- While there has been a surge in searches about a supposed Ashcroft Capital lawsuit, in reality, there is no information about an ongoing lawsuit with the real estate company readily available.

- Rather than a lawsuit, the real estate company Ashcroft Capital has been facing a lot of issues with investors who have paused their payouts.

- According to the resources that we have found on the internet, the major allegations in the Ashcroft Capital lawsuit include the unauthorized use of funds and failure to disclose material risks.

The Ashcroft Capital lawsuit is a hot topic that’s been popping up in searches and investor forums.

But what’s really going on? Is Ashcroft Capital in serious legal trouble, or is it a case of mistaken identity?

If you’re a real estate investor or just curious about where your money is going, this article will help clear things up in the simplest way possible.

I will talk about the following things:

- What is Ashcroft Capital?

- About the Ashcroft Capital lawsuit.

- Ashcroft Capital’s alleged fraud.

And if that is what you want to know, you have come to the right place! So, keep on reading this blog till the end…

What Is Ashcroft Capital?

Ashcroft Capital is a private real estate investment firm. That means they help people invest in big apartment buildings called “multifamily properties.”

Instead of one person buying an entire building, many investors put their money together, and Ashcroft manages everything — from buying and fixing the place to renting it out and selling it later.

They mainly focus on properties in growing cities across the U.S. and are known for trying to improve apartments so tenants have a nicer place to live.

Investors hope to make money over time when rents go up or when the building sells for more than it cost.

What Is The Ashcroft Capital Lawsuit About?

You might have seen people online talking about a lawsuit involving Ashcroft Capital. Some say investors are upset, and there’s legal trouble brewing. But what’s the truth behind this?

Well, here’s the thing — while there is a lawsuit involving someone named Ashcroft, it may not be about Ashcroft Capital at all. There’s a lot of confusion because of the name. So let’s look closely at what’s being said.

Some investors are raising concerns and talking about legal issues. There are also claims on social media and forums that Ashcroft Capital isn’t being honest about how they use money or who owns what.

That’s what started this whole buzz. But before we believe everything, we need to break down what these people are actually saying and whether these claims hold up.

Major Allegations Of The Supposed Ashcroft Capital Lawsuit

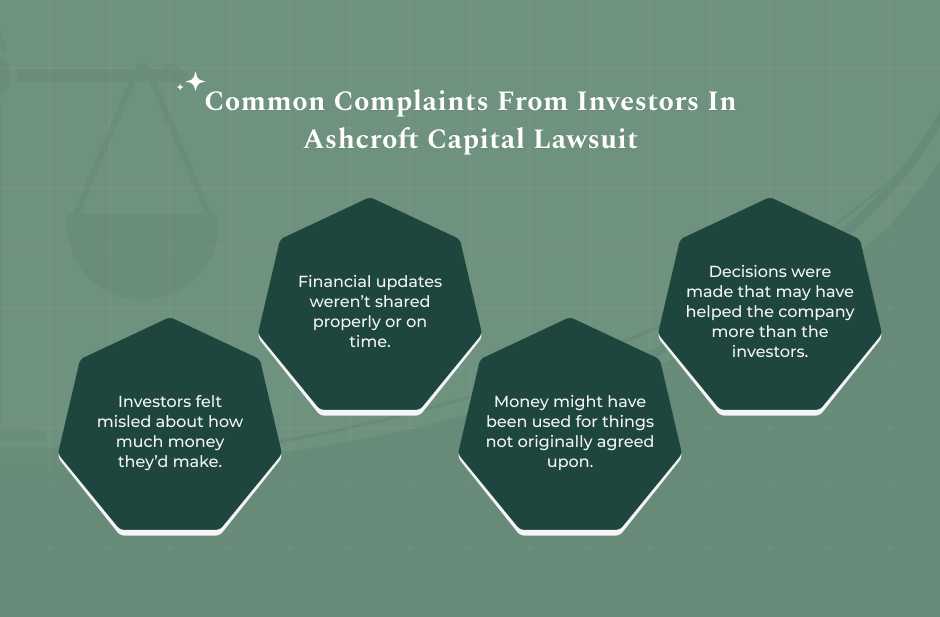

Some investors and critics have raised serious concerns about Ashcroft Capital. While no court has officially ruled against them (as of now), here are the major things being talked about:

| Allegation | What It Means |

| Failure to Disclose Risks | Ashcroft may not have told investors all the risks. So, people put in money without knowing what could go wrong. |

| Misleading Returns | Some say Ashcroft promised big returns (profits), but the actual results didn’t match the promises. |

| Unauthorized Use of Funds | Investors claim their money was used for things not mentioned before, like fixing buildings or paying other costs — without telling them first. |

| Lack of Transparency | Ashcroft is accused of not showing financial updates or reports on time, which left investors confused about where their money is. |

| Breach of Trust | Some say Ashcroft did things like selling or refinancing buildings early for its own benefit — not to help the people who invested the money. |

These allegations, if proven true, could have serious consequences. But again — a lawsuit doesn’t always mean someone is guilty. It just means people are asking a court to look into it.

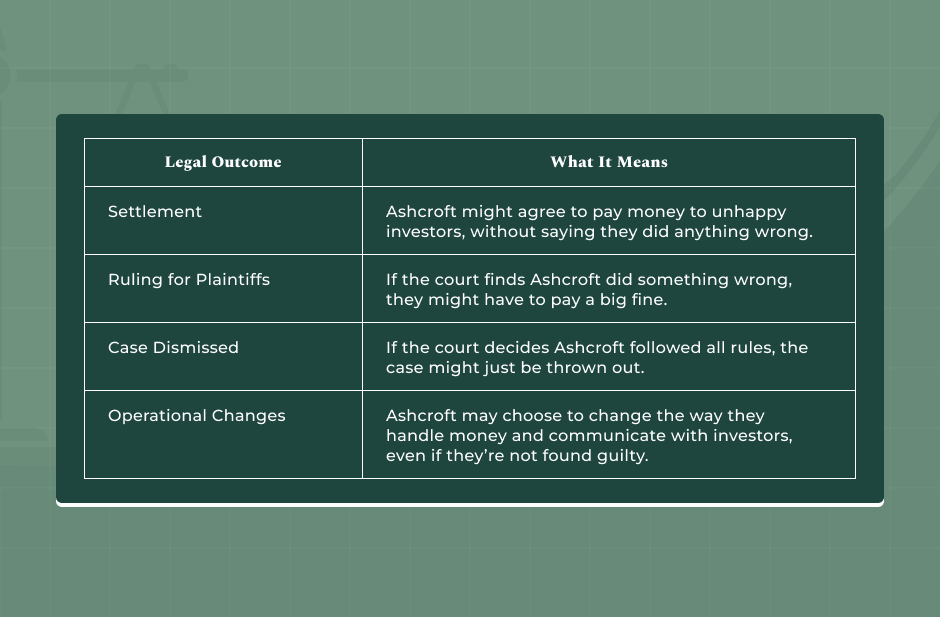

What Are The Possible Legal Outcomes Of The Ashcroft Capital Lawsuit?

As of May 2025, there is no confirmed payout or final decision in any lawsuit against Ashcroft Capital. But here are some possible outcomes:

No final decision or payout has happened yet. If a court does say Ashcroft is at fault, the money paid out will depend on how much investors lost and what the court thinks is fair.

Is There Really An Ashcroft Capital Lawsuit Going On?

Here’s the real scoop: Yes, there is a lawsuit — but it’s not against Ashcroft Capital. It’s against John Ashcroft, who used to be the U.S. Attorney General (kind of like the country’s top lawyer).

People often mix this up because of the name “Ashcroft.”

So, let’s clear it up:

- Ashcroft Capital is a private company that helps people invest in apartments.

- John Ashcroft is a former government official, not directly tied to the company.

- The lawsuit you might see online is against John Ashcroft, not Ashcroft Capital.

That’s why many people are confused. The lawsuit people talk about isn’t about real estate investments — it’s about something John Ashcroft did when he was in the government.

So, at this time, there’s no public lawsuit officially filed in court against Ashcroft Capital itself. But there are still concerns that the investors have raised, which I will talk about below.

Did Ashcroft Capital Commit Fraud With a $427M Cross-Collateralized Loan?

Let’s unpack a very serious concern raised by some investors and analysts.

While I was doing my research about the alleged Ashcroft Capital lawsuit, I came across a LinkedIn article that reported collateralization and an alleged round-tripping.

As per the report, in 2021, Ashcroft Capital announced they purchased a big apartment complex called “Elliot Norcross” with a partner company, National Property REIT Corp.

But here’s the thing — documents later showed Ashcroft might own only 10%, while acting like they owned a lot more. That’s a problem because:

- It may mislead investors into thinking Ashcroft had more control or value than it really did.

- It wasn’t clearly disclosed, which is a big no-no in finance.

In 2022, Ashcroft also got a giant $427 million loan by grouping (or “cross-collateralizing”) multiple properties as one big asset. But not all nine properties were used — only seven. Some investors say this was done to avoid questions about the property values.

There’s also a weird twist:

- In their marketing, Ashcroft said big names like Goldman Sachs and Blackstone were part of the deals since 2018–2020.

- But records show they only joined in 2022. That’s misleading and might make investors trust the deal more than they should have.

Finally, a term called “roundtripping” is used — it means buying and selling to yourself to make things look more profitable than they really are. Some critics say Ashcroft may have done this twice with the same building.

If these things are true, it could be a form of accounting fraud or misleading investment practices — both of which are serious.

What Should You Keep In Mind As An Investor In Real Estate?

If you’re investing your hard-earned money into real estate firms like Ashcroft Capital, keep these tips in mind:

Smart Investor Checklist:

• Ask Questions: If something sounds too good to be true, ask more questions.

• Check Ownership Details: Make sure the company really owns what it says it does.

• Demand Transparency: Companies should give regular updates on how they are using your money.

• Research Partnerships: Don’t assume big names are there— look it up yourself.

• Hire a Lawyer if Needed: If you feel cheated or confused, a lawyer can help you understand your rights.

Please always remember that investing is about trust. Always double-check who you’re trusting and what they’re doing with your money.

Read Also: