If you are planning to invest in the financial market, you should learn about the recent SEC legal battles. And there’s a reason why I say so!

You cannot think of investment in the United States without considering the U.S. Securities and Exchange Commission. This body makes rules and laws related to the financial markets.

Hence, if you, as an investor, don’t comply with the SEC’s regulations, you might face a legal battle.

So, if you are completely new to this SEC conundrum and want to know what it is all about, you have reached the right place.

In today’s blog, I will discuss the necessary SEC regulations that every investor should keep in mind. I will also discuss the recent SEC legal battles, which every investor should learn from.

Therefore, keep on reading this blog till the end to

What is SEC: A Brief Overview of Securities and Exchange Commission

To make you better understand what SEC is all about, let me give you a small example.

Imagine that you have decided to sell lemonade and have a stand for the same in your locality.

Now, you are selling them to your friends. However, one day, you realize that you need more money to buy better ingredients and amenities. So, you decide to ask your neighbors for help.

You request them to invest in your lemonade stand. And in return, you promise to give them a portion of your profit. Sounds fair?

However, some people lie about this entire business. They take money from the investors but do not sell any products. Additionally, they keep all the profits to themselves and cheat the investors of their money.

This is where the SEC, or the U.S. Securities and Exchange Commission, comes into play. This body makes rules and laws related to investment and participation in the financial market.

They were created in 1934 under the Securities Exchange Act after the Great Depression. The primary goal of this body of law is to regulate the securities market and protect investors from scams.

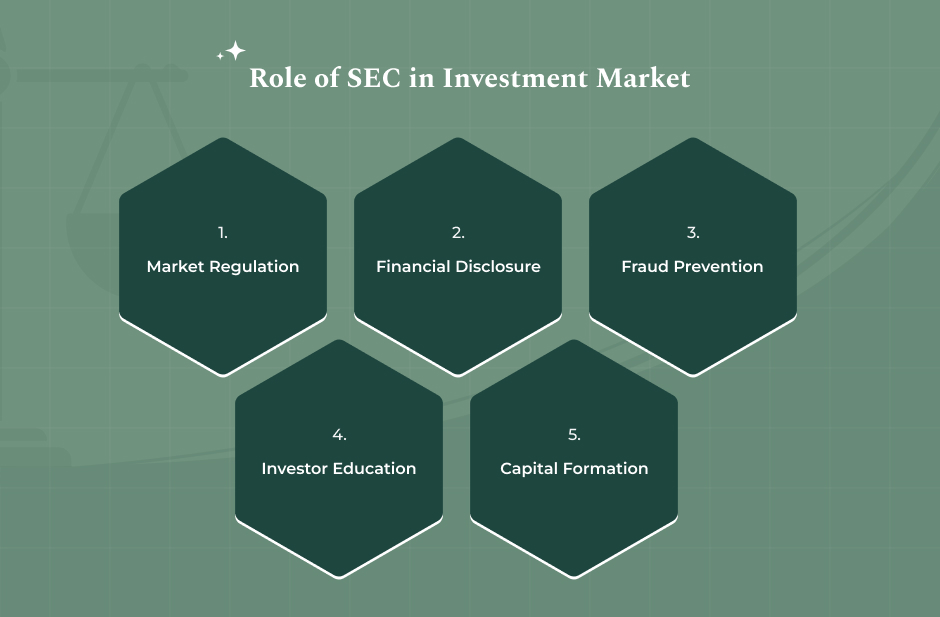

They have three main tasks:

- Protect investors

- Keep markets fair

- Help the economy grow

The SEC checks the stocks of companies in the financial market that are open to buy. They make sure that the companies are honest about their business.

SEC Compliance and Investment: What Should Investors Know?

Whenever you buy something at a store, you generally look at the box to see some of its details, right? For instance, looking at who made it, what’s inside, and whether it is safe.

Similarly, when people want to invest in a company, they need to know about their business and other important things they should know about (whether it is safe to invest or not). This is what the SEC does for the investors.

When I say “SEC Compliance,” it means that companies must follow the rules set by the Securities and Exchange Commission and share honest information. These include how they make money and how much risk is involved in this business.

Why does this matter? It helps investors make smart choices about their investment options and lowers the risk of scams and losing their money.

But what if a company hides some of its most important facts? In a case like that, they will have to face consequences.

Recent SEC Legal Battles: Where People Went Wrong

There have been several legal battles that the SEC has been a part of. But in case you want to know about the recent ones, you have reached the right place.

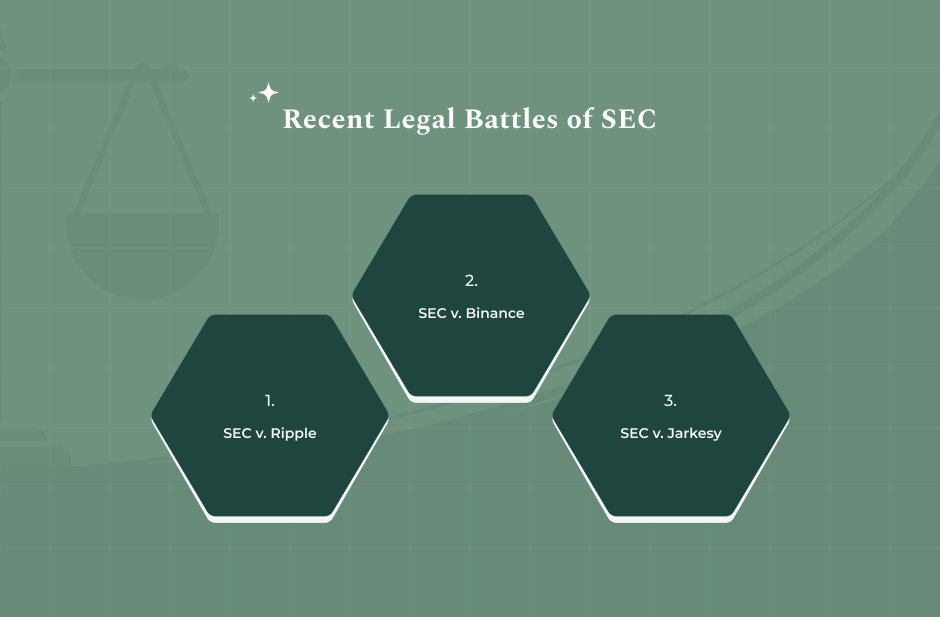

In recent years, the regulatory body has been a part of several lawsuits. The most prominent ones included the cases against Binance and Ripple.

Here’s a better look at them:

SEC v. Ripple Labs Inc.

In December 2020, SEC used the Ripple Labs. According to the regulatory body, the company had sold securities that weren’t registered as XRP (a digital token). The entire case centered on whether the law should classify XRP as a security or not.

In July 2023, the court was somewhat in favor of the SEC. They were of the opinion that Ripple had violated the securities law with the institutional sales of XRP. However, they also stated that selling it to the general public was not wrong.

Based on the judgment, Ripple was fined an amount of $125 million.

SEC v. Binance

Secondly, there was a massive case in 2024 wherein the SEC filed a lawsuit against one of the latest cryptocurrency exchanges in the world, as well as its founder, Changpeng Zhao.

The commission accused Binance of carrying out its operations without having a proper registration and misleading the investors on the same.

Recently, in February 2025, both the parties (plaintiff and defendant) appealed for a 60-day break in the legal proceedings. Why? Because the U.S. authorities need some time to develop a regulatory framework regarding digital assets.

SEC v. George Jarkesy

Finally, in 2024, the U.S. Securities and Exchange Commission accused George Jarkesy of certain financial frauds related to securities.

However, what was different this time was the fact that instead of appealing to a federal court, the SEC decided to carry out an internal administrative process against Jarkesy.

According to experts, the Supreme Court stated that the SEC had violated laws and did not allow Jarkesy his right to a jury trial.

Recent Developments in SEC Regulations

Times have changed, and so has SEC. After all, if it is supposed to be a rulebook for the financial markets, don’t rules have to change over time?

Most critics say that the SEC of the early 2000s was more like a body that fuelled corruption and financial fraud. However, it has now come full circle and enforced its regulatory powers like an authority.

Now that you have learned about the recent SEC legal battles, here are a few changes that you should know about:

Cybersecurity Disclosure Rule

In 2023, the SEC introduced a rule requiring public companies to disclose significant cybersecurity incidents as quickly as possible. This was a great step as it enhanced transparency and helped investors become more aware.

Stock Market Trading Reforms

In September 2024, The U.S. Securities and Exchange Commission reduced the minimum price movement for every stick from 1 to half a cent. This was for certain liquid stocks.

This rule, which came into effect in November of that year, aims to lower the trading cost for all investors.

Digital Assets Regulation

In the same year of 2024, the U.S. House passed the Financial Innovation and Technology for the 21st Century Act in May. It aimed to clarify the regulatory framework for all digital assets.

How? They did that by defining roles for the SEC and the Commodity Futures Trading Commission, which was yet again a much-needed step.

Leadership Changes

After the 2024 presidential election, President-Elect Donald Trump announced plans to appoint former SEC Commissioner Paul Atkins as the new chairperson.

This was a potential shift towards a regulatory approach that might be more lenient. This particularly concerns cryptocurrency oversight.

Clearing Agencies Risk Management

In October 2024, the U.S. SEC adopted new rules related to risk management. With these, the body aimed to enhance the recovery planning and resilience of clearing agencies. These were a great step towards risk management practices.

Your Legal Guide: Learn From Recent SEC Legal Battles While Investing

The SEC was formed to protect investors and ensure fair and efficient trade and markets. It also facilitates the formation of money and capital in the economy.

With the help of its regulatory units, the U.S. Securities and Exchange Commission oversees the entire capital market, which (we all know) is the largest in the entire world.

In conclusion, as an investor, you must be aware of the SEC regulations. Only after thoroughly looking into whether the company follows the relegation of the SEC and is SEC compliant can you safely invest your money in it.

Additional Reading: