Wow—big companies make a ton of money, right? But sometimes they really mess up. I’m talking about hiding stuff, hurting the planet, cheating people—and then boom, they get caught.

Then the government comes in and—yep—they pay some insane fines. And when I say insane, I mean billions of dollars.

So, here’s the million-dollar question (er, maybe billion-dollar): who paid the largest criminal fine in history of the United States?

If you have some time on your hands and want to dig into the top offenders, you are literally in the right place!

Therefore, keep on reading this blog till the end…

Who Paid The Largest Criminal Fine in History and Why?

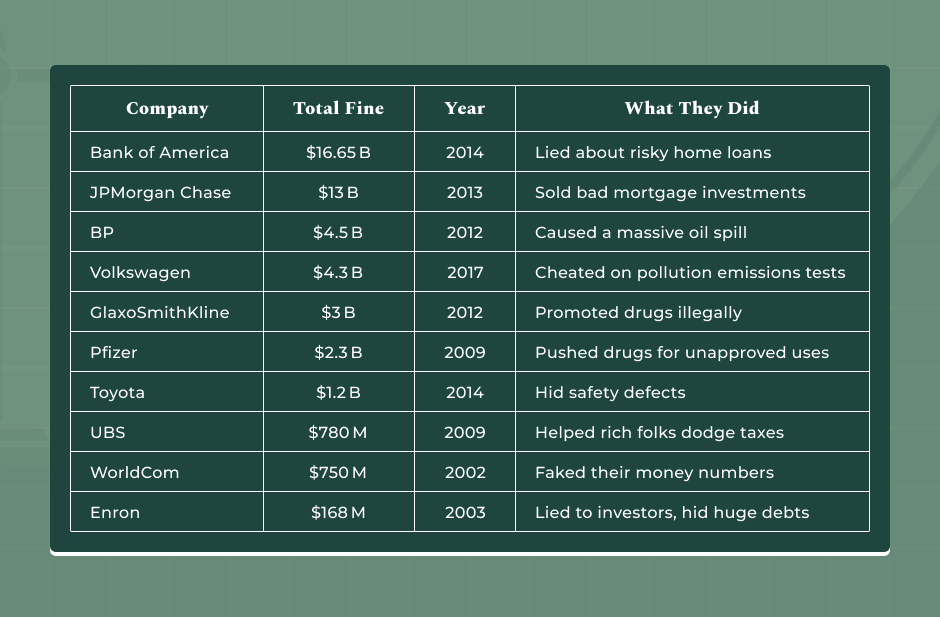

Here’s a list that you need to take a look at:

1. Bank of America — $16.65 B (2014)

| Fine Type | Civil settlement (not purely criminal) |

| Year | 2014 |

| Reason | Misleading investors during the mortgage crisis |

This one’s the biggest fine ever in the U.S.—no joke.

So, what went down? BofA said some home loans were super-safe, but… uh, they weren’t. When 2008 hit, it all came crashing down. People lost houses, life savings, the works.

- They made sketchy mortgage deals.

- They lied to investors.

Why it’s a big deal: So many families got screwed that the government slapped them with $16.65 billion. Yep, with a “B.”

2. JPMorgan Chase — $13 B (2013)

| Fine Type | Civil/criminal settlement |

| Year | 2013 |

| Reason | Misrepresentation of mortgage securities |

Same story, different bank.

What did they do? They sold risky mortgage stuff and didn’t tell the full truth. When the truth leaked—boom—people lost money all over again.

- Investors felt duped.

- Another big blow to the housing market.

3. BP — $4.5 B (2012)

| Fine Type | Criminal |

| Year | 2012 |

| Reason | Deepwater Horizon oil spill |

This one hit hard—literally. But what really happened?

In 2010, that giant oil rig in the Gulf went up in flames. Eleven workers died, and millions of gallons of oil flooded the water…

- Fish, birds, beaches—everything got wrecked.

- Laws were broken left and right.

So? BP ended up coughing up $4.5 billion in penalties.

4. Volkswagen — $4.3 B (2017)

| Fine Type | Criminal and civil |

| Year | 2017 |

| Reason | Emissions cheating scandal |

Yep—they cheated on car tests.

Ad here’s what the shady move was all about! VW snuck in software that messed with pollution tests so the cars seemed clean—at least in a lab. On the road? Not so much.

- Their cars basically “lied.”

- People breathed worse air because of it.

The price tag? A cool $4.3 billion in fines.

5. GlaxoSmithKline — $3 B (2012)

| Fine Type | Criminal and civil |

| Year | 2012 |

| Reason | Fraud and illegal drug marketing |

Drug companies making mistakes? Sadly, yep.

What was the deal? They pushed drugs for stuff they weren’t cleared for and, believe it or not, paid doctors to push them too.

- Completely illegal.

- Brought profits ahead of safety.

They took a $3 billion hit for that move.

6. Pfizer — $2.3 B (2009)

| Fine Type | Criminal and civil |

| Year | 2009 |

| Reason | Illegal marketing of drugs |

Pfizer was caught doing something really shady, too.

Now, what did one of the biggest names in the pharmaceuticals business do? They were telling doctors to use meds in ways not approved. And don’t we all know that its a big no-no?

- That’s called “off-label promotion.”

- And yes, they were paying doctors for it.

They ended up with a $2.3 billion fine—and that included a $1.3 billion criminal penalty, the biggest at that time.

7. Toyota — $1.2 B (2014)

| Fine Type | Criminal |

| Year | 2014 |

| Reason | Hiding safety defects |

Sudden car acceleration? Scary, right?

Their mistake? Some Toyotas shot forward unexpectedly—dangerous stuff. But they didn’t own up to it right away. Nope, they kept mum.

- They covered up safety issues.

- People got hurt or scared.

The fine? $1.2 billion from Uncle Sam.

8. UBS — $780 M (2009)

| Fine Type | Criminal |

| Year | 2009 |

| Reason | Assisting in offshore tax evasion |

This is a bank doing sneaky money stuff.

What went on? UBS helped U.S. rich folks hide cash offshore—so they wouldn’t pay taxes. Illegal and shady.

- Hidden accounts.

- America lost tons in taxes.

They paid $780 million and had to spill the names.

9. WorldCom — $750 M (2002)

| Fine Type | Civil |

| Year | 2002 |

| Reason | Corporate accounting fraud |

Remember when phone companies were huge? This one crashed hard.

And what did they do? They just… made up numbers. Huge profits that didn’t exist. It fooled everyone till it all collapsed.

- Profits tallied out of thin air.

- Biggest accounting fraud story for a while.

They got hit with $750 million in fines.

10. Enron — $168 M (2003)

| Fine Type | Criminal |

| Year | 2003 |

| Reason | Accounting fraud and deception |

One of the classic corporate scandals.

What happened? They hid massive losses, lied about earnings, and basically tricked everybody. When it blew up, it took many lives with it—literally.

- Smart, complex tricks to hide failure.

- Stock prices crashed, lives ruined.

They paid up $168 million, but the damage? Way bigger.

Your Legal Guide: What’s the Big Idea Here?

Before you leave, let’s take a look at this chart real quick:

| Company | Fine | Year |

| Bank of America | $16.65B | 2014 |

| JPMorgan Chase | $13B | 2013 |

| BP | $4.5B | 2012 |

| Volkswagen | $4.3B | 2017 |

| GlaxoSmithKline | $3B | 2012 |

| Pfizer | $2.3B | 2009 |

| Toyota | $1.2B | 2014 |

| UBS | $780M | 2009 |

| WorldCom | $750M | 2002 |

| Enron | $168M | 2003 |

These fines aren’t just big numbers—they show you something important:

- No company is too big to face consequences.

- What they do has real effects on people, animals, the environment.

- Laws are there to protect us from shady stuff.

Honestly, it’s kind of reassuring that nobody gets to just do whatever they want. These penalties give me hope that, maybe, we’re inching toward a world where big business means big responsibility.

Curious what else we can learn from this? Shoot me a message!

Read Also: