If you’ve been frantically Googling the difference between conservatorship vs power of attorney (POA), you’re in the right place.

These are legal terms, sure, but they’re actually about something super personal: who helps take care of you or your loved ones when you can’t do it yourself.

Let’s say someone in your family is getting older or dealing with a serious illness. You might wonder: “How do I help them with their money, health, or everyday decisions?”

This is where conservatorship and power of attorney come in. Both let someone else step in to help, but they work in very different ways.

So, if you are planning to understand which one you need to choose, you are in the right place. Therefore, keep on reading this blog till the end…

What is Conservatorship?

A conservatorship happens when someone is no longer able to take care of themselves, and the court steps in to help. The court picks someone called a conservator to make decisions for them.

This usually happens when:

- Someone is elderly and has dementia or Alzheimer’s

- A person has a mental illness or disability

- There’s no legal plan like a POA in place

So, how does it really work?

It starts with a family member (or someone close) asking the court to appoint a conservator. The court will then:

- Review the person’s health and finances

- Talk to doctors and family members

- Decide if conservatorship is really needed

If approved, the court chooses someone to manage the person’s life.

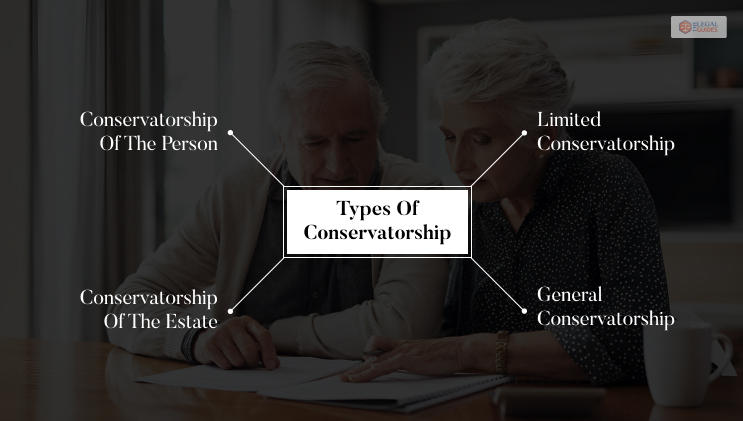

Types of Conservatorship

Conservatorships are categorized based on the level of control required and the needs of the protected individual (the conservatee). Here are the main types:

1. Conservatorship of the Person: The conservator helps with the following things:

- Medical decisions

- Living arrangements

- Daily care like food, hygiene, and safety

Example: Grandma has dementia and forgets to take her medicine. The conservator makes sure she goes to doctor visits and stays safe.

2. Conservatorship of the Estate: The conservator manages money. In other words, they help:

- Pays bills

- Handles property or investments

- Prevents financial abuse

Example: Uncle Bob can’t manage his bank account anymore. The conservator makes sure bills are paid and no one takes advantage.

3. Limited Conservatorship: This is used for people with developmental disabilities, like autism, who can still do some things independently. The conservator helps only in certain areas—like health or education decisions.

4. General Conservatorship: This is for people who need full assistance. It’s usually given to older adults with serious conditions like Alzheimer’s.

When Should You Choose Conservatorship?

You may need a conservatorship when:

- Someone is already incapacitated (they can’t think clearly or make decisions)

- No legal documents like a POA or trust were made earlier

- There’s a risk of financial abuse

- The family needs legal protection over the person’s assets or health

Conservatorship is not quick or simple. It involves:

- Court hearings

- Regular reporting

- Sometimes high legal costs

But it’s necessary when there’s no other legal way to protect someone.

What is Power of Attorney?

A Power of Attorney is a legal paper that lets you choose someone to act for you when you can’t—or just don’t want to—handle things yourself.

That person is called your agent or attorney-in-fact. You get to decide:

- Who it is

- What they can do

- How long their powers last

The key difference? You create a POA before anything bad happens. It’s like giving someone the keys—but only if and when you say so.

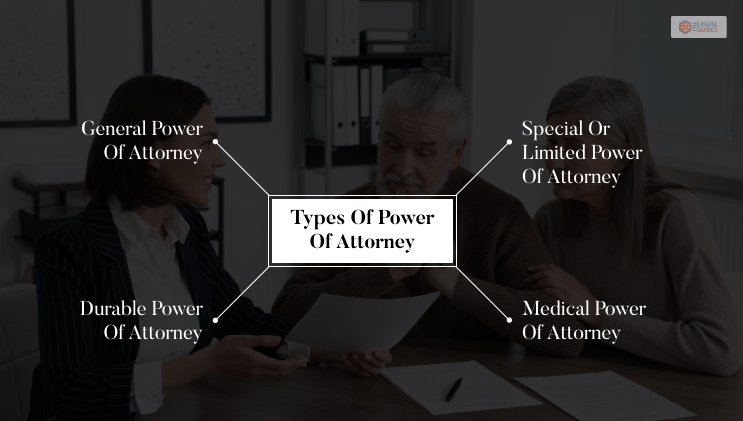

Types of Power of Attorney

Here are the main types you should know:

1. General Power of Attorney: This gives your agent broad powers over your money and property. It ends if you become mentally incapable.

2. Durable Power of Attorney: This stays in effect even if you become mentally unfit. Best for long-term planning, especially for health issues.

3. Special or Limited Power of Attorney: This gives power for specific tasks only—like selling a house or managing bills while you’re traveling.

4. Medical Power of Attorney: This lets someone make healthcare decisions for you if you can’t. For example: You’re in a coma. Your agent decides what treatments you get.

When Should You Choose Power of Attorney?

Most of us often see that people choose a POA almost all the time. But that’s not really the case. There are certain situations when legal experts recommend that their clients go for a POA over conservatorship.

Some of them are as follows:

- Early Planning: In case one is sure that he will need help, he can appoint an agent by setting up a POA and be sure that the one he has chosen will take care of the things. This is highly convenient for elderly persons who want to be ready if they have memory loss coming up.

- Limited Scope: A POA is a very convenient way. You can assign particular jobs to it ten, such as finances while you are traveling, without giving up the total control.

- Avoiding Court Oversight: Since a POA does not need court approval, it is more convenient as the process is shorter, cheaper, and more private.

Basically, the decision on whether to use a POA or a conservatorship is based on the individual’s situation.

Conservatorship VS Power of Attorney: What’s the Difference?

| Aspect | Conservatorship | Power of Attorney |

| Establishment | Court process with legal fees | Created privately by the principal |

| Authority | Granted by the court | Granted voluntarily by the individual |

| Control | A court-appointed conservator takes full or partial control | Principal retains control until incapacitated or revoked |

| Scope | Covers all areas unless limited by the court | It can be specific (e.g., finances) or broad |

| Revocation | Requires court approval | Can be revoked by the principal at any time |

Now that you are (hopefully) fully aware of what conservatorship is and what the buzz is about POA, it’s time for you to learn about their core differences!

It is very important to have a good understanding of the differences between conservatorship and power of attorney. Why? Well, simple: it helps you manage the personal, financial, or medical affairs of somebody.

Both of the legal instruments authorise the appointed person to act for the other person, but the differences in control, procedure, and extent are quite substantial.

Control and Autonomy:

A conservatorship is a court order that usually greatly limits the individual’s rights to make decisions for themselves. On the other hand, a power of attorney is a document that is created voluntarily and gives the person the right to still have control until they are not able to make decisions anymore.

Legal Process:

The process of setting up a conservatorship is a legal one, it can take a long time and be quite expensive. A power of attorney is usually easier to carry out and does not require a court’s approval.

Scope of Authority:

The powers of the conservators are more limited and at the same time they bear a number of obligations. The power of attorney can be further narrowed to specific purposes or it can include health care, finances or both.

Duration:

Conditions that the court decides, govern the duration of the conservatorship. Powers of attorney can be canceled or they can come up to a natural end in cases such as the death of the principal.

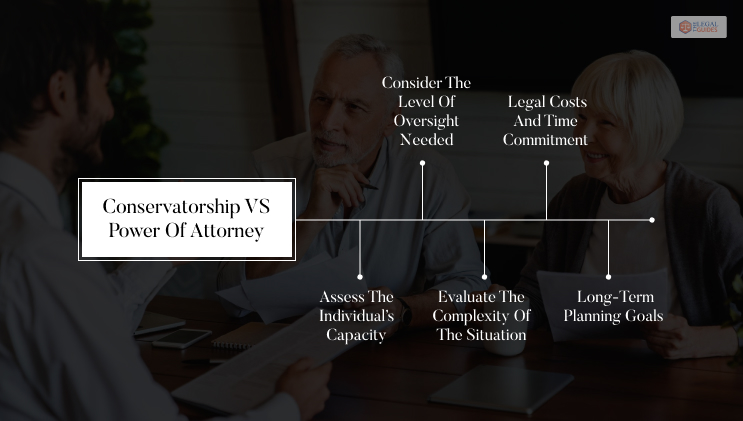

Your Legal Guide: Which One Should You Choose Between Conservatorship Vs Power Of Attorney?

Let’s walk through how to decide.

Choose POA if:

- The person is mentally capable now

- You want to pick someone you trust

- You want to keep control

- You’re planning ahead, not reacting to an emergency

Choose Conservatorship if:

- The person is already mentally incapacitated

- They didn’t set up a POA before

- You need legal permission to help them

- You want court supervision to avoid conflict

It all comes down to this:

- A Power of Attorney is something you set up while you’re still healthy and aware.

- A Conservatorship kicks in after someone loses the ability to make choices and needs protection.

Both are important tools, but the best choice depends on timing, mental state, and legal needs.

So, if you or your loved one is still mentally sharp, don’t wait. Setting up a POA now could save your family time, stress, and thousands of dollars down the road.

And if it’s already too late for that? A conservatorship might be the safest and only option left.

Read Also: