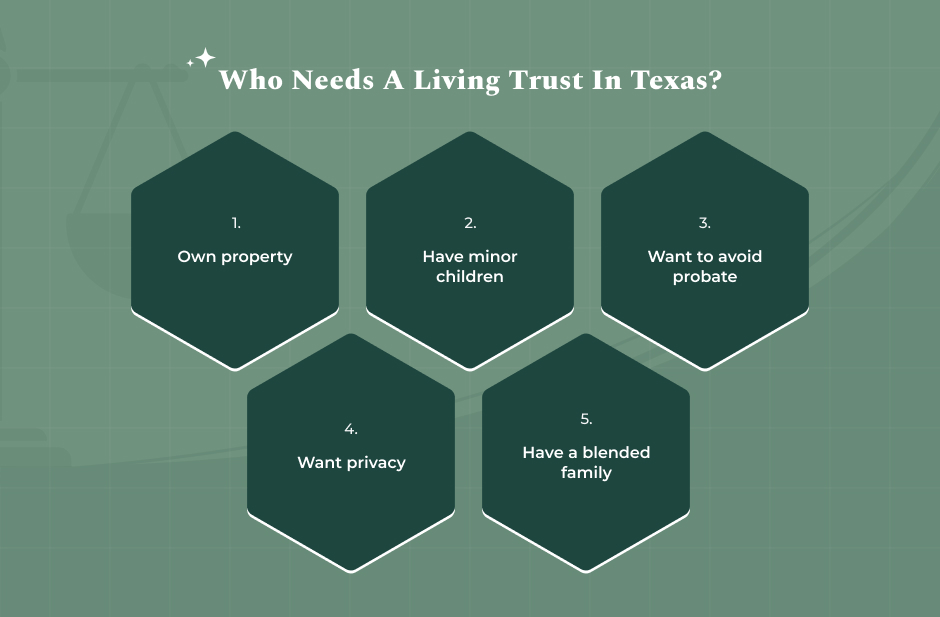

Do You Need a Living Trust?

A living trust is not just for the rich. It can benefit anyone who owns property, has children, or wants to avoid probate. Here are some signs that you might need a living trust in Texas:

- Own property: If you have a house, land, or business, a trust makes transferring ownership easier.

- Have minor children: A trust lets you decide when and how they get their inheritance, instead of giving them a lump sum at 18.

- Want to avoid probate: Probate can take months or years. A living trust lets your beneficiaries receive assets immediately.

- Want privacy: Unlike a will, which becomes public record, a trust keeps your financial matters private.

- Have a blended family: A trust ensures that children from a previous marriage get their rightful inheritance.

If any of these apply to you, a living trust might be a smart choice.

How Can a Living Trust in Texas Help?

A living trust guards your assets and makes things easy for your loved ones. Here’s an example:

Sarah, a single mother with two children, has a house in Texas; she wishes for her children to inherit it after her death.

The will the mother has will only ensure her kids go through an inherited probate court process, which may last more than a year and costs thousands of dollars in legal fees.

So, instead of a living will, she created a living trust, turning her children into beneficiaries and assigning her brother as the trustee.

At the time of her death, her brother will simply grant the house to her children without going through the court. This saves time, money, and stress.

This is why most people find living trusts better than having pour-over wills: everything goes swiftly and smoothly.

How Can You Make a Living Trust in Texas?

Now that you know what a living trust in Texas is all about, it is time for you to learn how to set it up or create it.

Setting up a living trust in Texas involves these simple steps:

1. Decide What to Include: List your assets, such as your home, car, bank accounts, and investments. Anything you put in the trust avoids probate.

2. Choose a Trustee: You can be your own trustee while you’re alive. However, you must also name a backup trustee to take over after you pass away. This can be a family member, friend, or lawyer.

3. Create a Trust Document: You can hire an estate planning attorney or use an online legal service to draft a trust document that follows Texas laws.

4. Sign the Document: In Texas, you need to sign your trust document in front of a notary public.

5. Transfer Assets into the Trust: This step is critical. Your trust is useless unless you move your assets into it. For example, you can change the title of your house from your name to the trust’s name. Additionally, you may also update your bank accounts and investment accounts.

Trust vs. Will in Texas: Which One Do You Need?

A will and a living trust both decide what happens to your property after you pass away, but they work differently:

| Feature | Living Trust | Will |

| Avoids Probate? | Yes | No |

| Takes Effect | While you’re alive | After you pass away |

| Keeps Information Private? | Yes | No (Wills become public) |

| Allows Conditions? | Yes (You can control when/how assets are distributed) | No |

If you want full control and to avoid probate, a living trust is better. If you just need a simple plan and don’t mind probate, a will might be enough. Some people use both for extra protection.

Your Legal Guide: Things to Keep in Mind While Making a Living Trust in Texas

A living trust in Texas is a great way to protect your assets and make life easier for your loved ones. Here are a few things to remember:

- A living trust avoids probate, saving time and money.

- You stay in control while you’re alive.

- Choose a responsible trustee to handle things after you’re gone.

- Don’t forget to transfer assets into the trust—otherwise, it won’t work.

- Consult a professional to make sure your trust is legally solid.

By planning ahead, you can protect your family, save money, and make sure your assets go exactly where you want them to. A living trust is more than just a legal document—it’s peace of mind.

Read Also: