What is visa provisioning service is a query asked by most consumers when they notice an unknown $0.00 or $0.01 transaction appearing on their bank statement. This vital cyber technology fills the existing gap between your plastic card and your mobile payment solution.

In this article, we tell you about:

- What is visa provisioning service $0

- Why a $0 charge appears in the verification process

- What Tokenization Does to Protect You Against Hackers.

- Procedures to debug common provisioning mistakes.

What Is A Visa Provisioning Service? Meaning And Importance

A what is visa provisioning service query may begin with a confusion point during a statement analysis. In short, this type of service is a background-level of security mechanism designed to “provision” or embed card information into a virtual world.

This service functions as the online distribution mechanism facilitating the transfer of card information from banks to either a mobile phone and/or a wearable device.

So, what is visa provisioning service? Without the presence of this service, you would not be able to use the mobile payment services offered by the likes of Apple Pay and Google Wallet. The importance of this service is that it makes sure that the digital copy of your credit card is authentic and approved by your bank or institution. Therefore, it has become an integral part of the “tap-to-pay” culture that we experience every day.

Definition & Core Concept

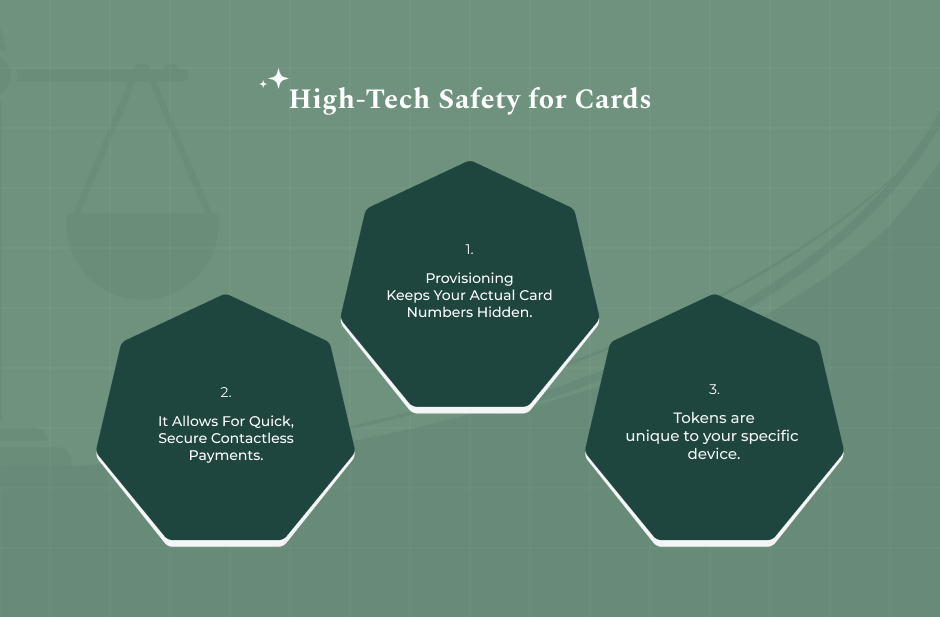

What is visa provisioning service? Provisioning is basically a short explanation for the preparation of a device with the required data. In the arena of finance, the visa provisioning service is basically the power behind the generation of a unique token for the mobile phone.

This token is used as a replacement for the 16-digit card number of the actual card during payment. This means that the actual card information is not revealed to the merchant. Thus, this makes it less prone to data breach (Source: Visa Developer).

Why Cardholders and Merchants are Interested

For cardholders, it gives peace of mind. Now, let’s say that the merchant’s database has been hacked by thieves. Then, all that they’ll be able to discover is an irrelevant digital card number, but not your actual primary account number.

Also, for card issuers, it decreases liability. Due to the fact that they don’t store sensitive information, there are minimal chances that they will become victims of sophisticated cyber-attacks.

So, “what is visa provisioning service” is an option that gives an optimized checkout, which promotes customer satisfaction.

The $0 Provisioning Charge For Consumers

One of the most common places where people interact with this technology is the “what is Visa Provisioning Service $0” entry. You might see a pending transaction for zero dollars or one cent. While this sounds like cryptic billing, it isn’t. It’s a transaction that is non-financial.

The “ping” that you may often get from the system makes sure that the card stays active. Consequently, the bank will also allow for its use in the digital wallet.

This especially comes into play when there is an addition of a new card or device, and even when there’s a new Netflix or Amazon Subscription update.

Why The $0 Charge, You Ask?

The fee of $0 should be thought of as a digital handshake. The merchant or the wallet service initiates a request to your bank to inquire whether the card is valid or not. The result is a yes or no without any movement of funds. This is part of a visa provisioning service and prevents the addition of a dead or a stolen card to the device.

How Long Does The Pending Status Stay?

Since these are not actual charges, they will not remain on your statement indefinitely. Most of what is a visa provisioning service charge will be removed from your statement in 24 to 72 hours.

They will never actually transition from Pending to Posted in your transaction history. However, if a $0.00 shows up on your statement, it is a possible display glitch in your bank’s mobile app.

How Visa Provisioning Functions

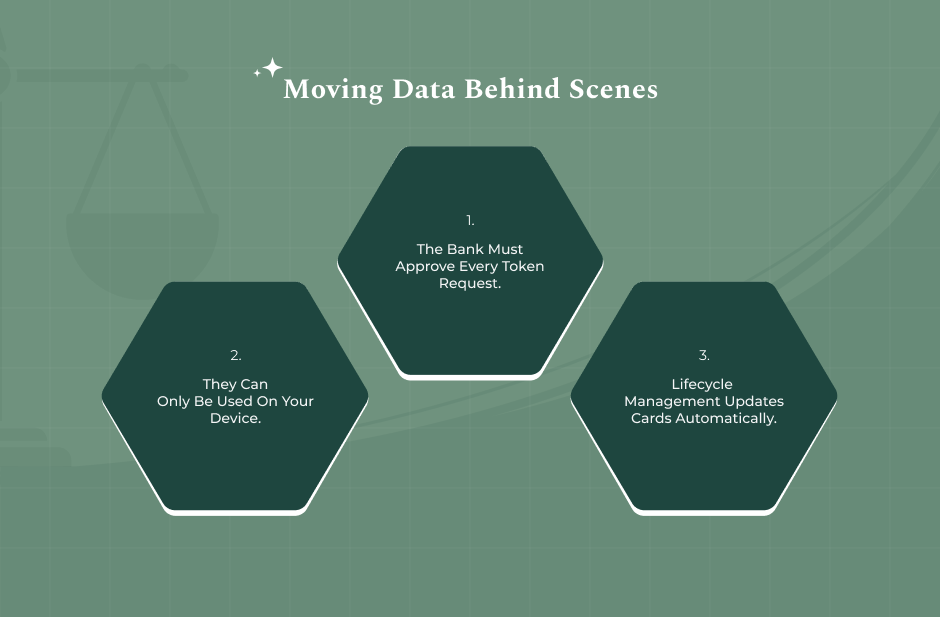

To grasp what is visa provisioning service, you only need to take a small peek. A simple four-step activity where the parties are yourself, the wallet service provider, Visa, and the issuing bank of the card. The scanning of the card is what starts a quick and easy communication chain.

Firstly, your phone will be sending an encrypted message to your wallet service provider. Then, the provider asks for a token from Visa. Finally, Visa takes a check of your bank details. They basically clarify if you are indeed the legitimate owner of your card. All of this happens in less than a second!

Token Generation & Device Binding

Once the bank gets the green light, a unique digital identifier is created by Visa. The “token” is bound to your hardware. That means that even if your token information gets stolen, the thief can’t use the information on another phone because their hardware signatures don’t match. Binding the hardware to the token is a strong protective measure.

Lifecycle- From Activation To Deletion

A token has its own life. It can be suspended when you misplace your phone, or it can be automatically updated when your bank prepares and sends you a new physical card with a new expiry date. You do not have to add your card again manually because it is visa provisioning service that manages ‘lifecycle’ of your token.

Security, Fraud, & Risk Management

Security is the major reason for the existence of the service named what is visa provisioning service.

In the days when card-on-file transactions prevailed, the major susceptibility was the exposure of actual card numbers if a fitness center or a streaming service had been hacked into by a hacker. This would mean the exposure of actual card numbers of thousands of users.

However, scammers are always smart. They even employ social engineering to con their targets to reveal their one-time passcodes, also referred to as OTP.

The scammer is thus able to remotely load your card onto their own device. To counter this, Visa has developed advanced AI technology.

Visa Provisioning Intelligence (VPI)

Let’s find out more information on the broader topic of “What is visa provisioning service”. In late 2023, Visa also introduced Visa Provisioning Intelligence, an AI solution aimed at eliminating fraud at its origin (Visa Investor Relations). The solution assigns a score to every provisioning request, ranging between 1 and 99.

If a customer receives a high score, it implies that their request may look malicious, maybe because it is originating from a different IP or a device that has notably participated in past cases of fraud.

Threats and Mitigations

Although the technology is robust, “human factor” is a risk nonetheless. Always be vigilant about receiving text or phone requests for a “verification code” when you have not asked for it.

The fact that you have received a code means that someone is attempting to make use of what is visa provisioning service to associate your card with their mobile device.

Read Also: H1B Visa Stamping In USA (2025 Guide) – Latest Rules And Process

What Is Visa Provisioning Service: Handling Routine Provisioning Problems

Occasionally, the system will fail. You may try to link your card to Apple Pay and see “Account Not Eligible.”

Instead, see the errors in the visa provisioning service banking app on your phone. Such occurrences are simple to correct if you know the right place to go. Most times, this fails because of a mismatch of the data.

In case you have an address at the bank and different address information in Apple and Google accounts, the authentication may go wrong. Some older “prepaid” cards cannot work with tokenization at all.

Name and Address Discrepancies

Make sure your name is spelled the same way when it is put into your card and your mobile wallet account name. A missing middle initial, for example, can sometimes cause a failure in what is visa provisioning service. If you have moved, make an address change with your bank before attempting to add your card to a new device.

Read Also: H1b DMV USCIS License Renewal Issue And Solutions – Complete Guide

What To Do When You Suspect Fraud

If you notice a charge of $0 and it is not because you have newly added your card to some new application or device, you should contact your bank right away.

This could be a “card testing attack.” It means that a hacker is just testing whether your stolen credit card information is still valid. Most banks can freeze your card instantly using their mobile applications.

Frequently Asked Questions (FAQs):

What is visa provisioning service is actually the “invisible shield” that makes modern digital payments. Because it utilizes “tokenization,” it keeps your actual credit card number out of the sight of hackers and merchants.

This can be the case when a merchant you use for recurring payments, for instance, Spotify or a gym membership, makes a regular check to confirm the validity of your card.

This does not mean you are being charged at the time or that anyone is using your card at the time of the transaction. This is a background task of the “what is Visa provisioning service”.

It is a genuine security service offered by most major banks. But cyber scammers may use it as bait to deceive you. If you receive a text message requesting that you click a link “to verify Visa Provisioning,” it is most likely a phishing scam.

It can never be turned off completely because it has become a necessary part of the Visa network’s overall security. It can, however, be disconnected if your credit cards are removed from any digital payment services, such as Apple Pay or Samsung Pay. This will erase the tokens assigned to your device, disabling the Visa provisioning service’s active monitoring of it.

No. You will never see the “charge,” which debits funds from your account. If you see an amount charged to your account other than $0.00 or $0.01, it simply means the charge was for purchasing, not the redemption check trial for the service, which all clients enjoy for free.