Today, we talk about Domicile vs Residence. Many people use the terms “domicile” and “residence” synonymously, as if they mean the same thing. In casual conversation, they probably do. But legally speaking, the difference between domicile vs residence is enormous.

It plays into your taxes, your right to vote, where you can get a divorce, and how your property passes after you die.

Understanding domicile versus residence is important if you are moving across state lines or if you live abroad as an expat. One describes where you are, while the other describes where you legally belong.

This guide gives clear, straightforward information to explain the crucial difference between the two- domicile versus residence, and the implications of mixing them up.

Domicile Vs Residence: Defining The Two Legal Concepts

To understand the core conflict between domicile and residence, we first have to look at what each term actually means within a legal context. The answer comes down to physical presence versus mental intent.

What Is “Residence” In Domicile Vs Residence? (Physical Presence)

Residence is essentially where a person’s usual place of abode is. You are resident in a place for some length of time. Such presence may be short term or even temporary.

The following is the key residence fact.

Only A Fact Exists

Residence bases itself upon where you physically happen to be living now IOM Publications.

Time Frame

You can establish residency in a very short time. If you reside in a hotel or apartment for a few days, it is a residence.

Number Allowed

You can have more than one residence at a time. You may have a primary residence in New York and a secondary residence in Florida.

Legal Implications

Residence is often used for simple things like mailing addresses, qualifying for certain state tuition, or obtaining a short-term work visa.

What Is “Domicile” In Domicile Vs Residence? (Intent + Permanence)

Domicile is much deeper than residence. Domicile is the place you consider your permanent home, your fixed and established legal center of life. You always plan to return there, even if you are currently living somewhere else.

The following is a summary of the key facts about domicile.

Intentional

Domicile requires both physical presence and the deliberate, provable intent to make that place your permanent home.

Time Period

Domicile needs time to get established and needs to be expressed through actions.

Number Allowed

A person can only ever have one domicile at any given time.

Legal Consequence

Domicile is a legal jurisdiction that governs the majority of your most important personal laws, such as inheritance, divorce, and overall tax liability.

Domicile Vs Residence: What Are The Core Differences?

The basic difference between domicile vs residence is that the former denotes a place you intend to stay forever. It is not just a semantic issue, because the difference is one the courts consider when determining your rights.

One Vs. Many

The easiest way to remember the distinction is this: you can have multiple residences, but you can only have one domicile.

For example, a student might be residing in California for college-a residence-but the permanent home, the family, and voting registration may still be in Texas-the domicile. When they go back for summer break, they go home to their domicile.

The Role Of Intent

The major legal difficulty with residence vs domicile is one of intent. A person has three homes in three different states, which state is their domicile? The court must look beyond where they spend the most time.

To prove your domicile in a particular place, the courts look for evidence of your intention of residing there permanently. Such proof may include.

- Where you register to vote.

- The place where you register your car and hold your driver’s license.

- Where you file your federal and state income tax returns.

- The place where you hold social club memberships or professional licenses.

- Where you would register your children for school.

Without strong proof of intent, a court might view you as never having effectively changed your original domicile, and that is where serious legal problems can arise.

Legal & Practical Consequences: Why The Distinction Between Domicile Vs Residence Matters?

Getting domicile vs residence wrong can cost you a lot in money and legal headaches.

Taxation, Income, And Wealth

Taxation is the most frequent reason why people are concerned with the difference between domicile vs residence.

The state in which you are domiciled can tax all of your income, regardless of its source. Let’s say that you spend time living in another state. Sure, your residence is a high-tax state, but you can prove your domicile is in a state with low or no income tax. In such cases, you save money.

Domicile Vs Residence – Domicile Audit

However, if you move to a tax-free state but don’t break ties with the high-tax state-by holding onto your old driver’s license, for example-the old state can claim you never changed your domicile.

They may then audit you and charge back taxes and penalties. This is what is called a “domicile audit.”

Inheritance And Estate Law – Domicile Vs Residence

Your domicile is important for estate-planning purposes: it’s the law of your domicile state that will ultimately define how your will is interpreted and what happens to your property at death.

Some states recognize “community property,” whereas others follow “separate property” rules. If you die, and your legal domicile cannot be determined by the court, for example, the distribution of your assets may be held up for years.

For an expat who is living abroad-a residence-their home domicile often still dictates the legal succession process.

Family Law And Divorce Jurisdiction

You generally have to be a resident of the state where you file for divorce. However, you must make a true domicile for the courts to have jurisdiction to enter an order finally determining child custody or support.

If one state’s court is not your true domicile, that state’s divorce decree may not be valid or enforceable in another state. You must clearly establish your domicile before you initiate family law proceedings.

How To Change Your Domicile Vs Residence?

It is easy to change residence, but changing domicile is much hard work since you have to prove your mental state.

It Is Easy To Change Residences

You change your residence simply by moving your body and your belongings. If you sign a one-year lease in a new city and take up residence there, you have established a residence. It’s a purely factual event. You don’t have to file anything with any court or government agency to change your residence.

Changing Domicile Requires Action And Proof

To change your domicile, three elements need to be established:

1. You left your old home without intending to return there permanently.

2. Next, you relocated to the new location.

3. You formed the clear and provable intent to make the new place your home for the indefinite future.

Also, you have to document every step of the process to prove this new domicile vs. residence situation. You need to cut the ties to the old state-surrender the old driver’s license, close the bank accounts-and establish the ties in the new state-register to vote, join local clubs, open new accounts.

Without a paper trail, the old state can claim you still retain your original domicile. This is particularly true in situations that involve high-tax states and a domicile vs. residence dispute.

Read Also: Detention Hearing Explained – Purpose, Procedure & What To Expect

Expert Tips – Proving Your True Domicile Vs Residence

If you are a global expat, retiree with two homes, or a digital nomad, you have to be highly vigilant not to fall into controversies between your legal domicile vs. residence status.

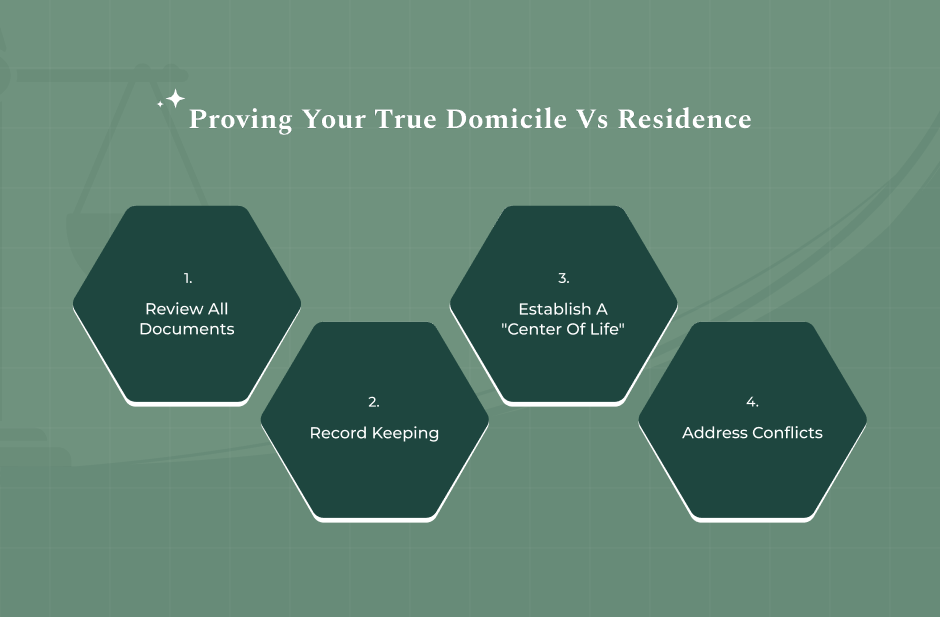

Here are the best practices in expert tips regarding the matter of Domicile vs Residence.

Review All Documents

Make sure that all official documents, such as your will, insurance forms, tax returns, and passport, reflect only the selected domicile address.

Record Keeping

Keep a diary or log that indicates how much time you spend in your domicile home versus your other residences.

Establish A “Center Of Life”

The state you claim as your domicile should be where your real “center of life” exists. That is, your principal doctors are there, you store your most valuable possessions, and maintain your most important relationships.

Address Conflicts

If you’re spending more than half of the year at a secondary residence, be prepared to defend why your actual domicile is elsewhere. This might get tricky.

Hence, you are advised to consult a legal or tax expert who deals with the laws on domicile vs. residence.

You need to handle the change of domicile versus residence with care. It’s a lot more than changing your mailing address.

Domicile vs Residence – Frequently Asked Questions (FAQs):

Understanding domicile versus residence enables you to control your legal life and avoid tax penalties. Be proactive with documentation of your legal home as respect to Domicile vs Residence.

Not by itself, but it is among the most powerful indicia a court will employ. You must swear, when you obtain a driver’s license, that you are a resident of that state, which will usually be defined as domicile.

If you hold a license in state A but claim state B as your domicile for tax purposes, for instance, you have created a huge conflict that will likely be utilized against you by a court.

No, unless you decide to make it so. Normally, as a college student you’re considered to have the domicile of your parents or legal guardians, unless you take active steps to establish your own.

Such steps would include registering to vote, working permanently, and declaring intent to stay indefinitely in State A after graduation.

No, you cannot legally have two separate domiciles. Your voting registration is a sure indicator of your intention and is one of the primary factors the courts rely on to find your domicile.

Trying to take advantage of one state for tax benefits and another for voting privileges may suggest that you are misrepresenting your true permanent legal residence.

That might have serious ramifications if the state taxing authority audits you.