Let’s talk about something that most people in Texas (read: office goers) think of: Texas Overtime Laws!

This set of laws tells you how much extra money you should get if you work more than usual. If you’re working in Texas and putting in more hours than your regular shift, you deserve more pay for that hard work!

Just like how you get extra candy for doing extra chores, workers should get extra money when they work more than 40 hours a week.

But what is it all about?

That’s exactly what I will be explaining in this blog. This article will help you understand how it all works in a super simple way. So, if that is what you want to now, keep on reading…

What Are Texas Overtime Laws?

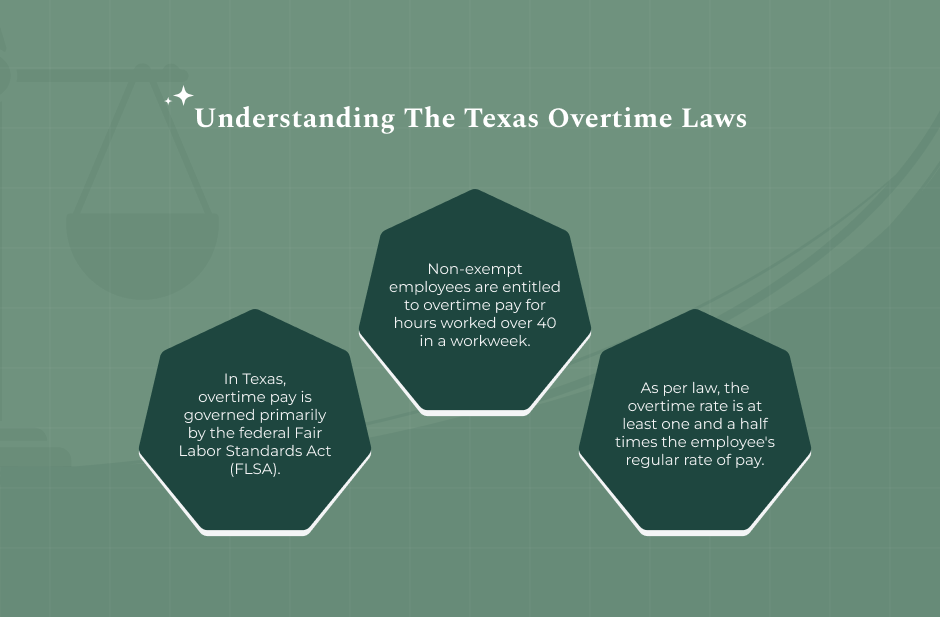

In Texas, if you work more than 40 hours in one week, your boss usually has to pay you more for those extra hours. Let’s break it down.

The Basics of Texas Overtime Laws

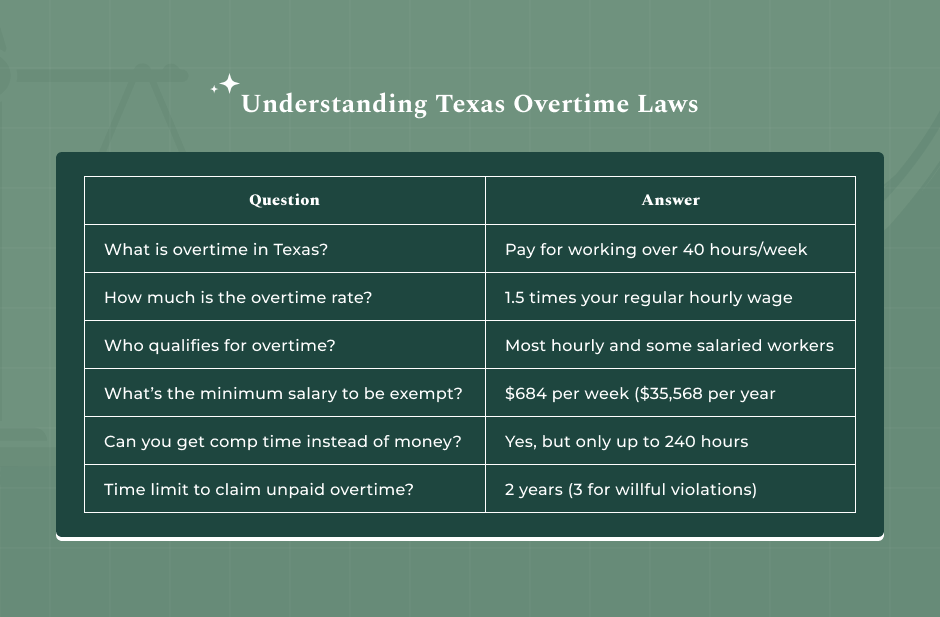

First things first— what is this “overtime” that I am talking about? Well, overtime is the extra money you get when you work more than 40 hours in one week.

