- Bank of America has been ordered by a federal judge to pay a sum of $540 million to resolve a decade old litigation with the FDIC.

- In 2017, the Federal Deposit Insurance Corporation (FDIC) alleged that BoA underpaid the assessments for deposit insurance.

- The Bank of America FDIC lawsuit was filed following a change in the federal rule in 2011 that changed how banks would report their exposure to counterparty risks.

On March 31, 2025, a federal judge ordered Bank of America (BofA) to pay $540.3 million to the Federal Deposit Insurance Corporation (FDIC) in a long-running dispute over underpaid deposit insurance assessments.

The decision brings closure to the Bank of America FDIC lawsuit filed in 2017, tied to a post-2008 rule change that redefined how large banks should calculate insurance contributions.

But what sparked this lawsuit, and why does it matter for banking compliance and regulation today?

In this article, I will explain:

- The role of FDIC in insurance.

- Why did FDIC sue Bank of America?

- What was the court’s decision?

- Bank of America’s response to this lawsuit.

- How this lawsuit impacted smaller banks.

So, if these are some of the things that you want to know, keep on reading till the end…

Understanding The FDIC’s Role And Deposit Insurance

Established in the year 1933, the FDIC safeguards depositors by insuring their funds—typically up to $250,000 per depositor, per insured bank. The insurance fund is maintained through quarterly assessments from member banks.

During periods of financial stress, such as the 2008 global financial crisis, the fund becomes strained. This prompted regulators to tighten rules and increase assessment requirements to rebuild financial resilience.

As stated by Investopedia, the financial crisis of 2008 began with the issue of “cheap credit and lax lending standards.” These were some of the things that fueled the problems in the housing price market.

Post Crisis Rule Changes In The 2011 FDIC Reform

The government wanted to take better measures to ensure that history does not repeat itself. As a result of that, the FDIC made certain changes in its rules related to how banks were supposed to report their counterparty exposure.

This is something that would affect how the banks would calculate their deposit insurance contributions. In other words, after that 2011 reform, banks were supposed to report on a consolidated entity level, rather than by individual counterparties.

Generally, having a fragmented view of such financial data would understate the exposure. The primary goal of this reform was to get a fuller and an overarching view of the risk concentration in the economy.

“The rule replaced the FDIC’s risk category system with a scorecard-based method for large and highly complex institutions (HCIs), using performance and loss severity scores to better capture risk. For HCIs, counterparty exposures at the consolidated entity level must be reported,” according to ABA Banking Journal,

FDIC’s Findings: Underreporting And Underpayment

In the year 2016, the FDIC conducted an audit. In their reports, the body revealed that BofA was not complying with the new rule fully.

Rather than reporting consolidated exposures, from 2012 to 2014, the bank reported individual exposures. This was a method that reduced its measured risk profile and thus lowered its insurance assessments.

As per the ABA Banking Journal, this form of individual reporting lowered its assessment. Therefore, “the FDIC invoiced BofA for over $1.12 billion in underpaid fees.”

In other words, as a result of such a finding in their audit, the FDIC alleged that Bank of America was “underpaying” its insurance deposits. They also stated that the institution might be unjustly benefiting from a softer assessment burden.

As stated by Banking Dive:

The FDIC contended the bank “made false or fraudulent statements about its counterparty exposures with the intent to evade its assessments,” preventing the agency from discovering the bank’s errors until the FDIC conducted a 2016 audit

Eventually, in 2017, the FDIC sued BofA. As reported by Reuters, it filed a lawsuit initially seeking more than $500 million in unpaid assessments, later amending its claim to $1.12 billion, including alleged interest and profits from avoided payments.

How Did Bank Of America Respond To The Allegations In The Bank Of America FDIC Lawsuit?

Bank of America contends that the 2011 FDIC rule is unlawful and violates the Administrative Procedure Act (APA). This is because it inconsistently treats the Federal Deposit Insurance Act (FDIA).

Additionally, the BofA also stated that the 2011 FDIC rule:

- It was made arbitrarily and capriciously.

- It is mired in procedural problems.

Moreover, it further argued that limitations barred certain assessment periods and that the FDIC did not have the basis to bring a claim of unjust enrichment.

However, Judge Loren Alikhan decided that the FDIC did not violate or breach the Administrative Procedure Act (APA) when the 2011 rule was issued and enforced.

Referring to Loper Bright, the judge mentioned that the court has to verify by itself whether the agency went beyond the powers granted to it by law.

“The court determined the FDIC acted within the broad authority granted by the FDIA, engaged in reasoned decision-making, relied on substantial evidence, and followed proper procedures,” states ABA Banking Journal.

Bank Of America FDIC Lawsuit: What Was The Court’s Decision In March 2025?

The court found BofA liable as it did not follow the FDIC interpretations of the 2011 rule. As per several sources, the “court sided with the FDIC, concluding the rule was unambiguous and supported consolidation at the ultimate parent level based on its text, context, history, and purpose.”

However, while the FDIC demanded a sum of $1.12 billion from the Bank of America, the “court found the FDIC’s claims for underpaid assessments from Q1 2012 to Q1 2013 time-barred.”

As a result of this statute of limitations, the FDIC was only able to sue BofA for the “unpaid assessments within three years of the due date.”

While the FDIC argued that the limitations period restarted once BofA revised its Call Reports, the court rejected this argument. As a result of this, the court ordered BofA to pay $540 million to the FDIC.

In the verdict, the court used the phrase “lawfully payable which aimed to show that the decision is considered a change in accounted for payments rather than an action of penalty.

Here are the key points from the U.S. District Judge Loren L. AliKhan, who delivered a decisive ruling in the Bank of America FDIC lawsuit:

- BofA must pay $540.3 million, covering underpayments for assessments from Q2 2013 through Q4 2014, including interest.

- Claims for periods before Q2 2013 were dismissed due to the statute of limitations. The FDIC filed its suit in January 2017, beyond the allowable three-year window for earlier quarters.

- Judge AliKhan ruled that the 2011 rule was lawful, rejecting BofA’s challenge that it was ambiguous or improperly adopted. She affirmed that the bank had “fair notice” of its obligations.

- The court also acknowledged BofA’s lack of intent to defraud. Because the bank disclosed its reporting method, it wasn’t deemed evasive.

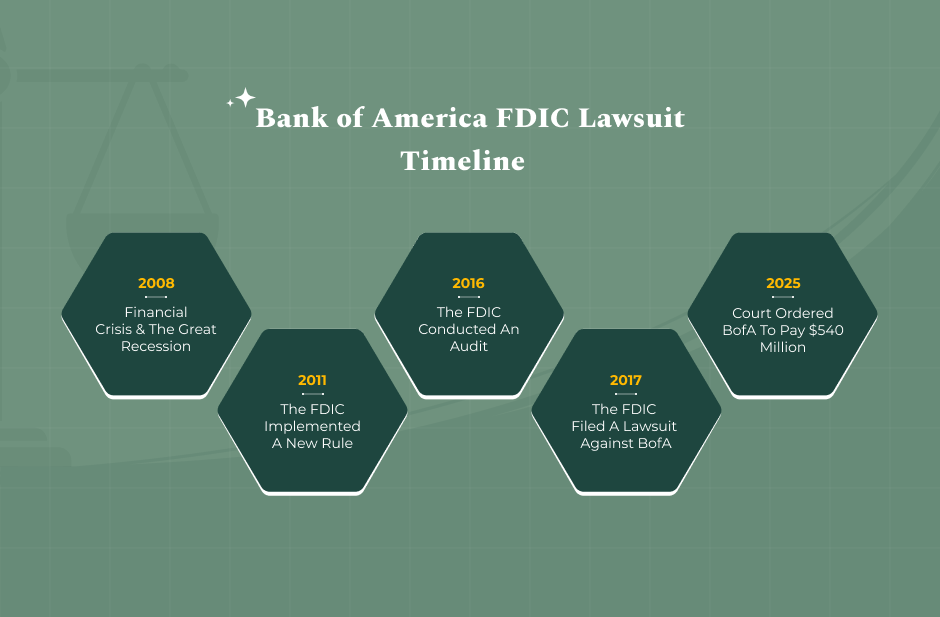

Timeline Of The Bank of America FDIC Lawsuit

The case was quite a journey, unfolding over more than eight years, with the following critical moments that changed the final result:

- 2017: The FDIC filed a complaint, demanding a total of $542 million, which was estimated to be due to underpayments from the second quarter of 2013 to the fourth quarter of 2014.

- 2018: Bank of America tried to get the case thrown out by asserting that the regulations set by the FDIC were unclear. However, the court did not accept the motion.

- After 2018: The FDIC amplified its accusations to cover more quarters as well as additional underpayments. Thus, the claimed amount increased to over $1.1 billion.

- April 14, 2025: The court made the final decision available to the public, which required BofA to pay $540.3 million.

Although the amount ordered is significantly less than what the FDIC sought in the end, the decision still conveys a strong message: compliance failures related to the technical interpretation of risk reporting may lead to substantial financial penalties, that is, long after the imposition period.

Your Legal Guide: How Did The Bank of America FDIC Lawsuit Impact Banking And Regulations?

When it comes to the FDIC and regulatory oversight, this particular ruling is a reaffirmation of the FDIC’s authority—particularly its ability to enforce post-crisis reforms and hold large institutions accountable, even years later.

It sends a message: technical misinterpretations of complex rule frameworks can result in material penalties.

As rightly pointed out by the Associated Press, though BofA’s first-quarter profit of $7.4 billion mitigated the blow, the ruling adds to a history of compliance and legal challenges. It also raises investor concerns about diligence in regulatory reporting.

Other large banks will likely re-examine their compliance infrastructures, especially regarding exposure reporting. This case underscores that even without fraudulent intent, misaligned interpretations with regulators’ frameworks:

- Can result in hefty financial liabilities.

- May trigger internal audits, policy rewrites, or reputational critiques.

The FDIC’s successful lawsuit against Bank of America closes an eight-year legal chapter—but the legacy of it extends far beyond: It is a reminder that regulatory frameworks, especially those born of crisis, remain enforceable and consequential. Even technical misreadings of rules—absent ill intent—can impose significant penalties.

For banking professionals, legal practitioners, and regulators alike, the case underscores the importance of clarity, compliance, and course-correction, reinforcing that prudent oversight still holds powerful teeth in the post-2008 era.

Read Also: