Bankruptcy is a legal process that the federal bankruptcy court oversees. It is designed to help businesses and individuals eliminate or repay their debt through legal means. Now, as most of us think, declaring bankruptcy might help you get away with your debt.

However, you must remember that once you have declared bankruptcy, it leaves a huge dent in your credit score. Bankruptcy will remain on your credit report for at least 7-10 years. This will directly affect your credit card accounts and further affect your loaning processes.

In this article, I will explain the following things:

- What is bankruptcy?

- What are its types?

- How does this process happen?

- The legal significance of bankruptcy.

Additionally, I will also talk about the questions that most people often ask about bankruptcy. So, if these are some of the things that you want to know, keep on reading this article till the end…

What Is Bankruptcy?

As we have already said, bankruptcy is a legal process to help individuals and businesses get away with their debts. You can say bankruptcy is usually a last resort for debt resolution because there are better ways to settle your debt.

Working with a bankruptcy lawyer can help you ensure your bankruptcy process goes smoothly and complies with all the bankruptcy proceedings’ rules and regulations.

Before you can file for bankruptcy, you need to meet certain requirements. For instance, you need to demonstrate that you can no longer repay your debt and have also completed credit counseling with a government-approved credit counselor.

If you decide to move forward with the bankruptcy proceeding, you need to decide which type of bankruptcy proceeding you want to go.

What Are The Types Of Bankruptcy?

Even though the general goal of all bankruptcy is to offer a solution to your debts, not all bankruptcies are designed to do so. Here are the types of bankruptcy that you can look into.

Chapter 7: Liquidation

Chapter 7 bankruptcy is also known as liquidation bankruptcy. It is a straightforward process where financial support becomes null. Once an individual or a business declares to be bankrupt, a court proceeding occurs where all assets are put on liquidation (sale) to pay off debtors. However, unsecured debt like medical bills and credit cards are erased.

Chapter 9: Municipalities

Chapter 9 bankruptcy is a repayment plan where cities, municipalities, and school districts reorganize and pay back what they owe.

Chapter 11: Large Reorganization

Chapter 11 bankruptcy is directly related to businesses or corporations. Businesses come with a plan on how they will continue working while paying off their debts. If the debt is just too much to handle, the bankruptcy is then passed on to chapter 13.

Chapter 12: Family farmers

Chapter 12 focuses on a family with farming businesses. This law helped the farmer families to avoid having to sell all their liabilities. While Chapter 12 is similar to chapter 13, it is more flexible and has higher debt limits.

Chapter 13: Repayment Plan

While the Chapter 7 bankruptcy plan forgives the debts, chapter 13 reorganizes the debts you have accrued. The court approves monthly payment plans by which you can slowly pay off your unsecured debts. The monthly payment amount depends on your monthly income.

Chapter 15: Used In Foreign Cases

Chapter 15 bankruptcy law deals with international bankruptcy issues and helps the debtors to access the US bankruptcy court.

How Does A Bankruptcy Happen?

If you are struggling financially, it helps you to come up with a payment plan to pay off your debt slowly but surely—either way, declaring bankruptcy grants you an automatic stay order on all the debt collectors’ activities.

According to Investopedia, “you file a petition with a federal court” when you file for bankruptcy. Applying for bankruptcy will not ease your debt; instead, the federal government will help you with a step-by-step plan to pay off your debts. This process does not involve deducting money from your bank accounts or garnishing your wages.

Your current life will be taken into consideration to ensure that you have enough learning to pay off your debt.

Here’s what the official website of the U.S Courts states about the filing process for bankruptcy:

“The procedural aspects of the bankruptcy process are governed by the Federal Rules of Bankruptcy Procedure (often called the “Bankruptcy Rules”) and local rules of each bankruptcy court. The Bankruptcy Rules contain a set of official forms for use in bankruptcy cases. The Bankruptcy Code and Bankruptcy Rules (and local rules) set forth the formal legal procedures for dealing with the debt problems of individuals and businesses.”

Note: Since there are different types of bankruptcies, the process may differ by type and jurisdiction. It is always best to check with your local court or consult a lawyer for clear guidance.

What Is The Legal Impact Of Bankruptcy?

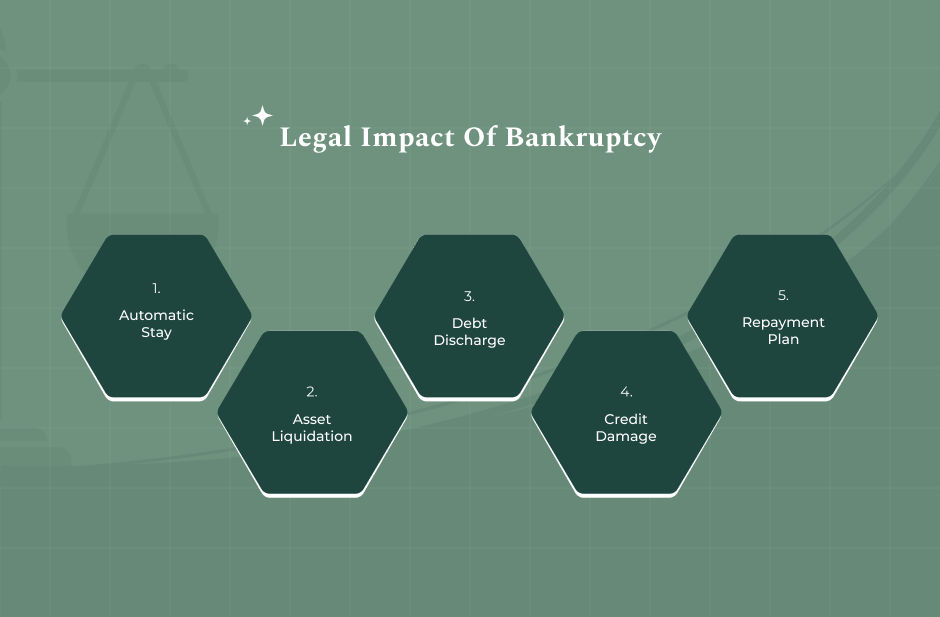

Many who qualify for bankruptcy hardly enjoy the advantages of this law. However, it is certain that bankruptcy does have some perks. Here are some of the legal significances of filing for bankruptcy:

- An Automatic Stay On The Creditors: After filing for bankruptcy, the court will automatically put a stay order on the debt collectors’ activity. This practice does not cancel your debt; however, it stops all the debt collection proceedings.

- Dischargeable Debts: Dischargeable debts are the debts you can cancel or discharge your responsibility for paying. A dischargeable debt is a debt that can be discharged by bankruptcy.

- Bankruptcy Exemption: If there is an asset that you have exempted, you do not have to worry about that asset being included in the bankruptcy proceedings.

- Credit Score: If you have a poor credit score, you can use bankruptcy to your advantage. Once all your debts are cleared off, you can have a fresh start and build a new credit score.

Frequently Asked Questions (FAQs):

Deciding to file for bankruptcy is not easy; however, if for some people, this can be the right choice. While bankruptcy might hurt your credit score for some years. However, with a proper payment plan, you can recover your credit score.

Here are some of the questions that most people often ask about what is bankruptcy. Take a look at them before you leave:

1. How Long Does A Bankruptcy Stay On Your Credit Report?

It can affect your credit score for as long as it remains in your credit reports. But the impact of bankruptcy can be diminished over time. That means your crest score can begin to recover itself even if the bankruptcy remains on your credit reports.

After the bankruptcy is removed from your credit score report card, you will find that your credit score has seen a fresh start; you just have to maintain paying off your bills in full on time.

For business owners specifically looking to rebuild after bankruptcy, exploring a free business credit score check can be a valuable way to monitor progress, assess financial standing, and take steps toward restoring business credibility.

2. How Often Can You File For Bankruptcy?

Once you have completed all your processes and have a new start, that does not mean that you will never need its help again. There may be a time in the future where you will need help with this law. So, when can you file bankruptcy again?

Once you have filed for bankruptcy, the court will deny a subsequent discharge of the same chapter for the next eight years. In simple terms, you need to wait for more than eight-year to file for it again.

3. What Are The Alternatives To Filing For Bankruptcy?

Some of the most common alternatives that legal professionals swear by when it comes to filing for bankruptcy include:

- Negotiating with the creditors.

- Exploring other forebearing options.

- Requesting an offer after compromising.