So, who gets to have this payment for working overtime? Not everyone. Overtime rules are for people who are called “non-exempt” workers. These are usually workers who are paid by the hour and not a fixed monthly salary.

Here’s a simple chart that might help you understand how overtime pay works in Texas law:

| Regular Hourly Pay | Overtime Rate (1.5x) | Extra Money per Overtime Hour |

| $10/hour | $15/hour | +$5 |

| $15/hour | $22.50/hour | +$7.50 |

| $20/hour | $30/hour | +$10 |

So, how much is this entire overtime pay thing? It’s 1.5 times your regular hourly wage. For example, if you earn $10 per hour:

$10 × 1.5 = $15 per overtime hour

Special Rules to Know in Texas

Texas has a few special rules that make things a little different. Let’s take a look:

Alternative Workweeks:

- Some companies have schedules where you work more hours in a day but fewer days in a week.

- If you work more than 10 hours in a day, you might still get overtime—even if you didn’t work more than 40 hours that week.

- This only happens if both you and your boss agree to it.

Compensatory Time (Comp Time):

- Instead of getting money for overtime, some workers can take time off later.

- This is called “comp time.”

- You can’t save more than 240 hours of comp time (that’s about 6 weeks off).

Who Doesn’t Get Overtime in Texas?

Some workers are exempt, which means they don’t get overtime pay, even if they work extra hours. Here’s who:

1. Executive Employees:

- These are managers or supervisors.

- They must manage at least 2 full-time workers.

2. Administrative Employees: They do office work and make important decisions.

3. Professional Employees: These are people with special training, like teachers, doctors, or lawyers.

4. Agricultural Workers: People who work on farms or ranches often follow different rules.

5. Commissioned Salespeople: If more than half of your pay comes from sales commission, you may not get overtime.

6. Computer Professionals: If you work in tech and earn a high salary, you might be exempt.

Getting Paid Correctly Under The Texas Overtime Laws

Now let’s talk about how you should get paid when working extra hours under the Texas Overtime Laws:

How Overtime is Calculated

- Overtime = 1.5 × regular hourly rate.

- If you have more than one pay rate, your boss will use an average (called a “weighted average”).

Breaks and Travel Time

- Breaks less than 20 minutes = paid time.

- Longer breaks = not paid.

- Travel time counts only if it’s part of your job (like driving to a work site).

No Cutting Corners

- Your boss can’t reduce your regular pay just to avoid paying overtime.

- That’s against the law in Texas.

If You’re Not Paid for Overtime

- You have up to 2 years to file a complaint.

- If your boss did it on purpose, you may have 3 years to take action.

Do You Get Overtime If You’re on Salary in Texas?

Let’s say you get paid the same amount every month—are you still eligible for overtime?

- Hourly workers get paid for each hour and usually qualify for overtime.

- Salaried workers get paid a fixed amount—no matter how many hours they work.

But here’s the important part: Not all salaried workers are exempt from overtime pay!

And that’s why you need to understand the entire game of salary exemption.

There are rules to decide if salaried workers can get overtime. You have to look at two things: what kind of work you do and how much money you make.

Job Types That Are Exempt

| Type of Worker | Key Job Duties |

| Executive | Manages people and makes decisions |

| Administrative | Works in an office, makes important choices |

| Professional | Uses special skills (like doctors, teachers, engineers) |

These folks are exempt only if they meet the duties AND get paid enough.

Minimum Salary Rule

To be exempt from overtime, a salaried worker must earn:

- At least $684 per week (as of 2021)

- That’s $35,568 per year

If you earn less than this, even if you’re salaried, you could still get overtime pay.

Your Legal Guide: Could Anything Change In The Future Related To Texas Overtime Laws?

The U.S. Department of Labor has talked about raising the minimum salary needed to be exempt. If that happens, more people could qualify for overtime, even if they’re salaried.

So, keep an eye out for updates. A new rule could mean more money in your paycheck!

Understanding Texas Overtime Laws is super important if you work more than 40 hours a week.

Whether you’re sweeping floors, working in IT, or managing a store—if you put in extra time, you should be paid fairly.

Quick Reminders:

- Overtime = 1.5× your hourly wage for over 40 hours/week

- Not everyone qualifies—some jobs are “exempt”

- Salaried workers may still get overtime if they earn less than $684/week

- You can file a complaint if you’re not paid what you’re owed

If you’re unsure whether you’re getting paid correctly, don’t just guess—ask an employment lawyer or file a complaint with the Texas Workforce Commission.

Your time matters. So make sure you’re getting what you deserve for every extra hour you give!

Read Also: