- A waiver of subrogation is a two-way agreement in an insurance policy in which an insured party gives up their right to seek compensation through the insurance company.

- The main purpose of such an agreement is to avoid costly and time-consuming litigation. Additionally, it protects business relationships.

- While waiver of subrogation often offers several benefits, some of its major drawbacks include increased costs through higher premiums, the possibility of a contractual breach, and reduced legal options for the policyholder.

A waiver of subrogation is basically a contractual provision with which an insured party agrees that their insurance company cannot seek compensation from a negligent third party after paying a covered claim.

In practical terms, if a contractor causes a fire and the insurer pays the loss, the insurer forfeits its right to sue the contractor. This agreement is common in industries like construction and real estate, helping prevent litigation and preserve relationships.

However, while it is true that the idea of getting a waiver of subrogation might look appealing to you, there are several mistakes that a policyholder should avoid making when getting into it.

In this article, I will explain:

- What is a waiver of subrogation?

- How does it work?

- What are the types of subrogation waivers?

- Its risks and benefits.

- Common mistakes that you need to avoid when getting into a waiver of subrogation.

So, if these are some of the things that you want to know, you have come to the right place. Therefore, keep on reading till the end…

What Is A Waiver Of Subrogation?

To understand what a waiver of subrogation is, it is important that you have a clear idea of what a subrogation is in the first place.

“Subrogation,” or “subro” for short, is the power that your insurance company has under your policy, after they have made a covered claim, to require the money back from the party causing the loss.

Such a refund is commonly obtained from the other party’s insurer, who is at fault. In the case that the subrogation claim filed by your insurer gets the green light, the money that will be generated can help pay for your deductible.

A waiver of subrogation basically waives this power. Investopedia explains that it is basically a “contractual provision whereby an insured waives the right of their insurance carrier to seek redress or seek compensation for losses from a negligent third party.”

With such an agreement, the insurer gives up its right to “step into your shoes” and recover the claim from the party at fault. In order to reduce litigation risk, this agreement is frequently used in contracts like:

- Construction projects.

- Leases.

- Vendor agreements.

According to Stephen Barker Law, though insurers may charge extra for this endorsement due to the increased risk, it helps streamline processes and maintain professional relationships.

Waiver of Subrogation vs. Indemnification

While indemnity shifts liability, waivers shift legal recourse.

• Indemnification: One party agrees to compensate another for loss or damage.

• Waiver of subrogation: Insurer gives up the right to sue the responsible third party.

Knowing the difference is vital in drafting contracts.

How Does Waiver Of Subrogation Work?

When an insured experiences a loss, the insurer will compensate the insured for the covered losses. In a situation where a third party is the cause, the insurer may exercise the right of subrogation to recover the claim or get damages from the third party responsible for the loss.

By signing a waiver of subrogation, the insurer is barred from seeking or filing a lawsuit against the responsible third party. These clauses may be part of contract agreements or may be attached as amendments to already existing contracts.

Just like any other contract, to be effective, the validity of the contract will be based on the mutual agreement of the parties involved.

Here are the steps involved in a waiver of subrogation:

- A loss occurs (e.g., damage via fire).

- The insurer pays for covered damage.

- Because of the waiver, the insurer cannot sue the at-fault party.

- The negligent party avoids legal exposure, preserving relationships.

Insureon explains with the help of an example that, if the electrician’s work was done based on a contract containing a waiver of subrogation clause, then your insurance company will not be able to go after the electrician in their place.

In other words, the insurer is not allowed to file a lawsuit against the electrician to get back the money they have already paid to you.

Types Of Waiver Of Subrogation

Considering the fact that waivers are found in different types of contracts, their type also varies. Some of the most common types of subrogation waivers include:

- Blanket waiver: Applies broadly across all contracts requiring such waivers.

- Scheduled waiver: Precisely names the entity or contract in which subrogation is waived.

- Mutual waiver: Both parties agree to waive subrogation against one another, balancing risk.

When Should You Include A Waiver Of Subrogation Clause?

There can be times when parties want to cut down on the possibility of legal disputes. And these are generally very costly. These are the times when they might want to include such a clause in their insurance.

You should include a waiver of subrogation clause when you have a business relationship with another party and want to avoid lawsuits between your respective insurance companies following a covered loss.

Here are some of the ways in which you can benefit from including the clause:

- Lawsuit avoidance: Reduces costly, time-consuming litigation.

- Preserves business partnerships: Helps maintain trust among contracting parties.

- Faster claims resolution: No need for protracted fault investigations.

- Efficient risk allocation: Prevents multiple parties from potentially suing each other over the same issue.

Policyholder Pulse reports that with the help of this agreement or clause, insured benefits by “shifting risk from the parties to the insurance company—which has collected premiums in exchange for assuming that risk—and shields the parties from having the insurance company later pass the risk of loss back to them.”

Common Industries Where People Use Waivers

• Construction contracts: Used to prevent litigation between subcontractors, general contractors, and owners.

• Commercial leases: Landlords and tenants often include these to avoid insurer disputes over covered losses.

• Vendor and service agreements: Clients may require vendors to waive policies to reduce risk..

• Special events and venues: For example, wedding venues commonly require caterers or photographers to include waivers in their insurance policies.

What Are The Common Mistakes You Must Avoid In Waiver Of Subrogation?

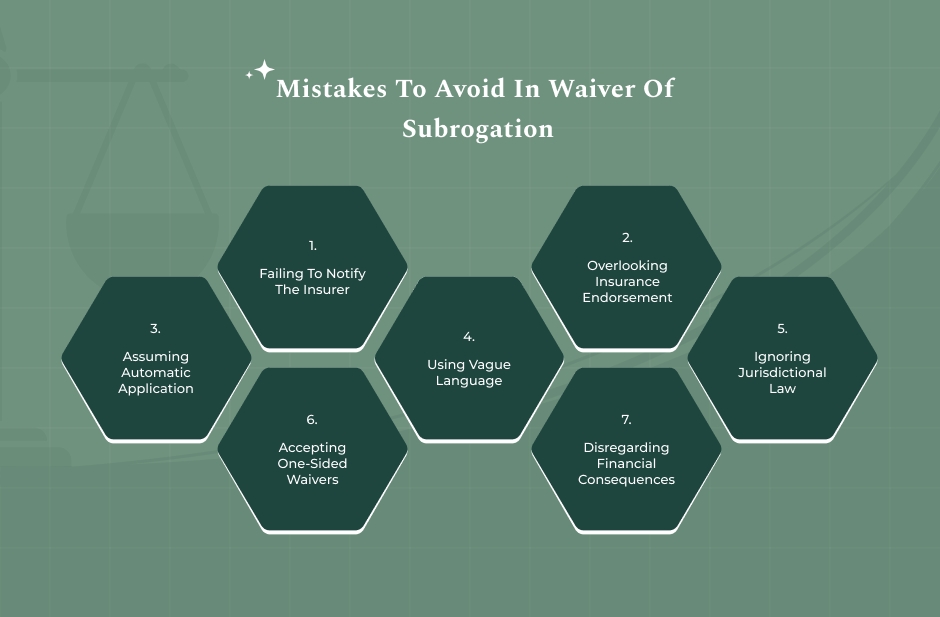

While a waiver of subrogation is a beneficial tool in many cases, there are times when not understanding the nitty-gritty of this clause can cause you trouble. Here are some of the mistakes that you must avoid making when you are getting into it:

- Failing to Notify the Insurer: Signing a waiver without insurer approval may breach your policy and void coverage.

- Overlooking the Insurance Endorsement: Check that the waiver is properly endorsed in the policy—not merely noted in a certificate of insurance.

- Assuming Waivers Apply Automatically: Blanket waivers still need proper policy language; don’t assume universal applicability.

- Using Vague or Overbroad Language: Courts may deny enforcement if the clause is not precise or context-specific.

- Ignoring Jurisdictional Law: Enforceability can vary by jurisdiction. For example, Capes Sokol states that Missouri courts uphold them, but other areas may not.

- Accepting One-Sided Waivers: Waivers that only protect one party can disadvantage you. It is best that you aim for mutual agreements when possible.

- Disregarding Financial Consequences: Higher premiums and increased insurer risk premiums can impact budgets—consider long-term costs.

Practical Pre-Signing Checklist

Before signing any waiver of subrogation clause:

• Have you informed and obtained approval from your insurer?

• Is the waiver clearly and specifically drafted?

• Is the waiver mutual or one-sided?

• Does the policy include a proper endorsement (not just a checkbox)?

• Have you evaluated cost implications, such as premiums?

• Have you confirmed enforceability under applicable laws?

• Did legal counsel review and approve the clause?

Your Legal Guide: How To Protect Yourself Legally In Waiver Of Subrogation?

A waiver of subrogation offers a powerful means to avoid litigation, streamline claims, and sustain business relationships. However, the waiver may do more harm than good without careful oversight of the following things:

- Brokered language.

- Insurer notification.

- Proper endorsement.

- Legal review.

If you want to protect yourself legally, here are some of the things that you need to do:

- Always notify the insurer and secure written consent before signing any waiver clause.

- Use clear, targeted language that specifies the scope, time, and parties involved.

- Aim for mutual waivers to balance contractual duties.

- Layer in other protective clauses, such as indemnity terms or additional insured endorsements.

- Consult legal counsel to ensure enforceability and compliance with local law.

Additionally, avoid these mistakes and follow the checklist mentioned above to make your waiver a strategic asset and not a liability.

Read Also: