Are we not all aware of the fact that planning ahead can make all the difference, especially when it comes to protecting our future?

But guess what? Disability planning is one of those things that often gets pushed aside until it’s too late.

And no, there is no one to be blamed. None of us expects that one day we won’t be able to do the work or live our lives as we normally do.

However, the truth is, if you or a loved one becomes disabled, having the right legal and financial documents in place can take a huge burden off your shoulders.

And I know it can get difficult to process the whole thing. Which is also one of the reasons why firms like Keele & Parke becomes their go to place for consultation!

But what are the things that you need to include in your disability planning checklist? What are the legal documents that you must have ready?

If these are some of the things that you want to know, then you have come to the right place. Therefore, keep on reading this blog till the end…

What is Disability Planning?

Before I tell you the things that you MUST have in your checklist while you are thinking about disability planning, let me explain what it is all about.

So, simply based on the name, it is clear that disability planning is the act of planning for a situation when one may be physically or mentally unable to take care of themselves or decide for their own.

And to be perfectly clear, it not only covers saving money or writing a will, but also extends to all the aspects of life support, from financials to healthcare services, and even to the help with daily activities.

It most often includes:

- Various legal papers such as the power of attorney, living will, and special needs trust.

- Money management plans for receiving income, benefits, and long-term care.

- Making decisions on personal and care issues, such as where to live, getting support services, etc.

The purpose is to develop a disability plan that is dynamic, realistic, and designed to the specific requirements of the person and his/her family.

Now, disability can be a result of anything. It can be because of a sudden accident. Or a slow-developing condition.

But regardless of that, the planning is there to make sure that a person’s voice is not lost, even when they are not able to speak for themselves.

Why Do You Need A Disability Planning Checklist?

According to the CDC, around 1 in 4 adults in the U.S. (that’s over 61 million people) live with some form of disability.

However, what shocked me while doing my research was the fact that despite these numbers, a large percentage of Americans don’t have any disability plan in place.

A 2023 survey by Caring.com showed that only 34% of Americans have an estate plan, which includes disability-related documents like power of attorney or advance directives. That means millions of families are left scrambling in emergencies.

So, how can a disability planning checklist help? Well, having this:

- Could possibly give back the resources of time, money, and energy later on.

- Help dodge a legal mess by giving the right people power of attorney in advance.

- Be sure that your own wishes are fulfilled if you are unable to communicate.

- Make sure that your children or dependents with disabilities are given continual care, a place to stay, and financial support.

- Assist families in qualifying for benefits such as Medicaid or Supplemental Security Income (SSI) by implementing the correct financial restructuring.

In the absence of such plans, the court may have to get involved and appoint a guardian or conservator. These people, who are most of the time someone you don’t even know, will then manage the affairs of the disabled person.

Such legal battles can go on for a long time and be very costly and emotionally exhausting for loved ones. Proper planning, on the

What Are the Key Reasons for Disability Planning?

Let’s dive deeper into why disability planning matters so much—legally, financially, and personally.

Advance Care Planning

Helps you make decisions before a crisis hits. And some of the different types of documents that this includes are:

- Living Will: States your preferences for end-of-life care

- Durable Power of Attorney for Healthcare: Appoints someone to make medical decisions for you

But why would you need something like this? Well, for starters, this avoids confusion among family members and medical staff about your wishes. Additionally, it gives YOU control, even if you’re unconscious or mentally incapacitated.

Future Planning

Secondly, and probably one of the most important things, is planning for the future. Disability planning creates a roadmap for long-term needs.

It includes the following things:

- Housing.

- Education.

- Employment.

And that’s not all. It also ensures independence for individuals with disabilities. It is especially important for families with children or adults who rely on daily support.

Besides this, disability planning can include setting up a Special Needs Trust to manage assets without disqualifying the person from government benefits.

Support Planning

Thirdly, one of the primary aspects of disability planning is the fact that it focuses on identifying and securing necessary services. It includes the following things:

- Medical and therapeutic care

- Educational support

- Rehabilitation and mobility services

- Case management or personal care aides

And, guess what? All these things are tailored to the person’s abilities, preferences, and goals.

Financial Planning

Finally, disability planning ensures that money is managed responsibly for the person’s lifetime. It helps with:

- Budgeting for care and daily expenses

- Applying for government assistance like Medicaid, SSDI, or SSI

- Structuring assets to avoid benefit disqualification (example: using ABLE accounts or trusts)

And just in case I did not make it clear before, it also protects assets from being misused or accessed by the wrong people.

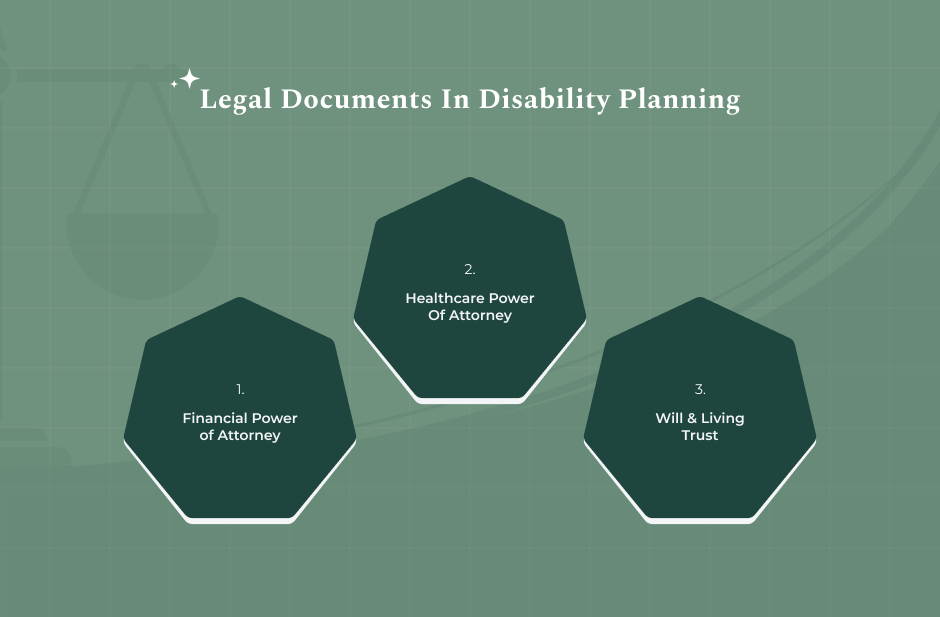

What Are Legal Documents That You Must Include in Your Disability Planning Checklist?

There are several things that might come to your mind when it come to preparing your disability planning. But what are the things that you absolutely cannot miss?

Here are the core legal documents every disability plan should have:

Financial Power of Attorney

- This allows a person you trust to manage your finances if you’re unable to

- They can pay bills, manage bank accounts, file taxes, and more

- Make sure it’s durable, which means it stays valid even if you become mentally incapacitated

Healthcare Power of Attorney

- Lets you appoint someone to make medical decisions on your behalf

- Covers treatments, surgeries, medications, and hospital care

- This person acts according to your preferences (often alongside a living will)

Will & Living Trust

- Will: Details how your assets should be distributed after your death

- Living Trust: Helps manage and transfer assets during your lifetime and beyond

- A Special Needs Trust can be added to protect benefits while providing financial support to someone with a disability

These documents ensure that your:

- Money and property are taken care of.

- Medical care aligns with your values.

- Loved ones don’t get stuck in probate court or legal disputes.

Your Legal Guide: Do You Need A Lawyer For Disability Planning?

The short answer? Yes, a lawyer can help a lot.

Although it is true that you can complete some documents using templates that are all over the internet, it is best that you hire a lawyer.

Why? Well, that’s because disability planning is very often the case that it involves intricate regulations especially in the case of benefits like Medicaid or SSI.

So how does a disability lawyer help you? Here’s how they assist:

- Prepare legal documents in accordance with the state law and your personal circumstances

- Assist in the establishment and financing of Special Needs Trusts or Living Trusts

- Be sure that your documents don’t have an unintended consequence of withdrawing assistance (for you or a loved one) from the government

- Offer the best possible guidance tailored to the unique situation of your family—if, for instance, you have a child with disabilities

- Support you in the process of requesting guardianship, conservatorship, or implementation of the decision-making framework

In conclusion, disability planning is not only concerned with the necessary documents. It is all about the peace of mind that it offers. And that is the reason why having legal support by your side is so very important!

Read Also: